The United States Congress has appropriated over a trillion-dollars to the climate agenda over the past three years.

Yet the biggest clean energy ETF has done this …

As you can see in the chart, the Blackrock clean energy ETF (ICLN) is down 60% from the highs, back near pre-covid levels.

*Alpha signal analysis attached at the end of note.

This is after direct funding of the clean energy agenda through the Cares Act, the American Rescue Plan, the Infrastructure bill and the "Inflation Reduction Act" - the latter of which, the administration doesn't even try to deny that its purpose (the "IRA") was to fund its clean energy agenda (branded as an inflation fighter).

Beyond the unprecedented magnitude of fiscal spending on this agenda, all financed via debt, there has been plenty of collateral damage to the economy.

It was clear along the way that unnecessarily prolonged covid restrictions and the Fed's unimaginable unwillingness to recognize the inflationary fire that was already upon us, contributed to the ability of the democrat aligned Congress and White House to get the final and largest tranches of clean energy agenda funding across the finish line.

Still, as you can see in the chart above, it hasn't materialized into value creation - at least yet.

Why?

Apparently, it's not enough - not even close.

The politicians meeting at the latest climate summit in the United Arab Emirates have realized that their experiment to transform the global energy system is very, very expensive. They are not only doubling down, they are tripling down. Over 100 countries pledged over the past few days to triple global renewable energy capacity by 2030.

According to the European Commission President, they need trillions of dollars of funding every year, not billions.

How are they going to fund it, with global sovereign debt already at record levels? I suspect they will find a way to incentivize private money (institutional/pension investors) to follow the government money.

What would open the flood gates? Rating agencies stamping AAA ratings on corporate "green bonds" (i.e. bonds issued by companies to specifically finance building clean energy capacity).

We already know the rating agencies are coercible. Remember, the real estate bubble was primarily driven by Fitch, Moody's and Standard & Poors unexplainably stamping AAA ratings on high risk/high yielding mortgage securities. With a AAA rating and a high yield, massive pension funds had no choice, if not an obligation to plow money into those investments.

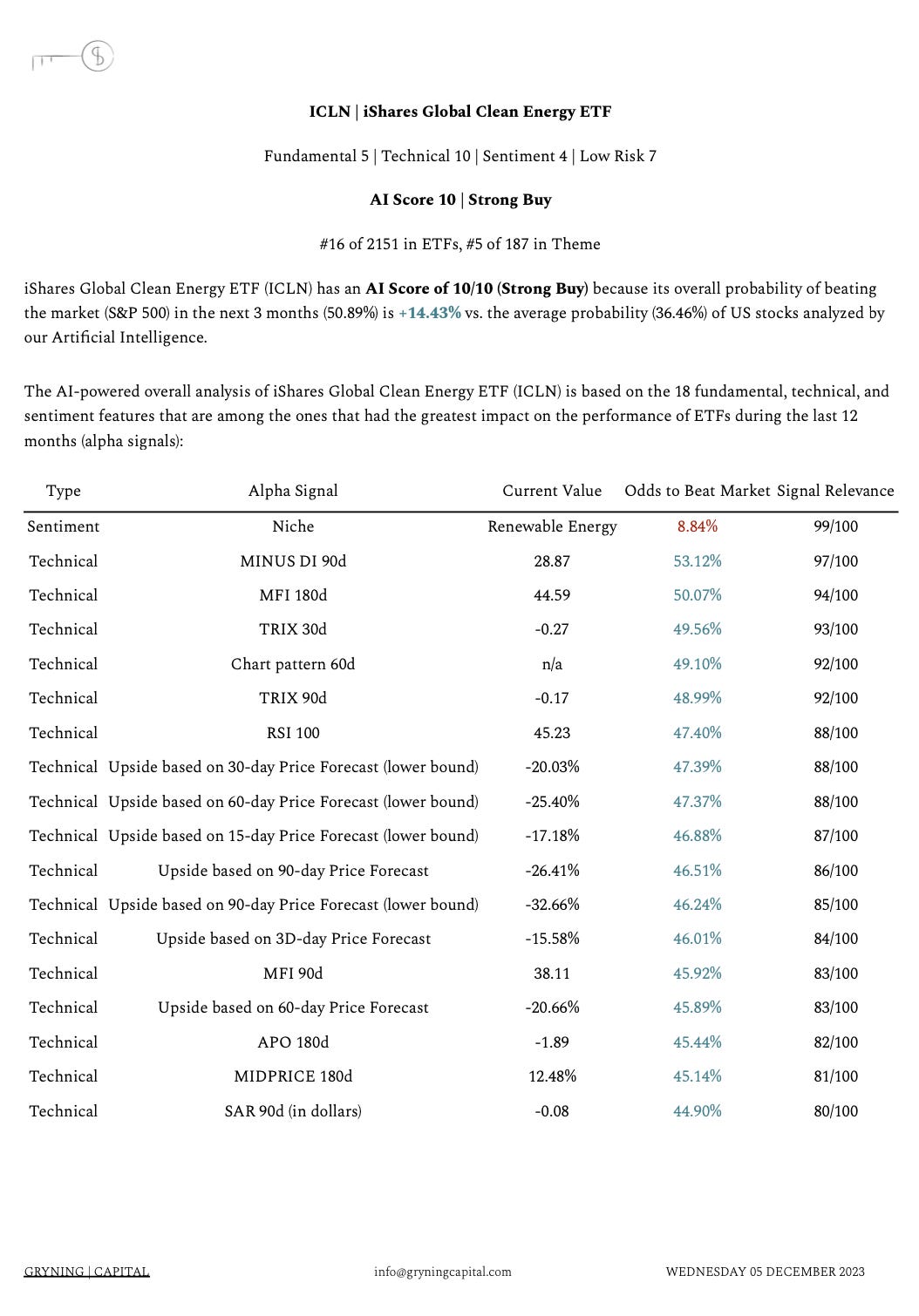

ICLN Alpha Signal Analysis.

Become a member of Gryning | Capital to get Alpha Signal Analysis for the Broad Market alongside 50 tickers of your choice to accompany Trade Idea’s identified by our AI.