Last week, we talked about the unwinding of some bubbly assets. It got uglier Monday morning, and then it got better.

Let's talk about what's going on…

We have over 40% growth in money supply in less than two years. That's a lot of excess money in an economy, chasing a relatively stable quantity of assets. When this happens, you get inflation, and you get irrationally allocated money. This can tend to result in money overflowing good assets, and being pushed to lower quality assets.

Much like the dotcom bubble, and the housing bubble, we again have seen this dynamic of irrational investment. The time of reckoning is here. In this case, it was the overly aggressive Fed and Government response to the pandemic that created the liquidity deluge, and the resulting excessive investment. Now it's the 'change in direction' of those policies that is ending it.

The prospective path of rising interest rates is already putting downward pressure on valuations. With that, some selling can quickly turn into more selling, which can turn into forced selling.

We've talked over the past two weeks about forced selling of overvalued, under-earning tech companies in the famed ARKK Funds - that was the "canary in the coal mine."

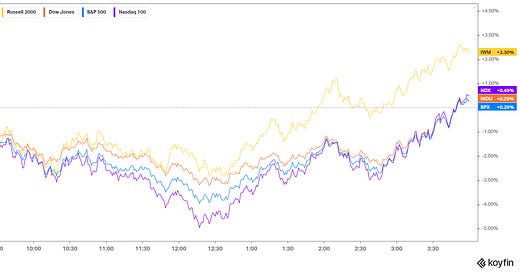

Here's the good news: After the selling became broad, markets recovered. Small cap stocks led the way. This signals that money is not running away from the stock market, it's simply moving (from overvalued, to undervalued). That's very positive.

Still, some think the decline in stocks to start the year may influence the Fed's current path of monetary policy. That's highly unlikely. Back in 2016 and 2018, a falling stock market caused the Fed to do an about-face on its plans for hiking rates - but the economy was weak and fragile, and inflation was soft.

This time, the Fed is dealing with a 5%+ growth economy, and 7% inflation. They won't be altering the path. That said, Jay Powell would be smart, in this Wednesday's post-FOMC press conference, to make it uneventful (i.e. give markets nothing new to chew on).