The push higher in yields last week continued yesterday, with the US 10-year yield is now trading up to 1.14%. That’s still very low, but the rate of change is huge - a rise of 25 basis points in a week, against a very low base.

This is a potential disruptor to keep an eye on, for stocks. Remember the taper tantrum?

In 2013, just a few months into QE3, the Fed began setting the table for reducing the size of its bond buying program, and telegraphing a QE exit strategy.

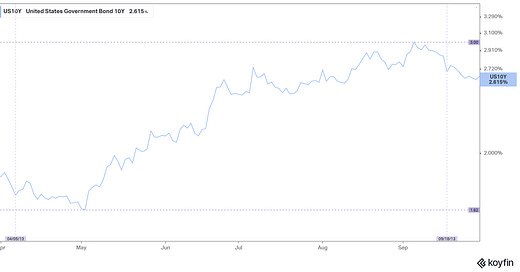

Rates went crazy, in four months the 10-year traded up to 3% from 1.6% (chart below). As a result, in June of 2013, mortgage rates jumped a half a percentage point in a week (the biggest one week move since 1987), in a very, very fragile housing market. Stocks had an 8% drawdown and then a 5% drawdown within those four months.

So it created volatility, but stocks ended the year up big in 2013.

This time around, a sharp move higher in rates would be painful for confidence, especially if it involved foreign selling of U.S. Treasuries. But importantly, we don't have to wonder if/when the Fed might respond to a destabilizing force. We know they are on red alert and will do anything/everything to maintain confidence and stability - even if it means outright buying stocks.