Until Markets Don't

US stocks closed sharply in the red on Thursday, as the Dow Jones tumbled 539 points marking the fourth losing streak and the biggest daily drop since March 2023.

Meanwhile, the S&P 500 and the Nasdaq declined 1.2% and 1.4%, respectively.

Investors also considered recent comments from Fed Chair Powell, who reiterated that despite inflationary pressures, it could be appropriate to start lowering interest rates this year.

All the sectors finished in the red with the tech and healthcare leading the losses.

Semiconductor stocks dragged the most, including Nvidia (-3.3%), AMD (-8.2%), Intel (-1.5%) and Micron Technology (-3%).

We've been watching this trendline in stocks. The nearly perfect 45 degree angle ascent of the world's benchmark stock market (proxy for economic and geopolitical health and outlook) originated from late October commentary of Fed Chair Jerome Powell, when he signalled the tightening cycle was over.

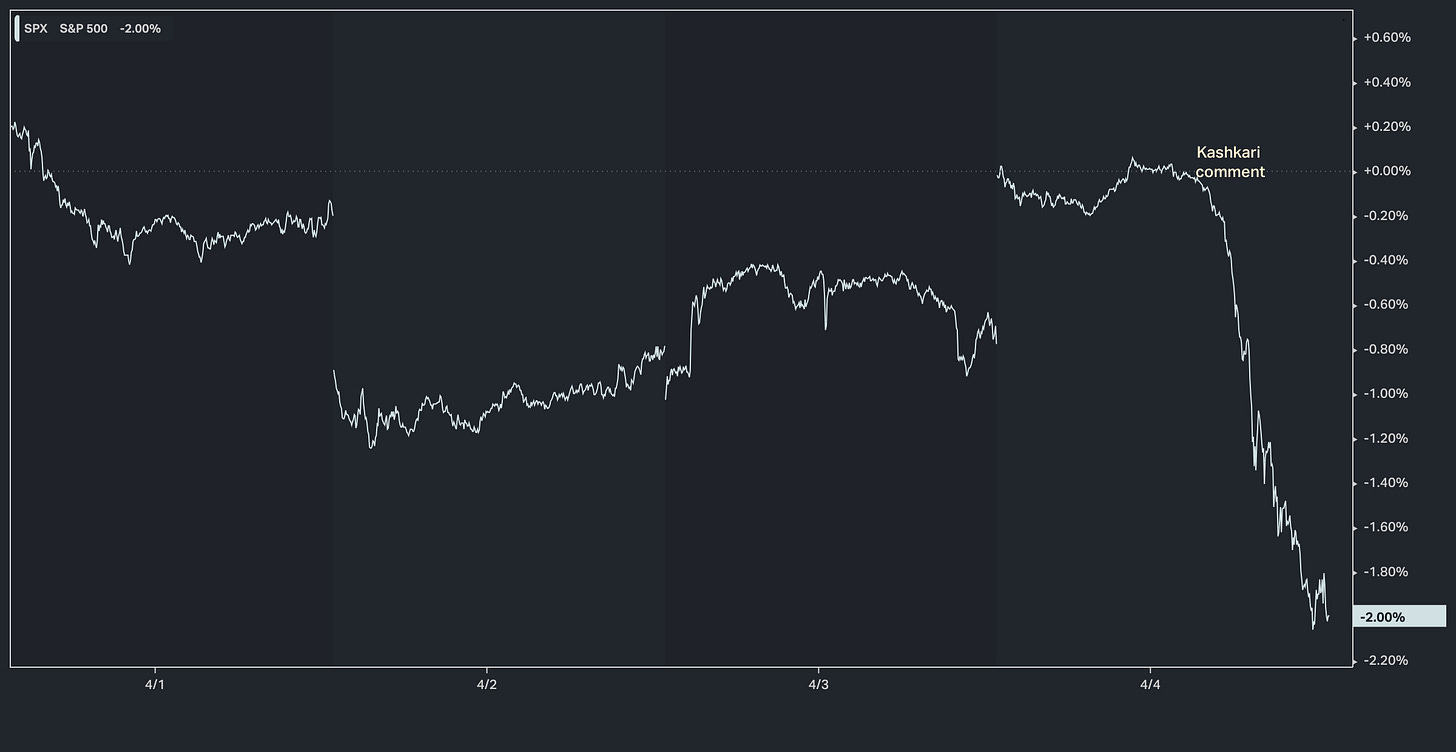

Since then, the market has gone from anticipating a change for seven quarter-point rate cuts this year, to five, to three. Meanwhile the Fed has telegraphed three cuts, with some members chattering about the possibility of two, then one. And now, from non-voting member Neel Kashkari, he suggested maybe none/zero rate cuts this year.

That comment from Kashkari hit the wires at a little after 13:00 (EST) - stocks did this ...

Remember, from the first chart, stocks have risen nearly 30% since late October, despite the dramatic curtailing of rate cut expectations. With that, there was another headline that hit a little after 13:00 (EST) in the afternoon.

Here's how Bloomberg interpreted it ...

Markets will ignore domestic political infighting and geopolitical posturing until markets don't. This communication from the White House, describing the takeaway from a phone call between Biden and Netanyahu may be the tipping point - threatening a policy shift on Israel is a wakeup call for markets.

Stocks immediately sold off.

Yields ended lower.

Gold spiked.

The market response was broad-based risk aversion. But there was more.

Shortly after the White House headline on Biden/Netanyahu, in the daily White House Press Briefing, the White House Security Communications Advisor, John Kirby, fielded questions on Biden's recent call with Xi Jinping. In doing so, he said Biden was clear, in that "nothing has changed about our One China policy, we don't support independence for Taiwan." I was watching it live. So much for "strategic ambiguity."

Also in the afternoon, the Secretary of State, Antony Blinken was at NATO headquarters, and said that "Ukraine will become a member of NATO," which is an affront to Putin's 2021 security ultimatum.

With these headlines coming out of the U.S. administration, the world became more dangerous. And just like that, the nuance surrounding today's job report, and rate cut timing becomes less important for markets.