The November inflation data was in-line with expectations.

What's notable? The impact of rising insurance premiums on shelter, physician services and (mostly) transportation.

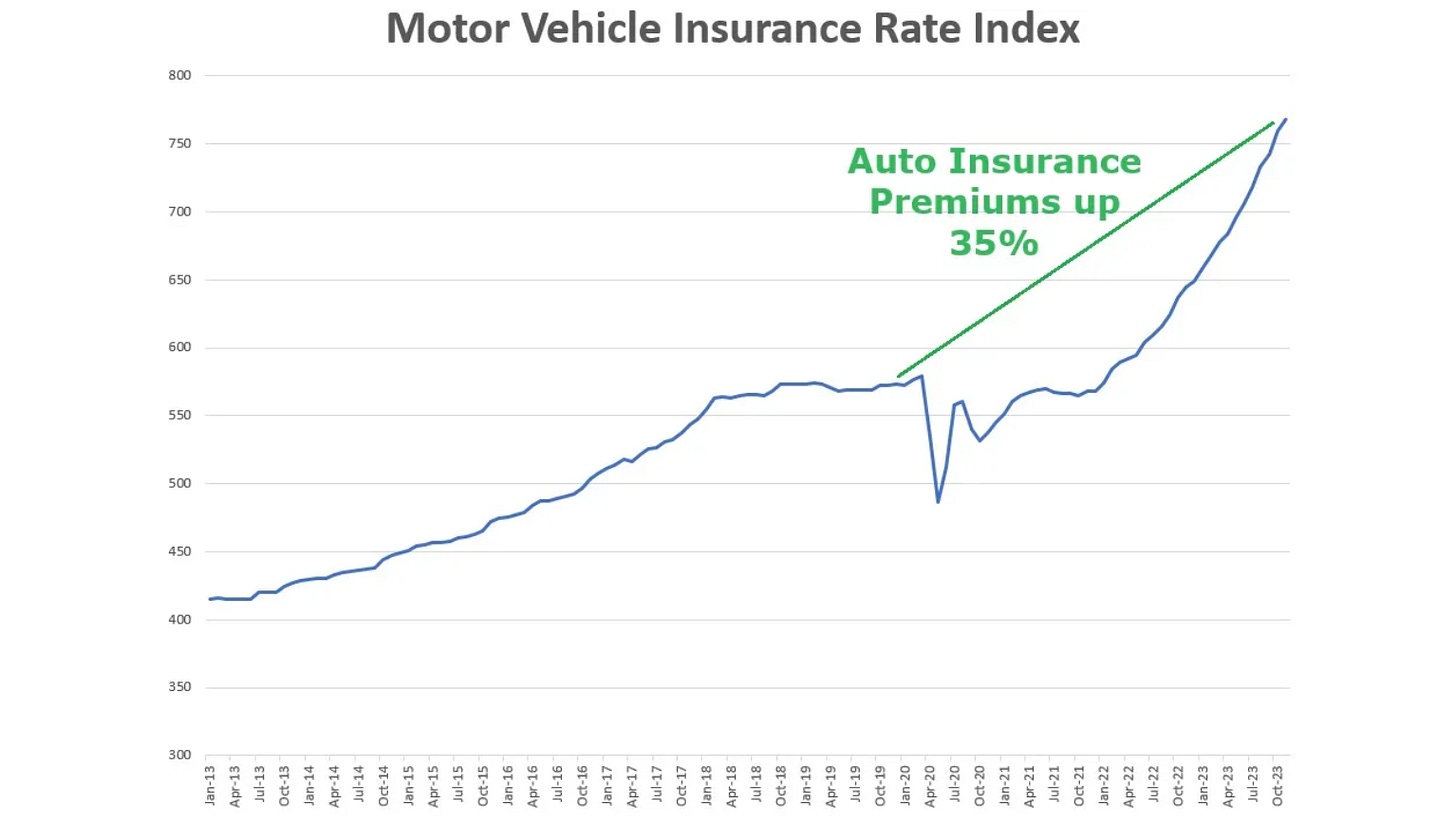

The change in the motor vehicle insurance component of CPI was up 19.2% compared to November of last year - it's now up 35% from pre-covid levels. Here's how that chart looks ...

The good news: This is a lagging feature (likely a late stage feature) of a hot inflationary period.

Remember, the massive monetary and fiscal response to the pandemic (plus the subsequent agenda spending binge) ramped the money supply by 40% in just two years. That was almost a decade's worth of money supply growth (on an absolute basis), dumped onto the economy in a span of two years.

That inflated asset prices. And the insurance industry just spent the past two years raising the price to insure those higher priced underlying assets.

Are the insurance price hikes over? If we look at the index on new car prices, it's up 21% from pre-covid levels. The used car index is up around 35%. The numbers, and the level and trajectory of inflation, seem to suggest the answer is yes.

With the above in mind, the Fed are meeting today.

The market expectations for interest rate cuts next year barely budged following this inflation data. We'll get an update to the Fed's Summary of Economic Projections, this is how it looked last September (the orange and the blue lines).

We looked at this chart early last month - it shows the current effective Fed Funds rate (5.3%), along with the Fed's projected path, all in orange. In blue, we have the current inflation rate (the Fed's favored core PCE, which has fallen to 3.5% now), along with the Fed's projected path for inflation.

The difference between the Fed Funds rate and inflation is the "real interest rate" (black numbers in the above chart). The real rate puts downward pressure on inflation and the economy - it's currently 1.8%. And as you can also see, the Fed's September projections had the real rate rising substantially next year (i.e. tightening financial conditions even further). Those real rate projections are in the blue circles in the chart.

In their new projections today, we should expect the Fed to project a real rate in 2024 at no more than the current real rate, which is 1.8%. After all, the current real rate is successfully pushing the inflation rate and the economic growth rate lower.

And as you can see on the far right side of the chart, the Fed itself projects the long-run real rate to be just 0.5%.

On St Lucy’s Day (Sankta Lucia), we at Gryning would like to offer you the ability to add AI to your trading & investment toolbox. You have two options, pick the one that provides you with the greatest benefit and we’ll double the membership period for free.