The Advance Q2 GDP Report indicated that real GDP decreased at a seasonally adjusted annual rate of -0.9% - marking the second straight quarter of contraction.

Real GDP in Q1 was down -1.6%.

Two sequential quarters of negative GDP growth is the layman’s definition of recession - the official recession designation is determined by the National Bureau of Economic Research (NBER), usually months after the trough of the business cycle…

The inverted yield curve and negative Leading Economic Index (LEI) say we are in recession.

Collapsed commodity prices signal recession.

Three straight months of declining consumer confidence say we are in a recession.

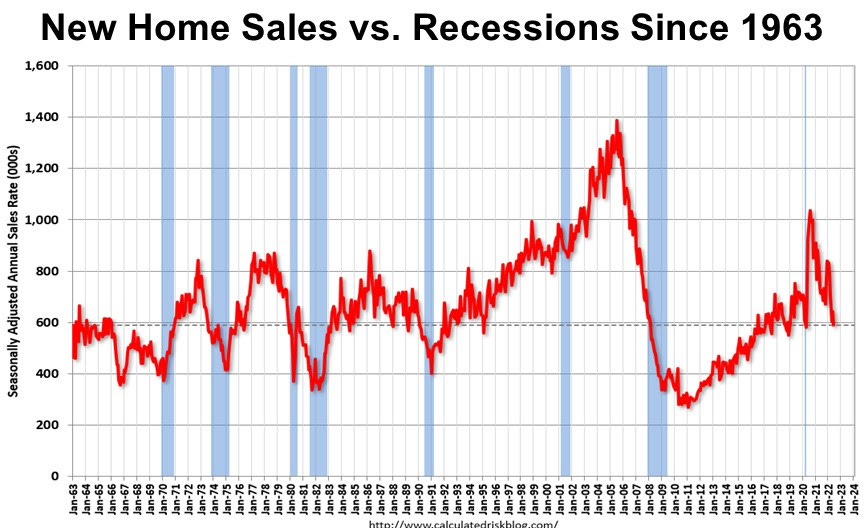

The 17.4% decline year-over-year in new home sales say we are in or near a recession.

Challenging or negative growth outlooks from Walmart, Shopify, McDonald’s, General Motors, UPS, Meta, Qualcomm and Best Buy so far this earnings season say we are in a recession.

Contrary to the above, Federal Reserve Chairman Powell says we are not in a recession. The good news is the stock market is not listening to what Powell says but is “data-dependent.” The additional good news is Powell says the Fed is also becoming more “data-dependent.”

What “data-dependent” translates to is we are in/near a recession and the Federal Reserve will be less aggressive with rate hikes than planned and are expected to cut interest rates beginning in 2023. This is a case when recession news today is a positive for stocks - lower interest rates allow for multiple expansion.

The other primary reason why a recession now is a positive for the stock market is recession appears to be mostly priced in - recession news has not taken the stock market down to new lows in the past weeks.

Rather, the market is responding positively to the increasing realisation that we are in recession and the rate increase outlook will be less severe -the 20-30% decline in the first half of the year was for the recession that almost no one saw coming. The second half of the year may be a pricing in of an eventual recovery.

P.S.: If you are a 'Do It Yourself Investor’ or someone that would like access to an institutional way of positioning your finances on the right side of the market, please consider subscribing - It's less than the price of a coffee a day!