Will He?

The S&P 500 lost 0.8%, the Dow dropped 299 points and the Nasdaq fell 0.9%.

US equities fell on Tuesday as investors closely monitored escalating tensions in the Middle East, with the Israel-Iran conflict entering its fifth day.

Disappointing US retail sales, which dropped 0.9% in May.

In corporate news, JetBlue Airways sank 7.9% after its CEO warned that weak travel demand makes break-even margins unlikely this year.

United, Delta, and American Airlines also slipped 6.2%, 4.3%, and 3.1%, respectively.

The Fed will head into its decision on monetary policy with some soft May economic data to digest. Yesterday’s reports showed:

Retail sales growth was negative on the month.

The National Association of Home Builders Index came in at housing recession levels.

Industrial production was negative on the month - below I show our internal model, which had a forecast of 0.114% at the start of the week.

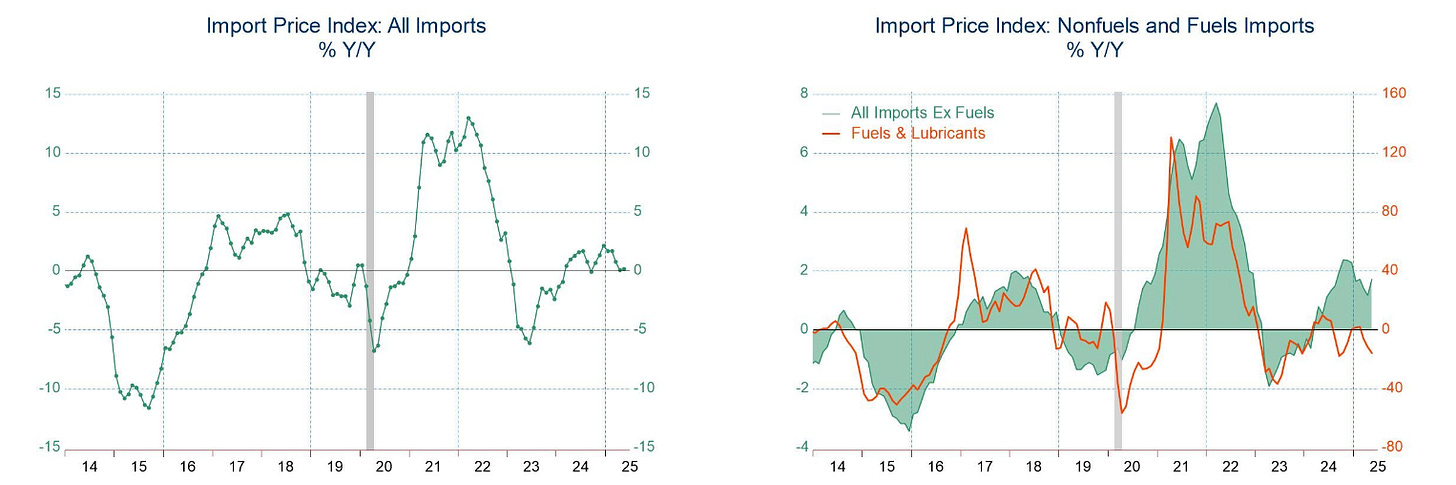

What about import prices? That's what the Fed is convinced should be rising, given the draconian tariffs.

Import prices were flat on the month. And since Trump launched tariffs on China on February 4th, the change in monthly import prices through May is down, not up.

Yesterday we talked about the Fed's view on trade policy uncertainty back in 2019. Unlike their inflationary view now, back then they saw it as a drag on growth - as demand destruction with deflationary pressures. And when they started cutting rates in July of 2019, they cited weak foreign growth (particularly in China and the euro area). So, weak global demand.

With that in mind, in addition to import price data, we also had data on export prices from the month of May.

Export prices were down 0.9% (weak global demand) - the largest monthly decline since October 2023.

What happened in October of 2023? Jerome Powell signalled the end of the tightening cycle (a dovish pivot).

Amplify Your Strategies: Adding our research to your investment pipeline is like adding an investment analyst team.