US stocks kicked off the week in the red, with the three major averages losing nearly 0.6%, as traders refrain from making big bets ahead of the US CPI report due tomorrow.

The new data should determine if the recent uptick in inflation was merely a temporary fluctuation or an indication that the trend of decreasing inflation has stalled.

The tech sector was the worst performer.

Meta and Amazon are down about 4% and 1.3% respectively and Nvidia lost more than 2%, after a 5.5% slump on Friday.

Also, Boeing declined more than 1.8% after Latam Airlines reported a technical event on a Boeing 787 Dreamliner that injured dozens of passengers.

Let’s build on last week’s discussion, the Bureau of Labor Statistics (BLS) has a history of making large revisions to the jobs data, under the Biden administration.

Going into last Friday's jobs report, we talked about the potential for some downward revisions to dampen some of the enthusiasm for the employment situation. Indeed, that was the case. When the BLS reported the February jobs data, they also included downward revisions for both the January and December job growth - by a total of 167,000 jobs.

So, adding up all of the revisions, they initially overreported 380,000 jobs in 2023. That can influence policymaking, and it can influence consumer confidence and spending. Additionally, within Friday's report, the unemployment rate for last month came in higher, at 3.9% - that's the highest in two years.

To be clear, the jobs numbers remain very good, but incrementally weaker than what had been in the Fed's calculus before Friday.

With that, we get the Fed decision on policy next week. Remember, there has been both formal and informal messaging from the Fed recently, that suggests they are worried about trading one problem for another (i.e. damaging a good employment situation by overly obsessing about the next tick in the inflation data, thus keeping rates too restrictive, for too long).

On that note, today we'll get the February inflation data. The consensus view is for a 0.4% monthly change. That's relatively hot, compared to the average of the past twelve months, but it should still push the change in year-over-year CPI to under 3%.

For a potential clue: What did the third largest global retailer have to say about the price environment? For the quarter ended Feb. 18th, Costco said prices for the quarter were flat (compared to a year ago), and that follows the prior quarter of just 0%-1% inflation.

We head into this inflation report with stocks again hugging this trendline, which originated from October, when Jerome Powell verbally signalled the end of the tightening cycle (similar line for Nasdaq) …

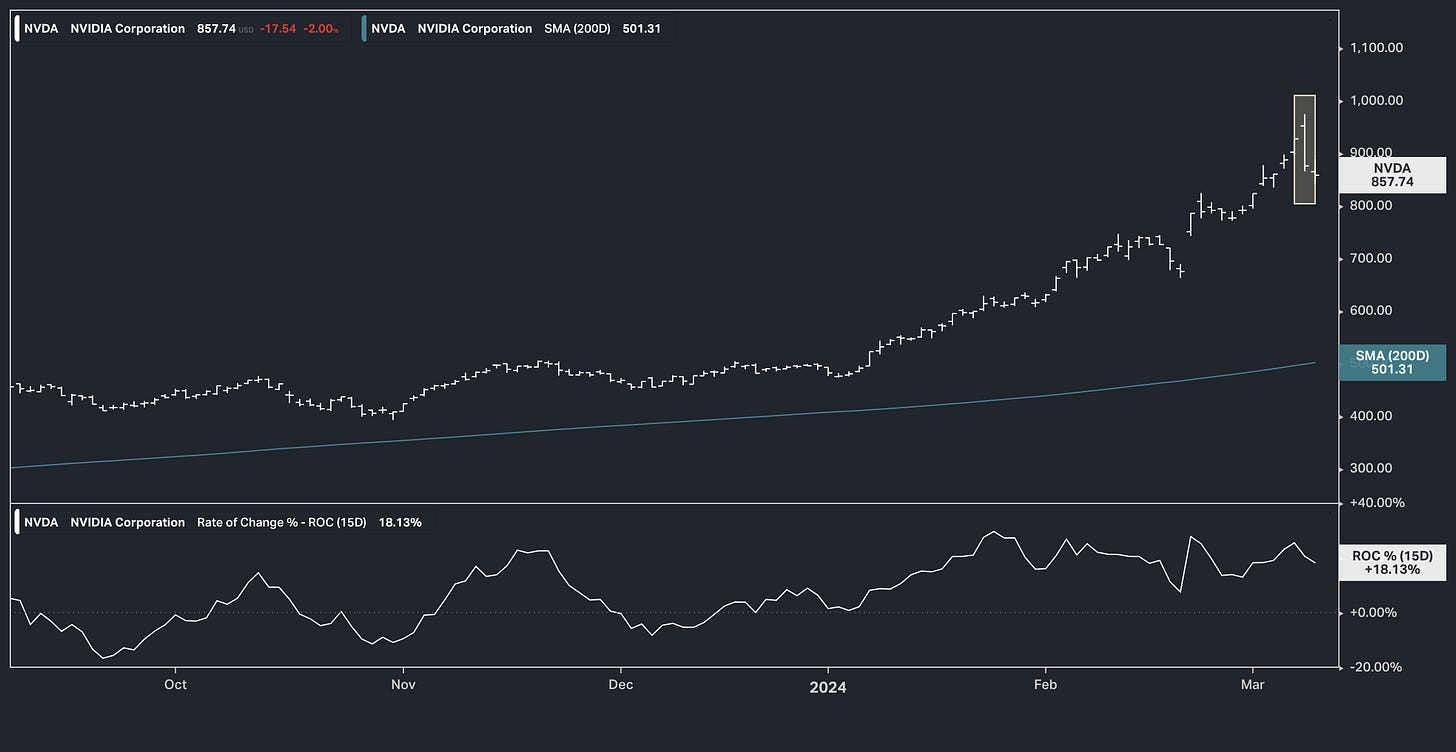

And with Nvidia, the proxy on the technology revolution, having posted a technical reversal signal on Friday - an outside day (yellow box).

So, technically the market looks vulnerable to a technical breakdown/correction. There are plenty of people in the investment community that would like to see it, to get a second chance to build positions in this technology revolution theme.

But the inflation data is unlikely to provide the catalyst. The CPI data should continue to demonstrate falling inflation, which should give the Fed more confidence to start moving on rates, which is good news for stocks.