Until They Don't

Wall Street closed lower on Thursday, after a hotter-than-expected PMI survey fueled concerns about prolonged higher interest rates.

The Dow Jones plunged by 605 points, marking its worst day of the year.

The flash S&P Global PMIs surpassed expectations, indicating an acceleration in US business activity.

This, coupled with persistent inflation, reinforced speculation that the Federal Reserve would maintain its current interest rate stance, pushing Treasury yields higher.

Megacap stocks fell, except for Nvidia, which surged 9.3%, surpassing $1,000 per share for the first time.

We talked about Nvidia's big earnings report yesterday - it was good for new record highs in the stock.

Adding to the earnings and outlook fuel, was the 10-for-1 stock split that was announced - to take place at the close on June 7. The split will expand the universe of potential Nvidia shareholders by bringing the cost to own a share down to around $100 a share.

This looks like the 2014 Apple split - Apple announced a 7-for-1 split when the stock was in the mid-$500s. It was around $700 by the time of the split. The stock was bought pre-split in anticipation of;

an increased appetite for Apple shares at a lower price (broader investor base),

the potential for Apple's inclusion in the Dow (DJIA), made possible by the lower share price (for a price-weighted index).

Nvidia may see a similar path. Now, while Nvidia had a good day, almost nothing else did.Broad stocks were down on the day.Commodities were down.Bonds were down.

Let's take a look at stocks …

Last month, after a nearly 30% rise in five months, the S&P futures put in a technical reversal signal (an outside day) - that signal predicted a 7% technical correction. We've since traded back to new highs, and we get another reversal signal. Same said for the Nasdaq.

Did Jensen Huang's insider view on the new industrial revolution impact the market's outlook on interest rates? Was it just a hot PMI report in the morning that triggered broad selling across markets? Or was it something else that may be raising the global risk temperature?

Perhaps it's the U.S. Treasury Secretary in Italy, meeting with G7 Finance Ministers, who stated an agenda that includes transferring ownership of seized Russian assets, and presenting a "wall of opposition" to China's trade practices.

Or perhaps it's the prospects of the United States President's political opponent being jailed by the end of next week.

As we discussed in early April - when the U.S. administration spent a day recklessly mixing geopolitical signals that ranged from policy confusion on Israel and Taiwan, to threatening Russia with Ukrainian membership in NATO - markets will ignore domestic political infighting and geopolitical posturing until they don't.

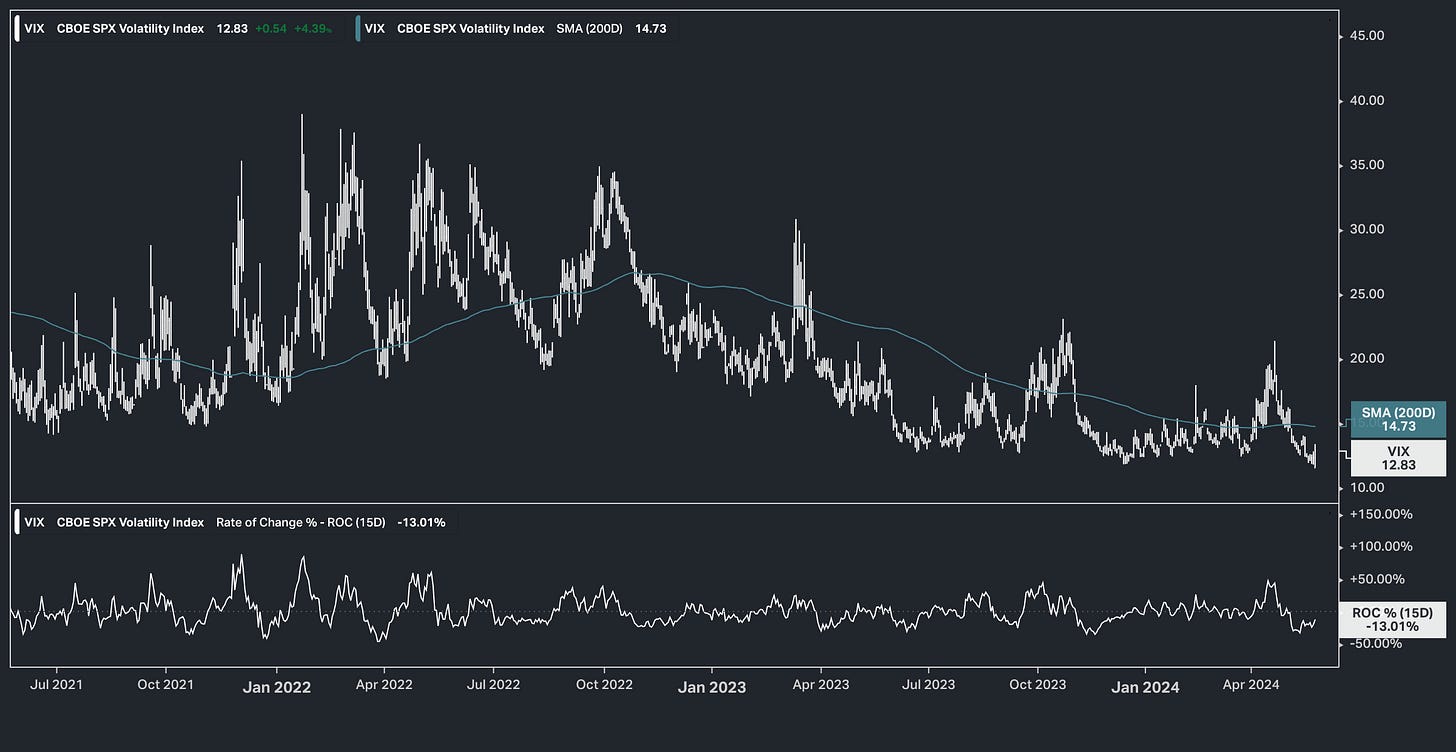

It's fair to say that there is greater geopolitical and domestic news risk in the world, if not shock risk, than is being reflected in this chart …

The VIX tracks the implied volatility of S&P 500 index options - this reflects the level of certainty that market makers have, or don't have, about the future.

To put it simply, if you are an options market maker, and you think the risk of a sharp market decline is rising, then you will charge more to sell downside protection (ex: puts on the S&P) to another market participant - just as an insurance company would charge a client more for a homeowner’s policy in an area more likely to see hurricanes.

An "uncertainty premium" would translate into the spikes (or higher levels) in the VIX. Again, as you can see in the far right of the chart, we haven't had it.