Nvidia neared the $1 trillion market cap level.

As I said a couple days ago, the Q1 earnings report, the incredible growth guidance for the rest of the year, and the discussion on customer demand for "re-tooling" for the generative AI transformation was a big wake-up call.

Maybe the most important thing said during the call was; "when the 'ChatGPT moment' came (the November 30, 2022 launch) ... it helped everybody crystallize how to transition from the technology of large language models to a product and service..."

That (ChatGPT) was the defining "moment" for the industry. We're just six months in.

Just as the world is pondering recession, if not depression (and deflationary bust), this earnings call (the "Nvidia moment") might be the defining moment for the rest of us - the moment that resets the perspective on the next decade, for perhaps a boom period.

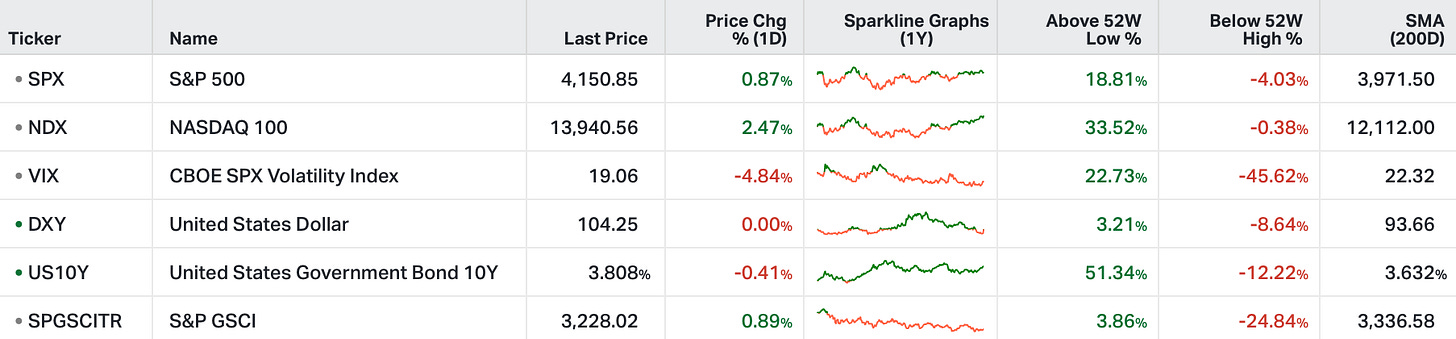

The interest rate markets seem to be reorienting toward this. The 10-year government bond yield has risen from 3.27% to 3.60% in just two weeks.

Of course, the narrative surrounding that has been "debt default." But at the peak of the debt default frenzy;

Gold was on record highs - it's now 6% lower, and falling.

The dollar is rising.

The Nasdaq just made another new high for the year.

And the interest rate market has swung, over the course of one month, from pricing in an absolute certainty of rate cuts by year end, to about a coin flips chance - and, moreover, now pricing in the chance of another rate hike.

Remember, AI will drive productivity growth. Productivity growth drives economic growth. And it's early . . .

From idea generation to due diligence, make GRYNING | Quant do all the heavy lifting.

The model covers nearly 40,000 global assets – including over 400 cryptocurrencies - and uses the power of machine learning to turn data points into actionable insights for you.

I understand all investors are not the same and I believe analysis should be tailored to your focus - pick and choose the category (shown below), or range, that suits you best. For instance, you're able to zone in on Brazilian Large Cap stocks, for insights with a greater than 3 month horizon.

A sample chartbook for U.S. stocks, etfs, and crypto is shown below.

Join GRYNING | Quant today and let’s start next week with insights that will build your performance.