We talked about regional banks and commercial real estate in my last Macro Perspectives note ( here ).

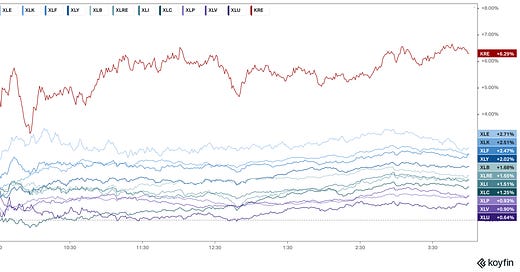

The regional bank ETF, KRE, was the best performing (unleveraged) ETF on the day, up 6.4%.

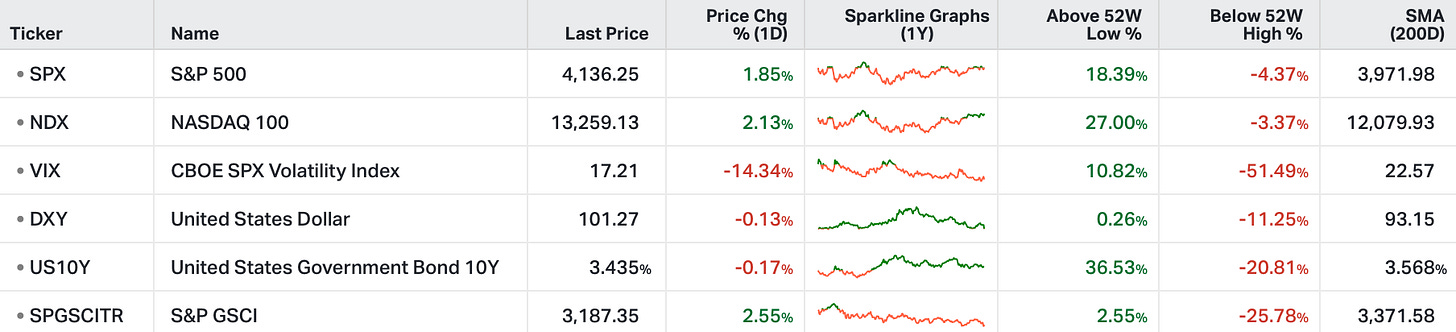

We also talked about the year-to-date underperformance in the broader stock market, relative to the big and mega cap tech - Friday, the strength in stocks was broad-based.

Was it the strong jobs report - another record low unemployment rate, in the face of 500 basis points of tightening over the past year?

I would say, don't underestimate the significance of the WHO's official ending of the global health emergency.

That's 38-months from the date they declared the emergency. Biden called the end to the U.S. national emergency last month, and U.S. public health emergency is due to end this week, May 11.

As a reminder, it was the WHO, declaring the clear global health crisis a pandemic, back on March 11 of 2020, that set all of the government "special powers" into motion.

Importantly, corporate America took marching orders from the WHO and CDC for the past three years.

Now we're finally at an official end point.

This should bring to an end, any remaining debt or eviction moratoriums. Student loans are due to restart the first of July.

With the "emergency" guardrails removed from the economy, which may expose more of the pain from the reset in prices and interest rates of the past three years, we may find that companies will regain their leverage over employees, getting them back to work in-person.

PS: Gryning believes everyone should have access to quant analysis. In yesterday’s post ( here ) we went around the world with a Point of Interest chart from all the Geopraphic regions covered by Gryning Quant.