Walmart beat on earnings and revenue - the stock finished down 8%.

Target beat on earnings and revenue - the stock finished UP 18%.

We've had this performance divergence (chart below) over the past year between two of the biggest retailers in the U.S.

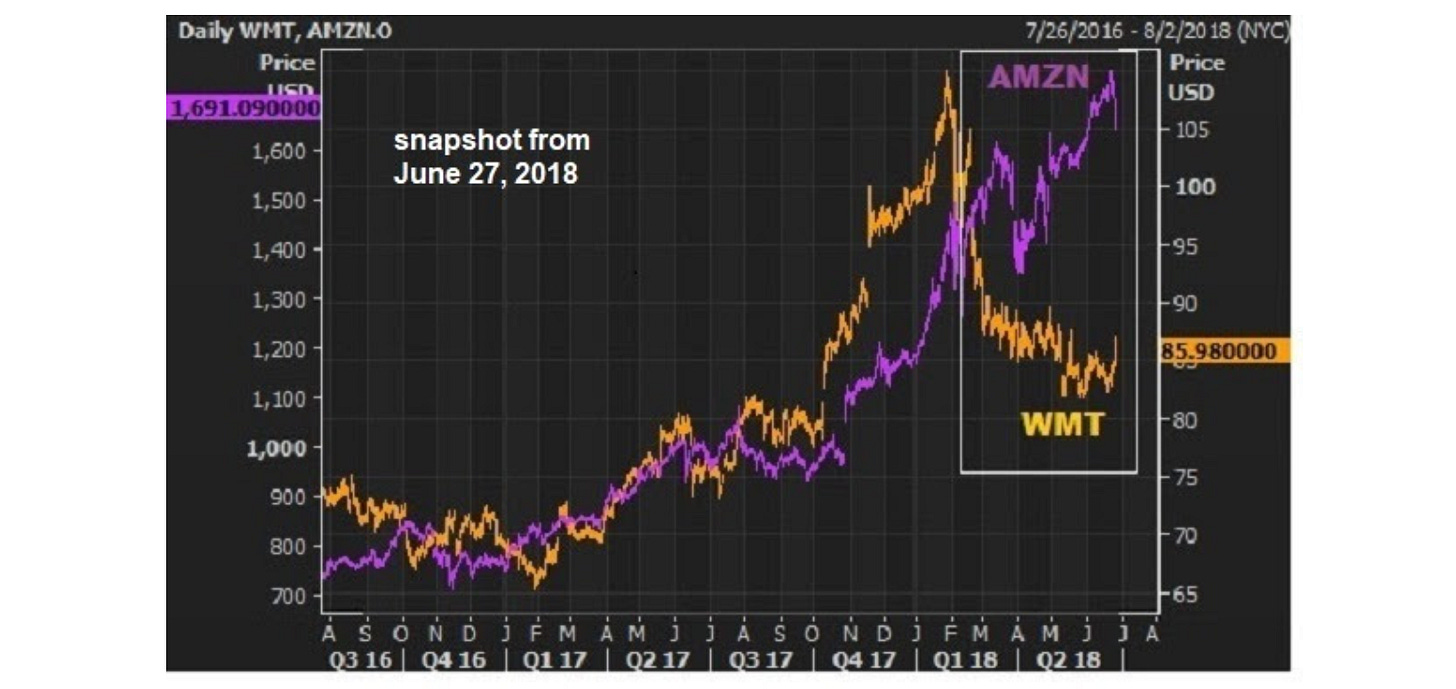

This reminds me of the Amazon/Walmart divergence of five years ago (2018). We talked about it then in my daily Macro Perspectives notes. Here's a look back at that chart . . .

The market was pricing Amazon like a runaway monopoly - killer of all industries, especially retail. The perception had been that Walmart was destined to become another rise and fall story of a dominant American retailer.

However, there was a clear and new catalyst that entered. Trump had made it very clear that he was not only looking to balance the playing field globally, but also domestically. That meant, the tech giants were due for some regulatory backlash. Amazon was in the crosshairs and it appeared that the foot was being lifted from the jugular of the old economy survivors.

The divergence was resolved (Walmart UP, Amazon Down) . . .

In the current case, the Walmart/Target divergence, Target has found itself in the crosshairs of political and cultural backlash. I suspect the WMT/TGT divergence will resolve in a similar way to the AMZN/WMT divergence. It may have started this week.

I show below a quantitative breakdown for Walmart and Target;

The dominant bearish price drivers for WMT being technical chart patterns - 12.18% & 19.12% odds of outperforming the market over the next 3 months showing the strongest signal relevance.

For TGT, the top 10 Alpha Signals all show positive odds of beating the market with the potential rally likely to be driven by technical factors.

You can access the above research by clicking on the button below. For further details, I can be reached on a.karlsson@gryningcapital.com .

ps: Become a member today and we’ll double your research period. Its not a Black Friday thing, its a Gryning thing . . .