In Friday’s jobs report, the market was looking for nearly a million new jobs created in the month of April.

It came in at about one-quarter of that.

Was this a warning signal that the economy is actually slower and more vulnerable than is being spelled in the data and corporate earnings?

That's precisely what the Biden administration wants us to believe, because that justifies the additional $4 trillion in spending they have lined up to push through Congress. With that, the glide path to more, massive spending is a positive for markets. That's why markets (stocks, commodities) were up, across the board.

But is the jobs report really a signal that the economy isn't so hot? Or does the softer employment number from April simply represent the reality that the government is winning the competition for labor by paying people two to four times (depending on what state you live in) the minimum wage to stay at home?

Common sense (plus empirical and anecdotal evidence) would tell us the latter.

The president and his treasury secretary told us on Friday that it's the former, and moreover they told us that enhanced unemployment benefits have nothing to do with keeping people from returning to work.

Data doesn't lie. It's a labor shortage issue, and it's a labor shortage issue because employers can't compete with the government on wages.

That's why existing workers are having to work longer hours in an attempt to satisfy hot demand, especially in the industry that was hardest hit in the pandemic (leisure and hospitality)...

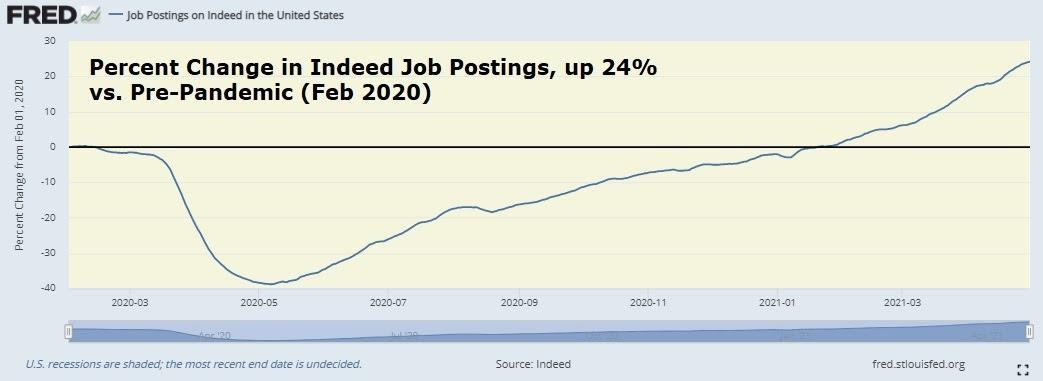

And that's why employers are desperately looking to add staff. As you can see in the chart below, job openings on Indeed, the online job board, are up 24% from the pre-pandemic levels.

Back in February 2020, the unemployment rate was 3.5%, near the tightest employment on record. The current unemployment rate is 6.1% (far higher), yet the market for talent looks even tighter than it was pre-pandemic.

This will all translate into higher wages, as employers are forced to raise wages to compete with the government. And wage inflation feeds price inflation. The wage inflation manufactured by the government (through subsidised unemployment) has already led to record savings levels, hot consumer spending and asset inflation. Big inflation in everyday consumer prices is next.

Keep buying assets (as an inflation hedge), and as we discussed on Thursday, among the options to protect buying power, gold is a relative bargain.