U.S. Presidential Election takes place today.

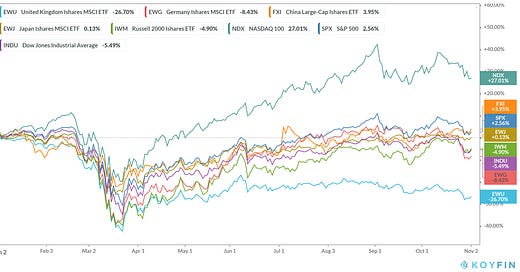

As we head into the high stakes election, global asset prices were up on the day. The broad stock market was up over 1%, but big tech was down.

Amazon was down 1.8%, Apple was down 1%, Facebook down 1.4%, and Twitter was down another 5% (after getting taken apart on Friday for more than 20%).

Remember, last week we talked about the big “technical” break down in the key tech stocks, following a day that the leaders of Google, Facebook and Twitter were grilled by the Senate. We discussed the potential valuation tipping point for big tech, as we've now breached the 1999 levels of tech representation in the S&P 500 index. Will this election serve as the catalyst, or "pin" to prick the bubble in big tech?

This sets up for a rotation. In a Trump win, a rotation into energy, infrastructure and value stocks. In a Biden victory, a rotation into the stocks that benefit from the democrat “clean energy” plan.

Let's talk about the probable scenarios from the election:

In the case of a Trump win - we should expect a more aggressive opening up of the economy.

In the case of a Trump win and an aligned Congress - we should expect a more aggressive opening up of the economy AND another stimulus package that would fund an aggressive infrastructure spend, with “bringing the supply chain home” as the centerpiece.

In the case of a Biden win - in a “blue wave” we will, no-doubt, get a monster, multi-trillion-dollar second stimulus package, to fund his/their very aggressive economic transformation/ “clean energy” plan.

In the case of a Biden win and split Congress - I suspect he may hold the economy hostage, through tighter virus mitigation, so that the Republican-led Senate will relent and do a second stimulus package (which will fund the clean energy plan).

In the case of a prolonged period of uncertainty, surrounding a contested election, we will likely get more Fed action, and a second stimulus package.

The common theme in these four scenarios is: Economic Fuel.