Yesterday we talked about earnings from Citi and JPMorgan - both were positive surprises on earnings and revenues.

Let's take a look at the other two, of the biggest four banks in the U.S.; Wells Fargo and Bank of America.

Results reported during the day were pretty much in line with estimates, but like Citi and JPM, both look a lot better than the headlines suggest.

For Bank of America; deposits were up 23% yoy, investment banking fees were up 15%, and wealth management client balances hit record levels. If you add back the $1.4 billion they added to their war chest of loan loss reserves, their EPS gets closer to 0.70 a share, which is in line with 2019 quarterly numbers.

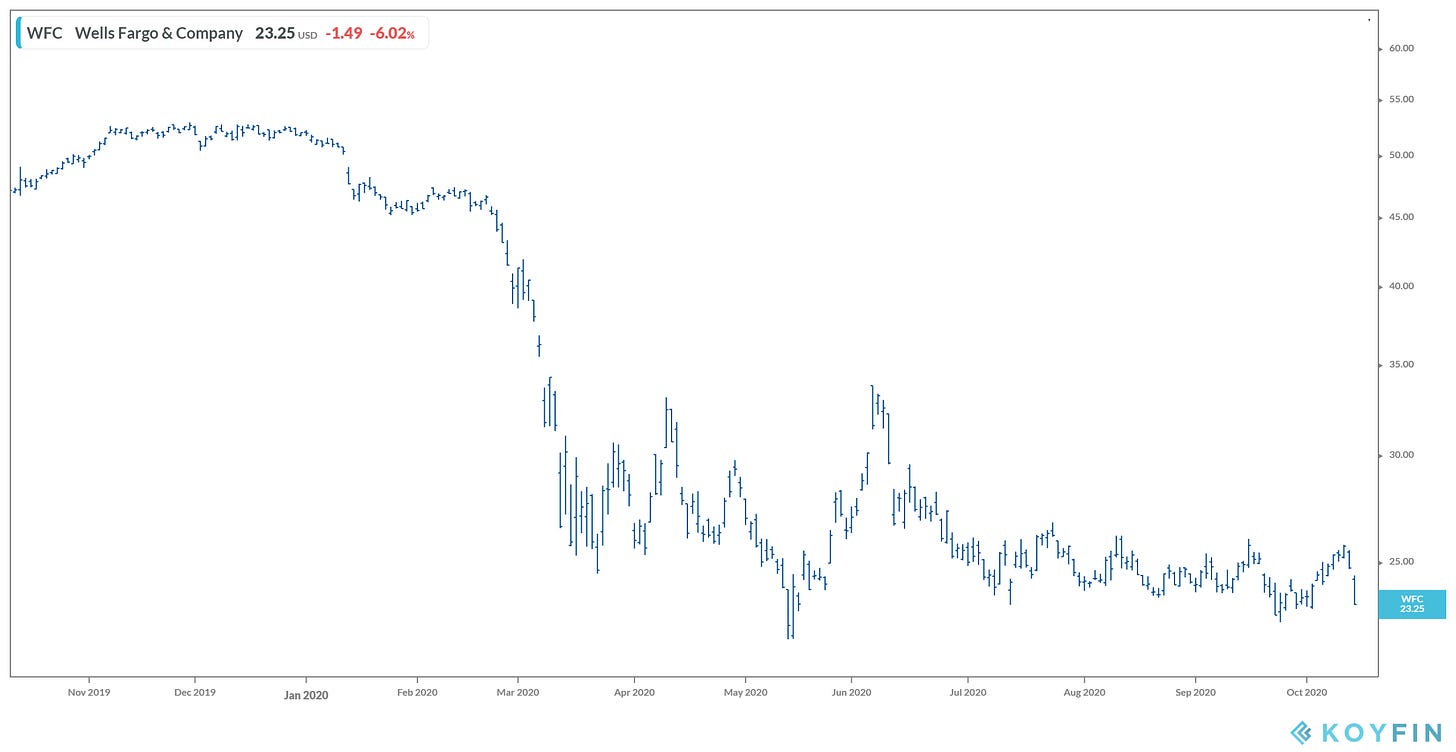

Wells Fargo is the worst of the bunch, by far, and may be one of the most hated bank stocks - which makes it interesting.

It's an early turnaround story, still working off the wounds of an account churning scandal from many years ago. For a CEO that's only a year on the job, he has been given the opportunity to take all the medicine - to pull forward all the losses. There is no better time than in a global crisis (especially when the Fed has your back) to put all the bad news you can muster on the table - it looks like CEO Charlie Scharf is working on it.

Wells put up $2 billion in net income in the third quarter, after taking $2.4 billion in charges. That includes booking losses to the tune of $961 million for "customer remediation" (refunds to customers for overcharging accounts) and $718 million for "restructuring charges" (severance payments). The bank also realised $769 million for credit losses, against a war chest of more than $20 billion in loan loss reserves.

As we discussed yesterday, assuming a continued economic recovery, the banks will ultimately distribute a lot of their loan loss reserves to shareholders. In the case of Wells Fargo, that's over $20 billion.