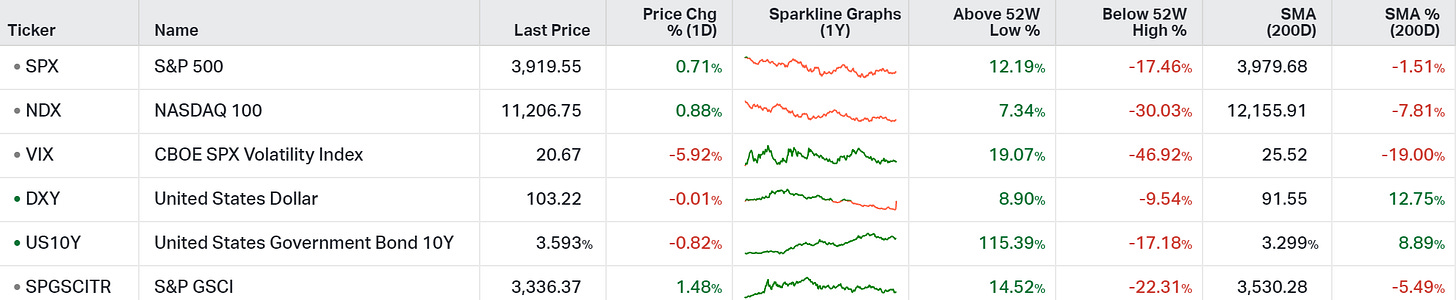

As we discussed yesterday, we should expect a big reaction in stocks from Thursday's (tomorrow) inflation report. The history of the past four months would suggest something on the order of 5%.

With the inflation data trending toward a soft, if not negative, monthly change in inflation, it sets up for a bullish breakout in stocks.

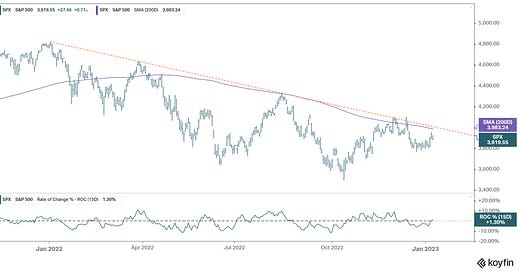

The above chart above has been referenced before, where stocks were testing the arbitrary downward sloping trend line (orange) and the 200-day moving average (purple) last month, heading into the CPI report. The number came in soft. There was a Fed meeting a day later, and they attempted to crush any optimism about an end to the tightening cycle - stocks went lower.

The stock market bought the message the Fed was selling. The bond market didn't.

At yesterday's close the 10-year yield is 150 basis points below where the Fed is projecting the Fed Funds rate at year end. As the bond king, Bill Gross, points out, the historical average spread is just 90 basis points. If the bond market is right, the stock market is going higher (breaking out of this downtrend).

If you enjoy reading my daily notes and know someone that may benefit from them, please pass this on.