US stocks finished mixed on Friday as investors analysed fresh inflation data that may impact the Federal Reserve's upcoming decisions on interest rates.

The S&P 500 lost 0.1%, and the Nasdaq slipped by 0.4%, pressured by a 2.1% drop in Nvidia shares, while the Dow Jones hit a fresh record with a 0.3% gain.

This fuelled expectations for a potential rate cut, with traders split between a 25 or 50 basis point reduction in the next Fed meeting.

US consumer sentiment reached a five-month high as borrowing costs eased, supporting hopes for a continued cooling of inflation towards the Fed’s 2% target in 2024.

Costco fell 1.7% after the membership-only retailer missed expectations for fiscal fourth-quarter revenue.

The Federal Reserve and much of the professional investment community interprets an inverted treasury yield curve (2-year rate greater than the 10-year rate) as a predictor of recession. The yield curve inverted over two years ago. The economy is growing at roughly 3% rate - from mid-2022, the S&P 500 is up over 60%.

Normally the yield curve works as a predictor of recession because an inverted yield curve causes banks to pull-back on lending. When bank profitability is squeezed by high short-term rates (what banks pay out to customers) and low long-term rates (what banks receive from loans made), they issue fewer loans. The credit contraction slows economic growth.

The yield curve failed to predict a recession this time for two primary reasons:

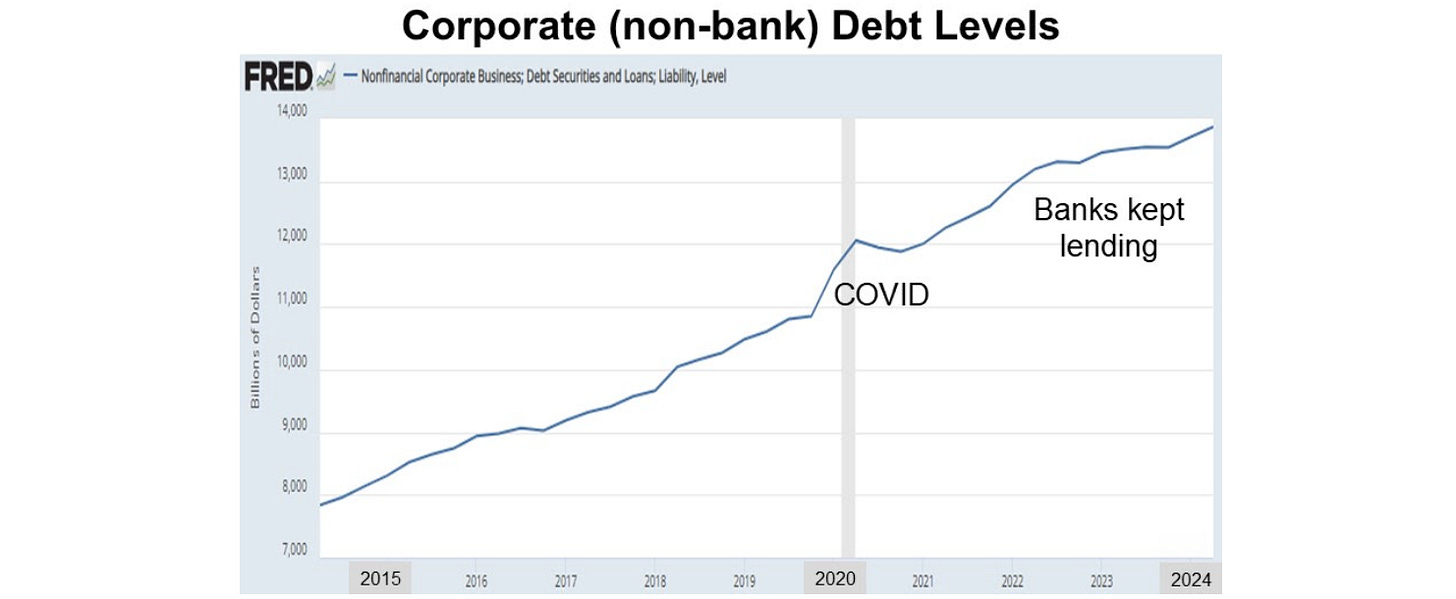

Banks continued to offer customers little to no interest on their deposit accounts even though the Fed kept raising the Fed Funds rate. Bank net interest margins remained positive and loans continued to flow. The first chart below shows corporations had plenty of access to loans from banks. The second chart shows corporate debt as a percentage of market value is at a low. This is mostly caused by the appreciation of corporate equities - a low debt/equity ratio signals low credit risk.

The Federal government and the Federal Reserve flooded the economy with money. There was no credit contraction. Household net worth and individual and corporate cash holdings increased to record levels following the pandemic.

The yield curve has regained its positive slope with the 10-year interest rate exceeding the 2-year rate. Bank profitability should continue to hold up and credit should remain relatively easy in a falling rate environment.

History suggests that if we continue to avoid recession, the stock market should perform well over the next twelve months.

According to Goldman Sachs, there were five times over the past forty years when the Fed eased and a recession did not imminently follow. On average, the S&P rallied 17% in the 12 months after the first cut.

JPMorgan says that over the past 40 years when the S&P 500 has been within 1% of an all-time high when the Fed cut rates, the market was higher a year later in all twelve instances of this phenomenon.

it is also possible that due to QE, the signal was erroneous. if the Fed did not own $3.5 trillion in bonds and mortgages, then it seems likely the long end of the curve would have remained far higher than it. traded, thus reducing the size and timing of any inversion. just a thought