Stocks in the US finished mixed on Monday, ahead of the US CPI release today, as the fourth week of earnings season kicked off.

Figures confirmed the disinflation process last year, showing no big surprises in the data.

Remarks from several Fed officials this week will also be scrutinised for the timing of the first rate reduction.

On the corporate front, Salesforce slipped 1.4% due to its cloud-based software stock performance.

Meanwhile, Hershey dipped 0.9% following a downgrade to underweight by Morgan Stanley due to softer demand.

We get the January inflation report today.

Going into this data last month, stocks were on record highs, the 10-year yield was trading around 4%, and the market was pricing in six quarter-point rate cuts for 2024.

We go into today’s data with stocks, again, on record highs, the 10-year yield is trading around 4.20% and the market is looking for five quarter-point rate cuts this year.

Of course, these rate expectations have been tamed over the past few weeks by some very deliberate Fed messaging. That leaves the interest rate market leaning in a direction that creates the opportunity for a positive surprise - in the form of more weak inflation data, which could influence the Fed to start calibrating for sooner or deeper rate cuts.

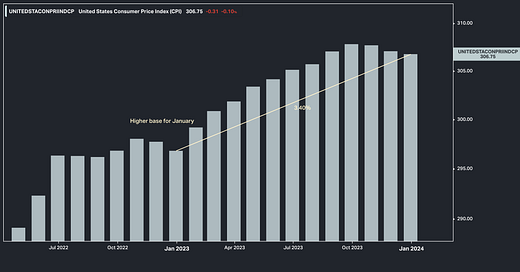

With that, let's take a look at the headline consumer price index as this is where we could get a positive surprise. We knew heading into last month's report, that the headline CPI would bounce - breaking the disinflation trend. This was because the year-over-year change in the December index value would be measured against the low base of the year prior. That calculation produced a 3.4% inflation number (up from the prior 3.1%). You can see it in this chart ...

You can also see the higher base that the January number will be measured against. With that, we looked at the table below last month, and deduced that we may be in for an acceleration in disinflation (i.e. a quickening in the fall of inflation). It may start with the report we see today.

The government's Bureau of Labor Statistics reports the 12-month change in prices without seasonal adjustments. That's the index in this table above. As you can see in the far right column of the blue shaded area of the table, the 12-month change in prices slides aggressively in the coming months - if we assume the average monthly price change over the past twelve months (of 0.23%).

If prices increased at this average monthly rate in January, we would see a headline inflation number well below 3%, and if we extrapolate that rate of change out to March, the CPI index would be at 2.33% by the Fed's March meeting.

ps: I have published our Monthly Multi-Asset Outlook - become a member to access investment themes that’ll place significant tail-winds for you and your portfolio.

This report has to disappoint Fed policymakers and further extinguish the probability of a March rate. Question, if inflation continues to surprise to the upside can the Fed still achieve a soft landing?