Continuing our discussions, the Fed has now set expectations that they will aggressively take the Fed Funds rate back to neutral (where they are neither accommodative nor restrictive).

After Jay Powell's comments on Monday, the market is now pricing in about a coin flips chance that the Fed determined benchmark interest rate will be there (neutral/mid 2% area) by the end of the year.

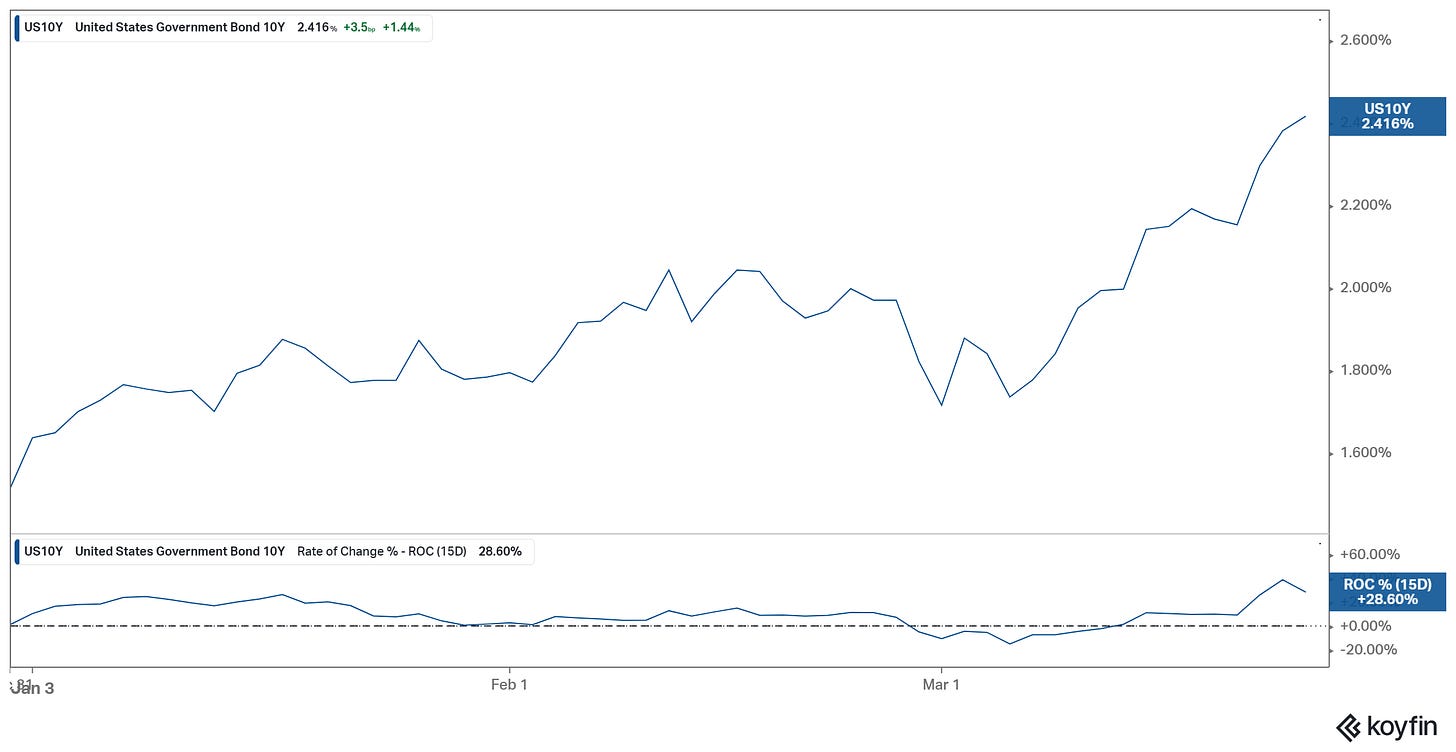

With that, the 10-year yield (the interest rate determined by the market) is starting to move. We are just in the early stages of seeing what the interest rate market will look like without the Fed's constant intervention (i.e. bond buying) of the past two years - Note: as of this month, the Fed is officially out of the QE business.

That's important to keep in mind, as the media continues to focus on the yield curve, which has been flattening and nearing inversion (a historical recession signal). Now that the Fed is out of the treasury market, so is the suppression on the longer-end of the yield curve. Translation: This potential "recession signal" being derived from the yield curve should be reversing.

With that, let's take a look at how the 10-year yield is behaving since the Fed meeting last week (it's UP, dramatically).

The 10-year yield started last Monday (Fed week), trading around 2%, yesterday it was close to 2.40%. That is pushing consumer rates higher, rapidly - the average 30-year fixed mortgage rate hit 4.7%.

If we consider a 2% spread between mortgages and the 10-year...and a spread of about 2% between the 10-year and the Fed Funds rate...then we should expect the 10-year yield to be in the mid 4% area by year end (if the Fed gets back to neutral), and we should expect mortgage rates to be over 6%.

Add in $4+ gas, even with a strong labour market and higher wages, and we should be getting to a point (by year end) where the standard of living is sliding.