US stocks finished higher on Tuesday, with tech shares resuming their recent rally amid slightly higher-than-expected inflation data that had little impact on expectations for the first rate cut by the Fed in June.

The S&P 500 rose 1.1%, to a new closing high, the Nasdaq gained 1.1% and the Dow Jones popped 235 points.

Nvidia surged 7.1%, Meta rose 3.3%, and Microsoft gained 2.6%.

Oracle closed at all-time high of $127.54, soaring 11.7%, marking its largest daily gain since 2021.

3M's stock rose 5% after announcing that William Brown, the former CEO of L3Harris Technologies, as its new CEO.

We had the February inflation data come in yesterday morning - it looks like this…

The headline Consumer Price Index (CPI) has stalled around the 3% mark, and it happens to have levelled off from where the Fed made its last rate hike. The speculation has been that the move from 3% to 2% will be longer and more difficult than the move from 9% to 3%.

The Fed's favoured inflation gauge, the Personal Consumption Expenditures Price Index (PCE), has had a much cleaner path. At the current 2.4% level, it's not far from the Fed's target.

What's the story? As we've discussed over the past few months, the insurance component of CPI has been a significant drag. Jerome Powell said the same recently. Take a look at the direction of household insurance…

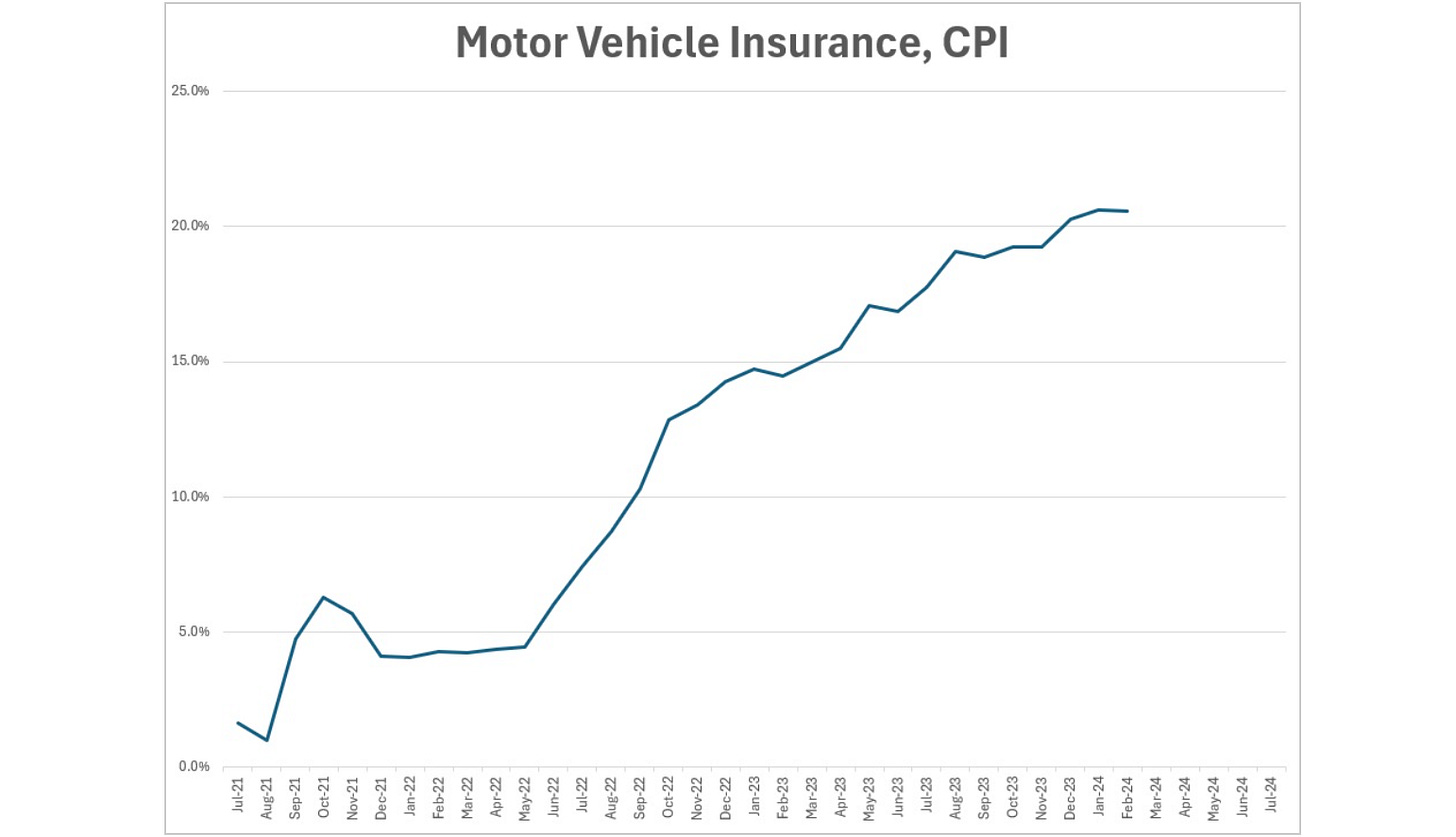

And the direction of auto insurance…

The (potential) reason why: the massive monetary and fiscal response to the pandemic (plus the subsequent agenda spending binge) ramped the money supply by 40% in just two years. That was almost a decade's worth of money supply growth (on an absolute basis), dumped onto the economy in a span of two years. That inflated asset prices. And the insurance industry spent the past two years raising the price to insure those higher priced underlying assets. But as we've also discussed this is a lagging feature (likely a late stage feature) of a hot inflationary period.

If we just pull out shelter from the consumer price index (which is influenced by changes in insurance premiums), CPI drops below 2%.

so, you have moved on from the trend of the last 3 months to removing the things that are rising in price. seriously, let's just remove the impact of all the things that are going up in price and then inflation will "be" much lower!

While I'm sure that the Fed can do every one of these calculations, they have been very clear that they are going to watch the numbers that print. I would argue there is scant evidence that inflation is heading back to 2%, maybe in our lifetimes. ultimately, housing costs have not been declining at all and show no signs of doing so. that 40% inflow of cash has many more years to work off before it is no longer an issue.