The March UK price data, released early yesterday morning, showed double-digit inflation. This was the Wall Street Journal headline.

Given that the Fed (the global interest rate anchor) is clearly contemplating the end of the road for the tightening cycle, a big inflation number in Europe, in a month that should have reflected tightening global credit conditions, set off some alarms. Rates went higher, stocks went lower and commodities went lower - globally.

But it was a false alarm. By this time next month, it's a good bet this same reading in the UK will have plunged.

Why? The "base effect."

The April inflation data will be measured against a significantly higher data point from twelve months prior.

Here's a visual, for perspective:

Even if April (this month) were to bring about a hot inflation number in the UK, the year-over-year CPI will likely land somewhere within the white box on this chart below. So, this time next month the media will be talking about an acceleration in the trend of "disinflation" in the UK.

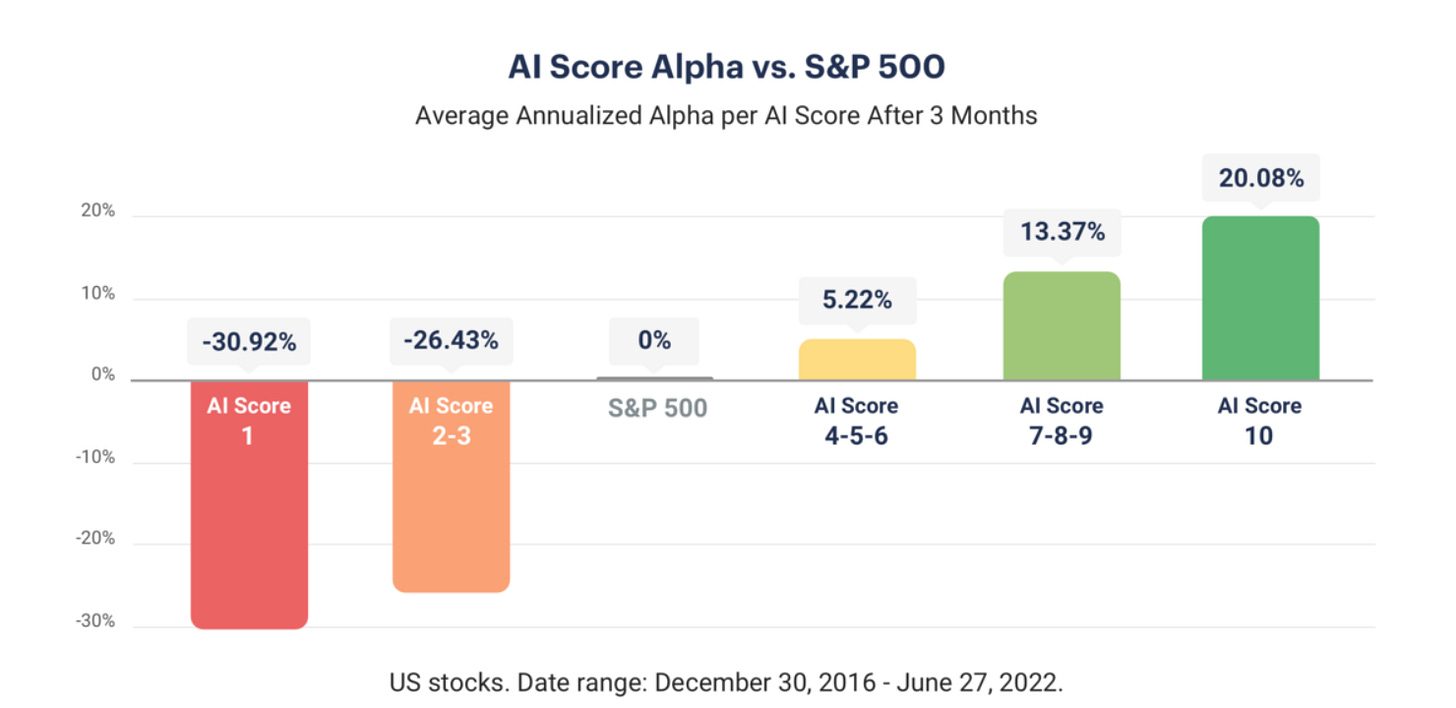

Gryning AI rates stocks (all US stocks & Stoxx Europe 600) with an easy-to-understand global AI Score, ranging from 1 to 10; the higher the score, the higher the probability of beating the market in the next 3 months.

The stocks are then ordered according to their potential of out-performing the market (generating alpha).

Stock ranking from 19 April 2023.

For more information and to access your own personal quant, click below: