Let’s continue from where we left off on Friday; the Fed has been verbally attacking demand. The mechanism they are targeting to bring demand down, as they've explicitly stated, is jobs.

With that, the September jobs report came in on Friday morning:

Unemployment ticked down—the Fed wants unemployment up.

So the Fed's rate path and jawboning (about the rate path) didn't raise the number of unemployed, leaving the gap between job openings and potential workers at 1.7 to one. The Fed's alleged target is one to one.

But as we also discussed, the objective of the Fed, in targeting jobs, is to reduce the leverage workers have in negotiating higher wages.

On that note, wage growth came in tame for the second consecutive month. At a 0.3% monthly change, that's 3.7% annualized wage growth. That's just a touch above the monthly annualized wage growth for the nine-month period prior to the pandemic.

Meanwhile, with headline inflation running at over 8%, employees are experiencing negative real wage growth (losing 5% in buying power over the past twelve months).

Of course, that's against a broad basket of goods (CPI). If we look at the basics of food, shelter, and energy, it's double-digit losses in buying power. This equates to a lower standard of living.

Is the Fed trying to suppress wages because they think prices will eventually fall, closing the gap between the change in the level of wages over the past two years and the change in the level of prices (i.e., restoring the standard of living)?

No. An IMF report, published four days ago, lays out the policymaker rationale for pinning wages down.

It says, "Real wages (after the effect of inflation) tend to go down initially as inflation outstrips wage growth." That limits the ability of consumers to maintain the level of demand. They can't afford to pay for goods. With that, businesses do worse and are less likely to hire and give raises. That process, they think, stops a self-reinforcing upward spiral in prices, where wages feed into higher prices, which feed into higher wages …

But it only works, according to the IMF report, if businesses and consumers expect future inflation to be tame.

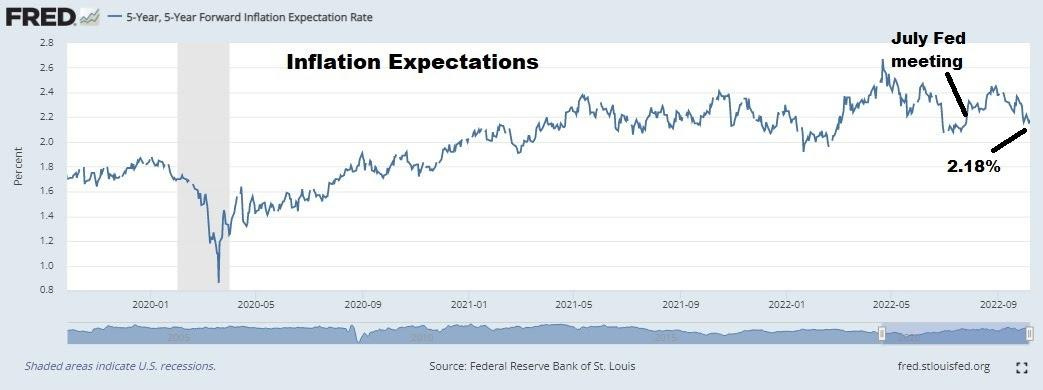

On that note, the Fed has talked down the stock market, and has continuously threatened to crush jobs and threatened a "whatever it takes" type of approach to crushing inflation-for the primary intent of managing down this chart:

As you can see, it has worked. Inflation expectations are 15 basis points lower today than at the September Fed meeting. and lower than the levels of the July Fed meeting, when the Fed signaled a pause in the tightening cycle.

So, again, the Fed's tough talk has worked. But remember, bringing down the rate of change in prices is different than bringing down the level of prices. The level of prices, thanks to this chart, is here to stay...

Wages will ultimately go higher, but the closing of the wage-price gap will be slow and painful.