We're through the first half of the year, and with history as our guide, we came into the year expecting a good year for stocks;

Going back to 1950, there has never been a 12-month period, following a midterm election, in which stocks were down.

The average 12-month return, following the eighteen midterm-elections of the past seventy years, was +16.3% (about double the long-term average return of the S&P 500).

The S&P 500 opened at 3,750 on November 8th, 2020 (election day). At the highs yesterday morning, it was trading just shy of 4,500 - that's a rise of about 20% over the past seven months.

That begs the question: What was the best 12-month period following a midterm election (over the past eighteen periods observed)? It was under Kennedy. Stocks rose 31% in the 12-months following the 1962 midterm election.

Interestingly, the worse stocks did in the 12-months prior to the midterm elections (over the 70-year period observed), the better they did after. In the current case, stocks were down 22% prior to this past November.

So, history would suggest more upside for stocks is probable over the next four months.

On that note, last week we discussed some reasons to believe the economy can do better than the consensus view. Among them, we've had some key risks removed over the past couple of months (the removal of the risk of a banking crisis, the removal of the risk of a U.S. government debt default, and the removal of the Fed's constant threats to destroy jobs and suppress wages).

Add to this, the fiscal bazooka has been loaded but has yet to be fired - just $600 billion of the $4+ trillion approved under the Biden administration has been deployed. A tsunami of money will be hitting this economy. Plus we have the introduction of a productivity boon, in generative AI.

With that, we've just had a significant revision higher to Q1 GDP (from 1.3% to 2%). The Atlanta Fed's GDP model is tracking an almost 2% annualized (real) growth rate for Q2 - importantly, that's about double the consensus view of the economist community.

Of course, the economist community will tell you that the yield curve is inverted. PMI's (manufacturing and services activity) are under 50 (economic contraction territory). The Fed is still hawkish. And with that, they continue to look for an impending recession.

But as we've discussed, the inverted yield curves (globally) can be quite reasonably attributed to bond market manipulation by central banks. Central bank intervention in bond markets, of varying degrees over the past 15 years, has all but canceled the validity of signals bond markets have historically given to markets about the economy.

On the latter (manufacturing activity, and the Fed), what matters (for markets, and the economic outlook) is incremental change.

This chart above is ISM Manufacturing PMI. The June reading was reported on Monday. Since the Fed began telegraphing a tightening cycle (in late '21), this index is down from 60 (in healthy expansionary territory), to 46 (in contractionary territory). The widely held assumption is that this contraction in manufacturing activity is predicting an imminent contraction in economic activity. Indeed, the plunges below the white line (in the chart above) have been accompanied by recessions.

Is it different this time? In each of these cases where the index has been at the white line or below, unemployment has been rising sharply, and, at least, at multi-year highs. This time, we're near record lows. Labor supply is very tight. And we have a tsunami of fiscal spending coming down the line, which is supportive of the labor market.

So, the question, when looking at this chart: Is it more likely that we see the next 5 points on this manufacturing index higher or lower? I suspect higher is the higher probability. That incremental change (higher) would be positive for market and economic sentiment.

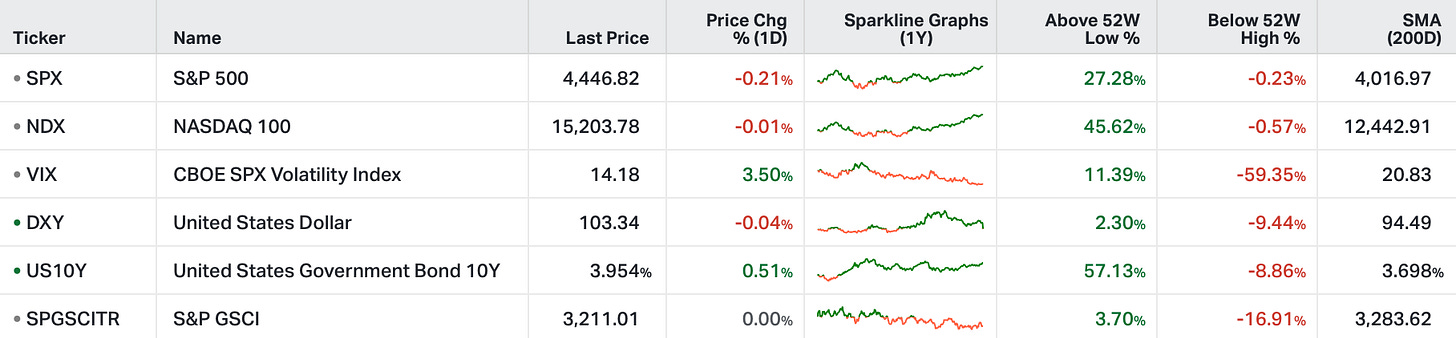

Finally, on the Fed outlook. Once again the Fed has postured to do more . . . and once again, the market is pricing it in. What matters most is that the Fed is near the end, and that market rates (the benchmark 10-year yield) remain contained.

On that note, this chart becomes very important to watch, with the move in yields over the past four days. The 4%+ level has been Kryptonite for global financial stability . . .

Gryning offers institutional grade analysis for Student, Independent and Professional Investors - we build portfolio’s and present trade idea’s centered firmly on the above three principles. Become a member by clicking below: