The Dow Jones added 135 points, to close at a fresh record high of 40,003, the S&P 500 edged higher by 0.1%, while the Nasdaq finished slightly lower.

The focus on interest rates and inflation continues to dominate market discussions.

Reddit shares surged 10% after the company announced a content partnership with OpenAI.

In contrast, Meme stocks declined for a third session, with GameStop falling 19.7% and AMC dropping 5.2%.

On the week, the S&P 500 added 1.4% and the Nasdaq advanced 1.9%, both marking a fourth consecutive winning week, which would be a first since February.

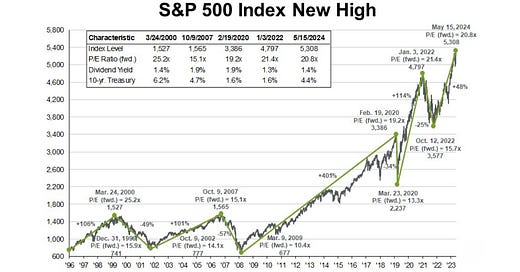

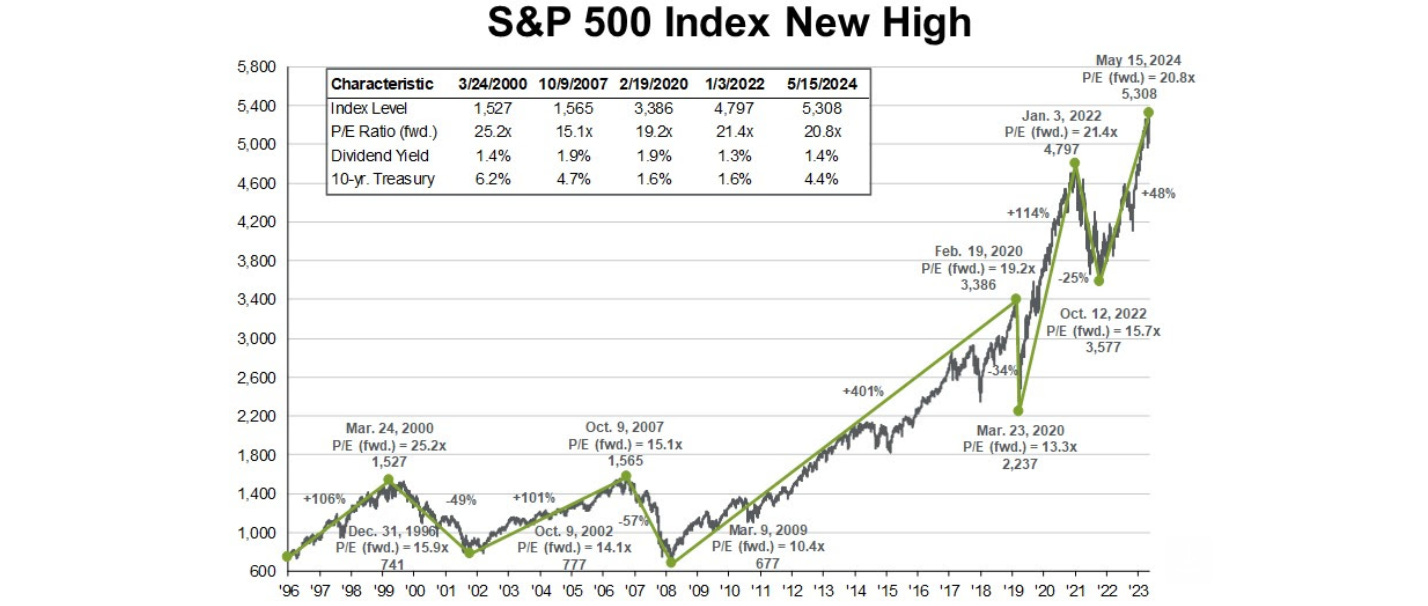

The S&P 500 Index reached a new high last week of 5,325.

The forward 12-month Price/Earnings (P/E) multiple of the market is 21x.

The 30-year average forward 12-month P/E is 16.6x.

Measured by P/E, dividend yield, price-to-book, price-to-free cash flow and earnings yield, the market is expensive relative to historical averages.

The propellent that moved the market higher was primarily provided by a benign CPI inflation report.

Core CPI reached a three-year low of 3.6% year-over-year growth in the April report.

In addition to the CPI report, April core retail sales declined by 0.3% versus a consensus expectation of a 0.1% increase.

In-line to lower than expected inflation data caused the 10-year treasury rate to decline from about 4.7% to 4.3% in the past two weeks - lower long-term interest rates are a positive catalyst for stock valuations.

Goldman Sachs forecasts the year-end value of the S&P 500 at 5,200, slightly below its current level. JPMorgan’s forecasts a valuation of 4,200, 20% below its currently level. With bonds offering yields of 5-8% annually, the relative attractiveness of buying stocks seems low at this new high.

However, a significant majority of professional forecasters and investment banks have missed almost every major economic forecast since Covid in 2020.

The most persistent indicator that market forecasters are too bearish is the consistently better-than-expected Gross Domestic Product (GDP) growth since Covid. The Atlanta Fed forecast for GDP growth this quarter (Q2, 2024) is 3.8%. The consensus expectation is 2%.

For Actionable Research & Market Insights from a Buyside Perspective - click on the link below.

It is remarkable how the forecasters continue to defend models that have been consistently wrong for years. after all, the Fed is the primary example, but it does appear as though nominal GDP is going to continue to run hot