Stocks rallied yesterday, oil and gold traded lower (again) - this has the appearance of a relief in the risk environment.

Is there reduced risk on the war front? Is there energy supply relief coming from the Iran negotiations? Are Covid lockdowns in China, foreshadowing another round of global pandemic restrictions?

We talked about the latter yesterday - it now appears that none of the above are dictating the recent market activity.

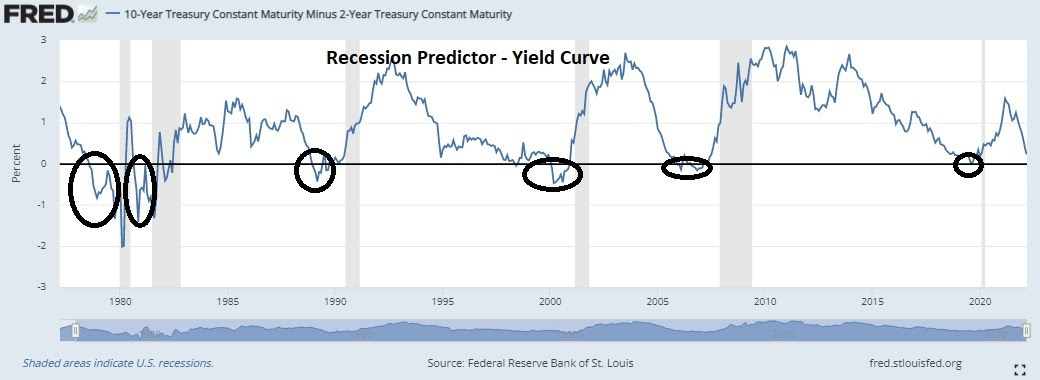

With the behaviour of the bond market the past two days, it does appear that the bond market is telling us something. We talked about the prospects of a yield curve inversion earlier this month, and we looked at this chart below…

As a reminder, this is the spread between the 10-year and 2-year Treasury yields. This had declined to 23 basis points when we looked at it on March 9th - today it's just 2 basis points (the 10-year yield is at 2.39%, and the 2-year yield is at 2.37%). Why does this matter? Each of the six recessions, dating back to 1955, were preceded by a yield curve inversion. Recession followed between 6 and 24 months.

Now, with that in mind, you would not be going out on a limb to call for a Fed-induced recession to come in the next 24 months (regardless of what this chart above tells you). After all, as we've discussed, the last time the Fed had to deal with an inflation problem like we're seeing now, they had to ramp rates ABOVE the rate of inflation, to bring inflation under control. That would be applying a heavy foot on the brakes of the economy.

But within this outlook, we should expect such a yield curve inversion to happen at much higher levels of interest rates. It would be reasonable to expect the inversion to take place because the 2-year yield is aggressively moving higher (along with the Fed Funds rate), not because the 10-year yield is stagnating at historically low levels, and then aggressively moving lower. That doesn't project a hot economy, where the Fed is just starting a tightening campaign (from emergency level rates).

So, what's happening to push the 10-year yield aggressively lower the past two days? It may have everything to do with Japan. The Bank of Japan intervened twice in the Japanese government bond market - buying JGBs in "unlimited amounts" to put a lid on rising bond yields (at just 25 basis points on the 10-year).

This "yield curve control" is, and has been, explicitly part of the BOJ's game plan to promote economic activity in Japan. But what is becoming clear, is that policy change in the U.S. is pulling all global interest rates higher - it's unwelcome. The 10-year yield in Germany has swung from negative 10 basis points, to positive 74 basis points, just this month! The 10-year yield in Japan is at six year highs, the highest levels since they adopted the plan to outright suppress Japanese yields back in 2016.

With this in mind, and the actions by the Bank of Japan this week, the move in the U.S. 10-year yield may be a signal that "yield curve control" could be coming to a central bank near you.

Remember, as we discussed last week, if we consider a 2% spread between mortgages and the (U.S.) 10-year...and a spread of about 2% between the 10-year and the Fed Funds rate...then we should expect the 10-year yield to be in the mid-4% area by year end (if the Fed gets back to neutral). And we should expect mortgage rates to be over 6%. But in anticipation, it's not crazy to think the 10-year yield (and therefore consumer rates, like mortgages, auto loans and credit cards) could reset to those levels very quickly (like a spike in rates).

An aggressive spike in market interest rates would be bad news for the major central banks of the world. How would they protect against that scenario? Yield curve control - to (attempt to) carefully manufacture a stable path to higher interest rates.