Remain Bullish

US stocks finished the last trading day of August on a positive note, as investors assessed key inflation data closely watched by the Federal Reserve.

The S&P 500 rose 1%, the Nasdaq 100 gained 1.3%, while the Dow Jones hit a new record close, adding 228 points.

This data bolstered hopes for Fed rate cuts later this year, as the economy showed resilience while keeping the door open for potential easing.

In corporate news, Dell Technologies jumped 4.3% after its Q2 earnings exceeded expectations.

Intel surged 9.5% on restructuring reports, despite a 56% decline this year.

The 2024 stock market has been all about Nvidia’s 159% appreciation.

Nvidia (NVDA) represents nearly 7% of the total S&P 500 market-cap weighted index.

Year-to-date through August 28 (just before earnings announcement), the S&P 500 was up roughly 18% versus the equally weighted index (RSP) up 10%.

The Dow Jones Industrial Average, which does not own NVDA, was up by about 10% as well.

This week, the equally weighted S&P 500 (RSP) and the Dow Jones Industrial Average (DIA) reached all-time highs.

It is not just about Nivida anymore. With investor confidence rising for September rate cuts and a soft landing, the rest of the stock market is beginning to perform.

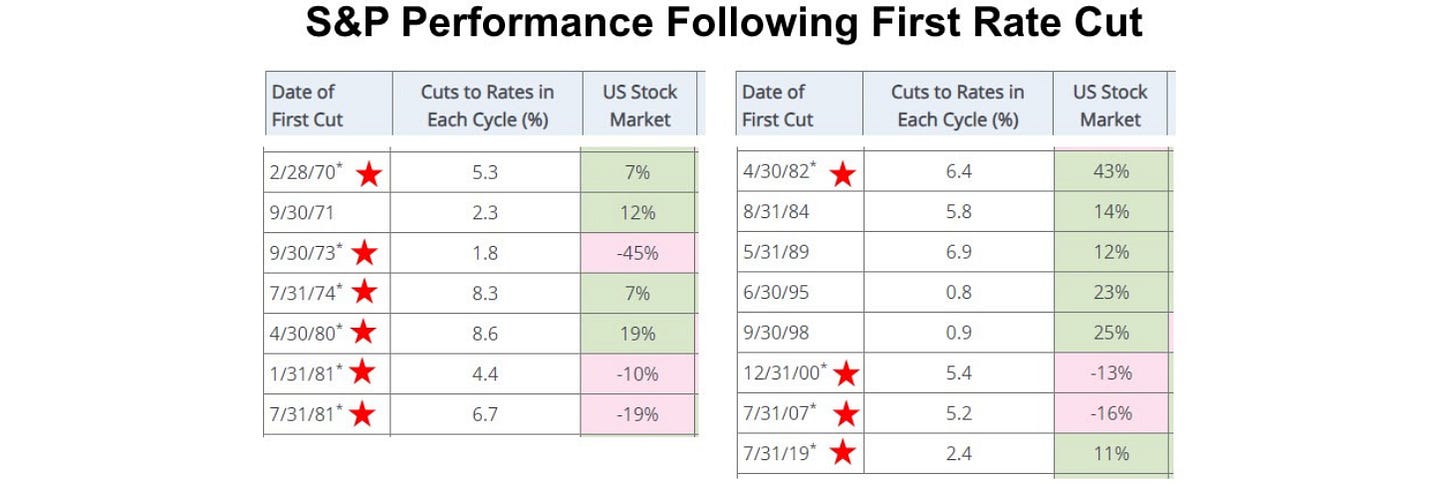

There are times when the Federal Reserve cuts interest rates and the economy is not in a recession and does not experience a recession for the next twelve months. In these cases, the average return of the S&P 500 in the 12-months following the first rate cut is 17%. In recessionary periods (red star) , the average return in the following year is negative 2% with a high degree of variability.

The economy is not currently in a recession. If the economy manages to stay out of a recession for another twelve months, all should be well.

Commonly, two primary recession signals are the inverted yield curve and a negative six-month moving average of the Leading Economic Index (LEI). Both signals have been indicating recession for about the past two years.

We are on the cusp of the treasury yield curve (10-year rate less the 2-year rate) uninverting. It is not uncommon for the yield curve to invert and then un-invert prior to a recession. The un-inversion is not an all-clear signal. For now, it may just mean that the distortions of the Covid shut down and fiscal and monetary response are dissipating.

It is encouraging that the Dow Jones Industrial Average and the equally weighted S&P 500 reached new all-time highs this week. This suggests it is unlikely a recession will begin in 2024. The price momentum is positive and we remain bullish.