For much of the year, the market has climbed the wall of worry, on several fronts:

Worry #1) the virus and, more importantly, the prospects of draconian government responses,

Worry #2) Russia and China taking advantage of U.S. position of weakness and flexing on their enlargement aspirations,

Worry #3) the lack of acknowledgement from the Fed on inflation, and therefore a catastrophic policy mistake, and...

Worry #4) related to #3 - the firing of the final, but toxic and inflationary fiscal bazooka, in the form of a tear down and rebuild of America spending plan.

In less than a week, it looks like three of these worries have been resolved.

No lockdowns. The Fed is moving on inflation. Build Back Better is dead (for now).

With that, we talked about the set up for a bounce back in stocks yesterday, particularly small caps (the Russell) - Russell finished the day up over 3%.

Earlier this month we compared the current period to 2014, where the domestic and geopolitical noise was high, and the Fed was ending its QE response to the financial crisis - and setting the table for the rate liftoff.

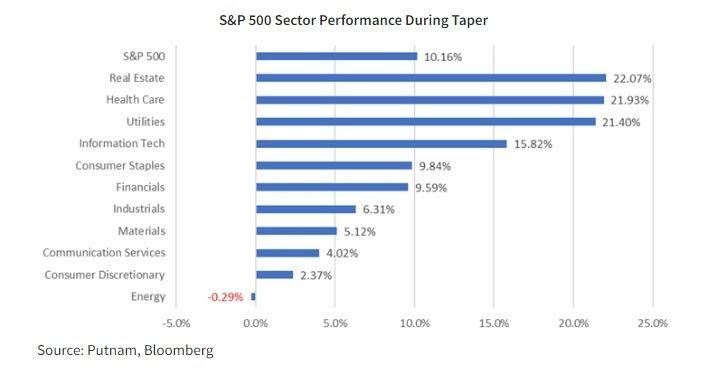

Through the Fed's taper, stocks went up - about 10%. From this graphic from Putnam, we can see which sectors performed the best in that period...