In recent days, we've seen a persistent climb in energy prices - to new record highs by the day.

We started yesterday with that burden of the building energy crisis, combined with a politician-imposed deadline on raising the debt ceiling. With that double whammy, stocks were sniffing around the lows of the recent correction in the morning.

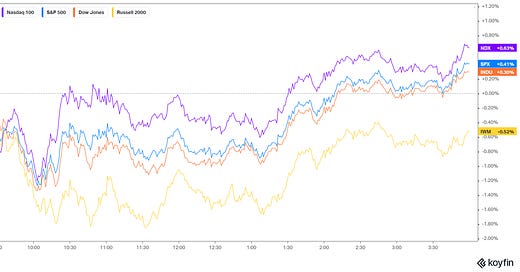

By the afternoon, stocks had bounced aggressively (nearly 2%), thanks to some well placed promises.

On the energy front: After Dutch natural gas prices jumped 60% in two days, Russia said it would send record amounts of natural gas to Europe this year. That was liberally interpreted as a promise - Global energy prices dropped.

On the debt ceiling front: As the President was hosting a meeting with some of the biggest corporate and banking leaders, laying out the consequences of a debt default to the American public, the other side (the Republican Senate) stepped up and floated an offer that would extend the debt ceiling deadline to December - Stocks rallied.

Now, every time U.S. debt is brought into the crosshairs we can expect the politicians to leverage the situation, and to use every chance they have to posture in front of cameras, insulting our intelligence with scare/doom and gloom debt-default scenarios. However now, in the post-global Financial Crisis and Pandemic era, we have plenty of visibility on this perceived disaster scenario.

Keep in mind, when a potential default in Greece threatened to destabilise the world, the major economic powers of the world stepped-in, providing support for Europe - helping to finance their rescue facilities and support the euro.

The takeaway: Within this crisis era, they (the major economies of the world) are all on the same team.

Not only will foreigners not dump U.S. Treasuries, they will buy U.S. Treasuries. In fact, even now, as this "default scenario" was being bandied about, the price of the 10-year Treasury was rising, as it did in the two debt ceiling dramas of the past ten years.

It all boils down to this: The world’s governments and central banks (led by the Fed) crossed the line in the sand, in response to the financial crisis - They all went all-in. They told us explicitly that they would do anything and everything to maintain stability and confidence in global markets. That hasn’t changed, in fact, the backstop powers have been wielded to a far greater extent in the pandemic response.

So, for perspective, a self-inflicted wound to the biggest economy in the world, that would destabilise global markets and threaten the global economic recovery, is highly unlikely - Not going to happen.