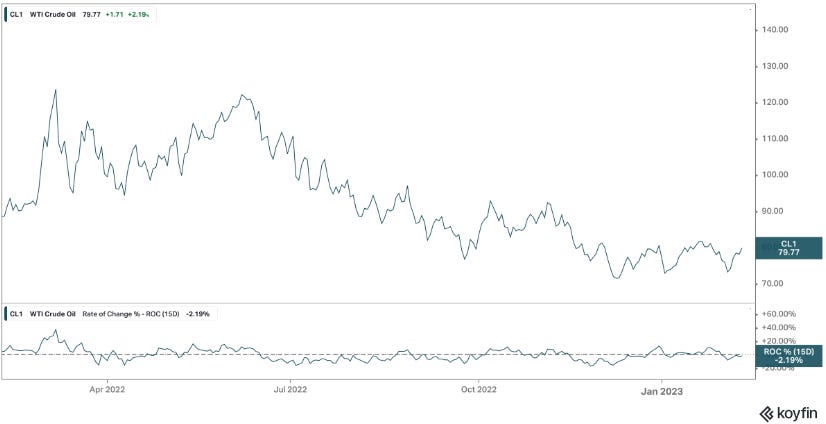

We talked about the oil situation last week, after Biden mistakenly admitted that U.S. producers have no incentive to invest profits in new production, given the administration's (and Western world's) war on oil.

As we've discussed the past two years here in my daily notes, the Western world's war on oil has put OPEC and Russia in the driver's seat to dictate supply, and therefore price.

On that note, the world has been naively hoping that OPEC would increase production to help ease the global oil price crunch (namely, for Western consumers). Not only have they rejected that notion, they have cut production since (last October).

Add to this, Russia announced a 5% production cut Friday.

Just as oil revenue dependent companies will act in their best interest, so will oil revenue dependent countries.

On the demand side;

China has scrapped its zero-covid policy,

the IMF has upgraded its global growth forecast,

the U.S. will be replenishing its Strategic Petroleum Reserves.

We should expect triple-digit oil prices to return.

Additionally, higher oil prices would reverse what has been a falling rate-of-change in overall prices (i.e. inflation). This fits with the scenario we've been discussing, of persistently higher than historically-average inflation.

The good news: With interest rates now normalized, persistently higher inflation can also be stable inflation.

These are the values the drive The GRYNING Portfolio.

If they match your values, click below and join for less than a coffee a month.