5 Points

US Stocks rallied on Friday, as the S&P 500 closed at all-time high of 4,839, adding 1.2%, the Dow Jones surged 395 points and the Nasdaq advanced 1.7%.

The technology sector led the session's gains as chip makers extended their rally, fueled by Taiwan Semiconductor's better-than-expected forecast the previous day and optimism around AI.

On the earnings front, Travelers Company jumped 6.7% after the insurer's fourth-quarter profit more than doubled, while Fifth Third Bancorp added 2.9% after beating estimates for both revenue and earnings.

Moreover, Michigan consumer sentiment unexpectedly reached 2021 highs, and inflation expectations for the year ahead fell to the lowest in three years.

For the week, the S&P 500 rose 1.1%, the Nasdaq jumped by 2%, and the Dow Jones ended 0.5% higher.

Macro Perspectives

In my previous note, we discussed the speech made by the newly elected President of Argentina, Javier Milei, at the World Economic Forum. He pierced the bubble of group-think in Davos.

Let's talk about the main point of his speech, his review of economic history, and how it may relate to the nascent technological revolution being set into motion by generative AI. Milei opened with the following statement about the state of the world, and his criticisms were squarely directed at the crowd in the room.

He said, "I'm here to tell you that the Western world is in danger. And it is in danger because those who are supposed to defend the values of the West are co-opted by a vision of the world that inexorably leads to socialism and thereby to poverty."

He goes on to say, "the main leaders of the Western world have abandoned the model of freedom for different versions of collectivism."

Why? What is their motivation?

Milei says, "Some have been motivated by well-meaning individuals looking to help others, and others have been motivated by the wish to belong to a privileged caste."

He related the current trajectory of the Western world to the fall of Argentina in the past century - after trading capitalism and world power, for socialism and poverty.

With that, he laid out the evidence for "free enterprise capitalism" as the "only possible system" to achieve prosperity and end world poverty.

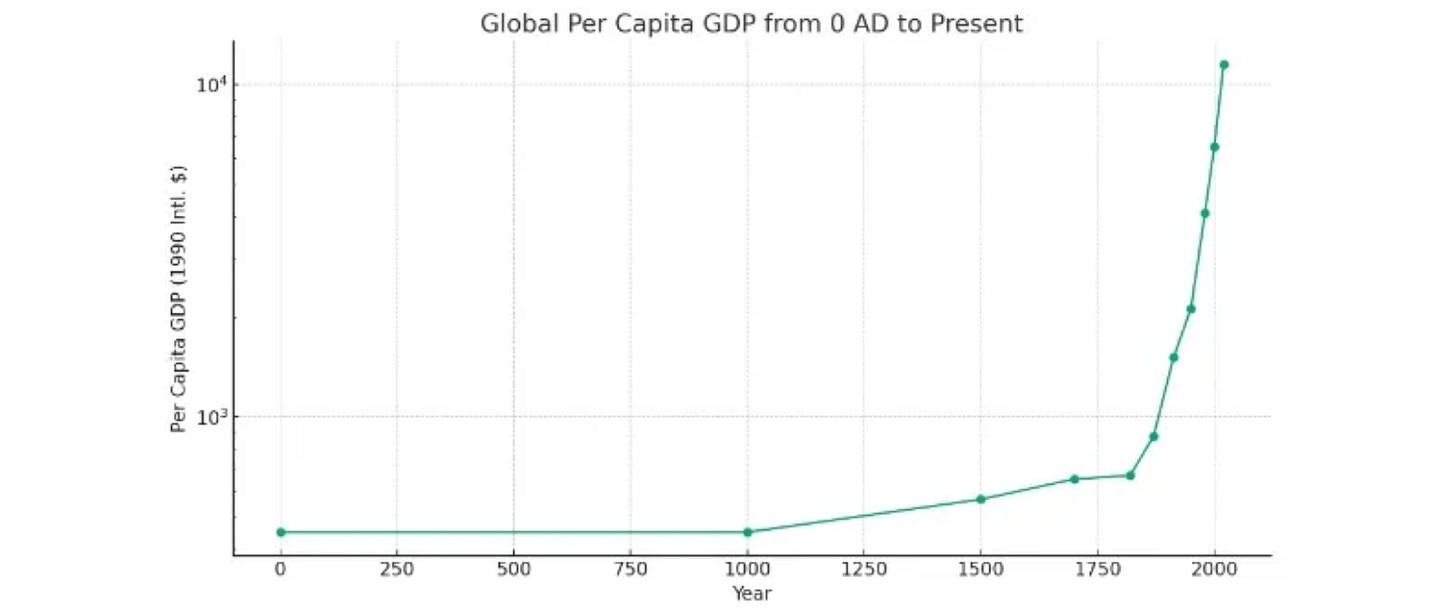

Here's the chart of economic history that he referenced...

This chart shows the long history of stagnation in per capita GDP (wealth and standard of living). Then came capitalism, and with it came exponential growth and prosperity.

Capitalist economic principles brought about innovation, which brought about industrialisation. And with industrialisation, Milei points to the rapid gains in per capita wealth (as you can see in the chart above). Per capita GDP began to double, and did so at an accelerating rate from 100 years, to 66 years, to 33 years, to the recent 23 years. As he says, the industrial revolution lifted 90% of the global population out of poverty.

Now, let's consider this backdrop, and how it relates to the early stages of this current technology revolution. What were the two most important technological advancements of the Industrial Revolution?

The steam engine and electricity.

Each played a critical role in transforming societies and economies - wealth and prosperity. Guess what generative AI has been compared to?

So, we have upon us a catalyst for explosive growth in per capita GDP and as we know, that comes with tremendous benefits for humanity.

History shows us, when you hit a certain level of per capita wealth you get the kind of improvements in quality of life that begin to drive exponential demand for things like electricity, air conditioning, cars ... energy (and commodities in general)!

You can see it in the chart below ...

So, back to the opening of this note, we can now see why the capitalist system and the related incentives to innovate are an affront to the World Economic Forum agenda/climate agenda.

Within the agenda, there is an explicit goal of lowering global energy consumption in the name of climate. Conversely, this technology revolution will, undoubtedly increase energy consumption - not just from computing power demands, but from the global wealth effect.

As an investor, we have to operate under the assumption that the world, over time, will improve, will grow and will be a better and more efficient place to live than it was before (democracy and capitalism will withstand the challenge). Some times the confidence level is higher than others…but the record is good.

With that, we should expect this technological revolution to accelerate the doubling rate of global per capita GDP - and with that, we should expect rapid demand growth for energy and commodities coming down the line.

Very well said, and I believe, why the climate agenda will ultimately collapse