Value in Energy

US stocks started the last week of June and Q2 in mixed territory, with the S&P 500 swinging around the flatline, the Nasdaq losing 0.7% while the Dow Jones gained 300 points.

Traders now brace for key PCE inflation data and comments from several Fed officials due this week to assess the monetary policy outlook.

The tech sector was by far the biggest laggard as the AI-rally frenzy pause continues, with Nvidia falling about 6%, a third consecutive day of losses.

Also, Apple gained 1% and Meta added about 0.8% amid news the two companies are discussing an AI partnership.

Alphabet was little changed and Amazon lost 1% while Microsoft edged 0.2% lower.

We’ve recently talked about the technical - outside day - reversal signal in Nvidia - it's now down 10% from Thursday's close.

And as we also discussed in my Friday & yesterday’s note, due to the disproportionately heavy weighting of Nvidia in the S&P 500 and Nasdaq, those key indices also put in reversal signals.

With that, we discussed the prospect that these signals could trigger a (needed) rotation, and broadening of market performance.

With the behaviour of stocks over the past three days, that seems to be developing. To open the week the Nasdaq and S&P 500 were down, the Dow, Russell (small caps) and equal weighted S&P 500 were UP.

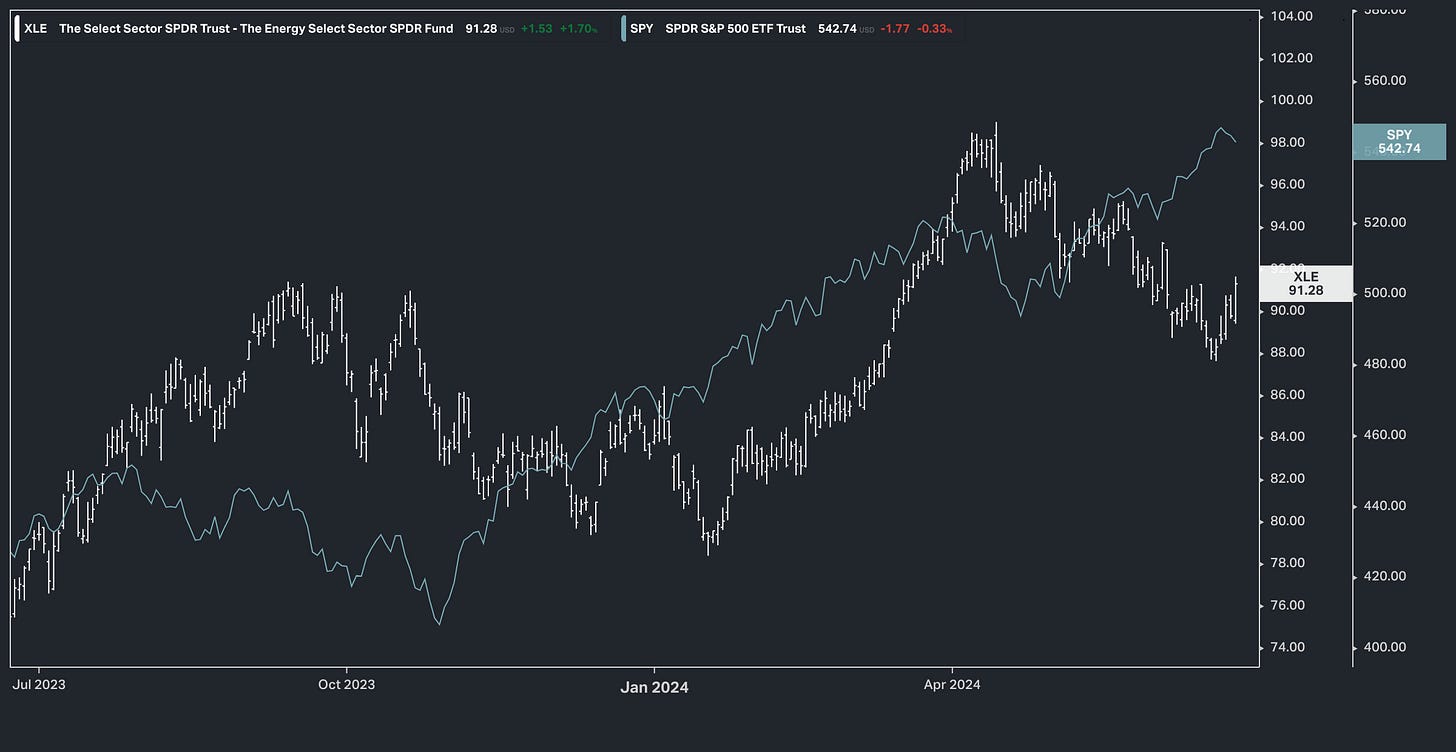

Unsurprisingly, with a rotation from expensive to cheap, the best performing sector of the day was energy.

The energy sector clearly represents the best value. It's expected to contribute almost 7% to S&P 500 earnings in Q2 (with the largest upward revision), but makes up just 3.5% of the index by market cap (as you can see in the graphic below). And that market cap representation within the index is near historic low levels.