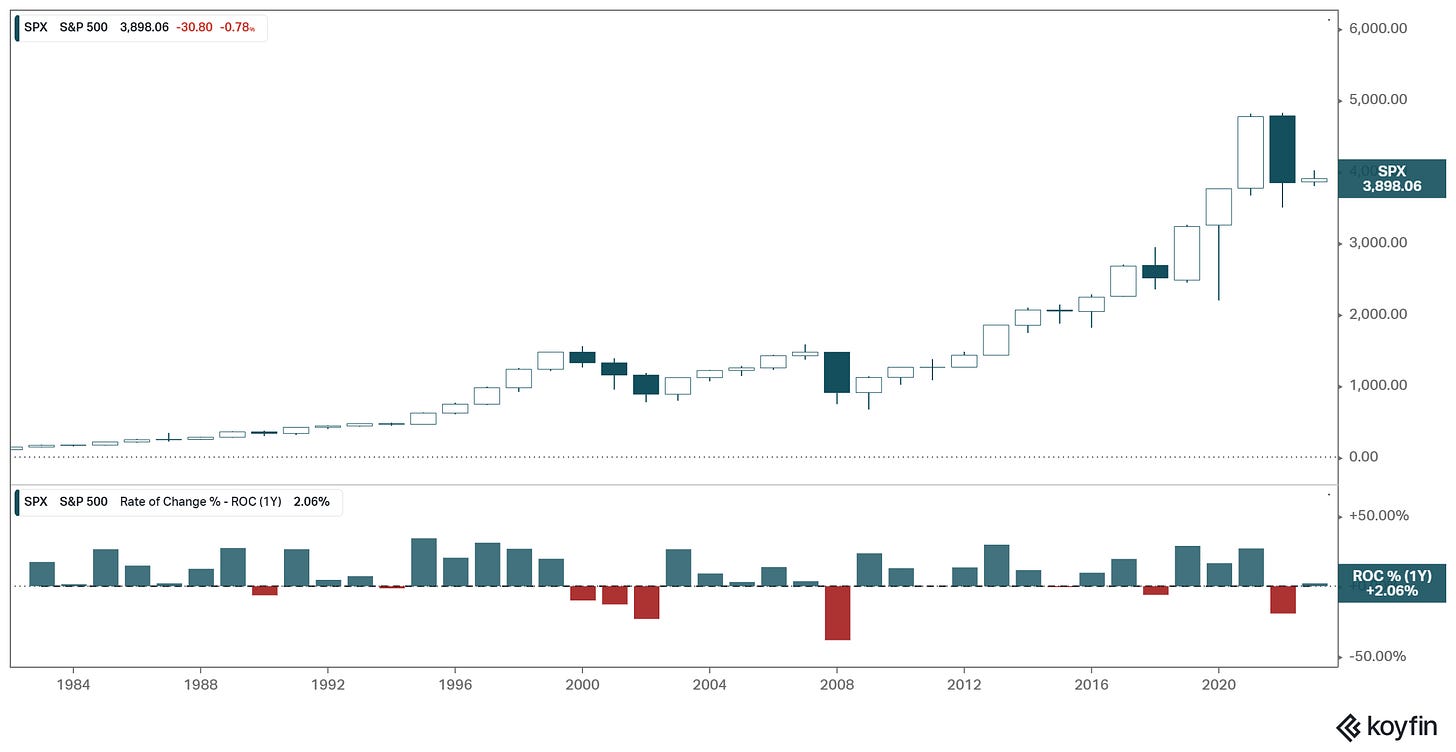

If we look back over the past 13 years, investors have had plenty to worry about.

Let's step through the post-Great Financial Crisis period.

Following the global government and central bank rescue efforts and stimulus of 2009, Wall Street told us the era of developed world dominance had come to an end, and that the future of investing was in China. By 2010, it was obvious that China couldn't thrive while the Western world economies were suffering.

The slowdown in China became the worry for markets.

In 2011, during a debt ceiling fight on Capitol Hill, Standard and Poor downgraded the U.S. credit rating, cutting it from AAA.

Next up, Europe: Europe was on the brink of a sovereign debt default and collapse of the euro, over the course of a few years.

Then we had Ukraine/Russia 1.0.

Then the Chinese stock market crashed, and China shocked global markets with a surprise currency devaluation.

Then oil prices crashed.

Then Trump entered, and was immediately impeached.

Then the world was shaken by the U.S./China trade war.

Then we had a global pandemic.

Then we had rampant, 40-year high inflation.

And then we had Ukraine/Russia 2.0.

Along the way, stocks climbed the wall of worry. Including dividends, the S&P 500 delivered eleven winning years, averaging 17.6% - and two losing years, averaging down 11.3%. Fourteen years later, and throughout all of the chaos listed above, every dollar in the stock market is worth $3.48.

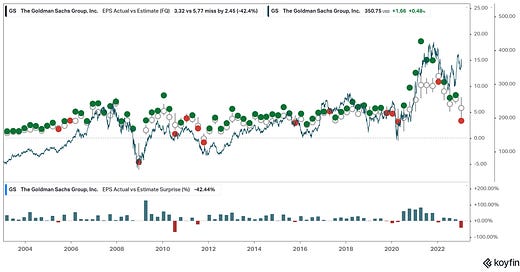

Here we are in 2023, and again, there is plenty to worry about, including another debt ceiling saga. Why does a "wall of worry" tend to be constructive for bull markets? Because it breeds positive surprise . . . here’s what it looks like on an individual stock level.

Join The Gryning Portfolio today and you’ll be able to implement our 2023 Model Portfolio before Monday’s open.