In my last note, we revisited the mid-term election analogue for stocks.

The 12-month period following the past eighteen mid-term elections, of the past seventy years, has been positive for stocks - to the tune of a 16% return, on average.

Indeed, stocks are tracking that analogue this year.

Today, let's revisit another analogue we discussed coming into 2023 - it has to do with the trusty 60% equity/40% bond portfolio.

As you might recall, at one-point last year, this portfolio mix was down as much as 30% - that was tracking to be the worst on record, even worse than 1931 (the depths of the Great Depression).

The 60/40 portfolio finished last year, down 18%.

Now, it's not rare for this portfolio to be down on the year. It's happened about a quarter of the time, but it is rare (four times going back to 1928) for both stocks AND bonds to be down on the year - stocks were down 18% (S&P 500, total return) and bonds were down 18% (10-year bond, total return).

So, let's revisit how stocks performed in the year following these four rare occurrences, that shared the features of a negative 60/40 portfolio return, driven by a negative annual return for both stocks and bonds.

It happened in 1931 - that was followed by a negative return year for stocks (down 9%) and a positive return year for bonds (up 9%).

It happened in 1941 - that was followed by a positive year for stocks (up 19%) and a positive year for bonds (up 2%).

It happened in 1969 - that was followed by a positive year for stocks (up 4%) and a positive year for bonds (up 16%).

It happened in 2018 - that was followed by a positive year for stocks (up 31%) and a positive year for bonds (up 10%).

Now we've had the fifth occurrence, in 2022. And more than eight months into the year, stocks are up 17%, and bonds are down 1%.

This year's performance in the bond market is deviating from history. This is thanks to the sledgehammer of rate hikes, and threats of more (by the Fed), which have weighed steadily on bond prices throughout the year (prices down, yields up).

On that note, we head into a Fed meeting this week, with the benchmark 10-year bond yield having printed a new 16-year high overnight -now hanging around the 4.30% yield mark, a level that has marked a high, and a turning point, on two other occasions over the past year.

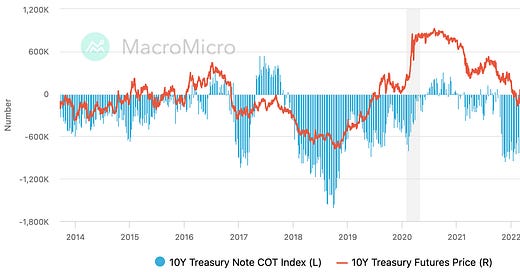

With this setup, speculators are net short treasury futures (i.e. short bond prices) at record levels.

What does that mean? They are leaning heavily in the direction of a break higher in yields (lower in bond prices) - these extreme positions tend to be contrarian indicators.

The last time the market was positioned near this extreme of a short (against bond prices) was September-October of 2018. Those bets were wrong. It was the turning point, and those levels weren't seen for another four years.

PS: If you know someone that might like to receive my daily notes, they can sign up by clicking below . . .