Trendlines

US stocks erased early gains as declines in heavyweight chip companies pressured tech-exposed equity indices, while markets assessed recent data and geared up for the Federal Reserve’s policy decision.

The Nasdaq 100 closed 1.3% lower, reaching its lowest level in nearly two months, while the S&P 500 fell 0.5%.

Microsoft fell 0.9% ahead of its earnings release after the closing bell, while Apple, Alphabet, and Meta experienced muted activity ahead of their reports later in the week.

On the earnings front, Merck sank 9.8%, and Procter & Gamble plunged 4.8% following their respective results.

Still, the Dow gained 205 points, extending its outperformance over tech-heavy counterparts, supported by banks and insurers.

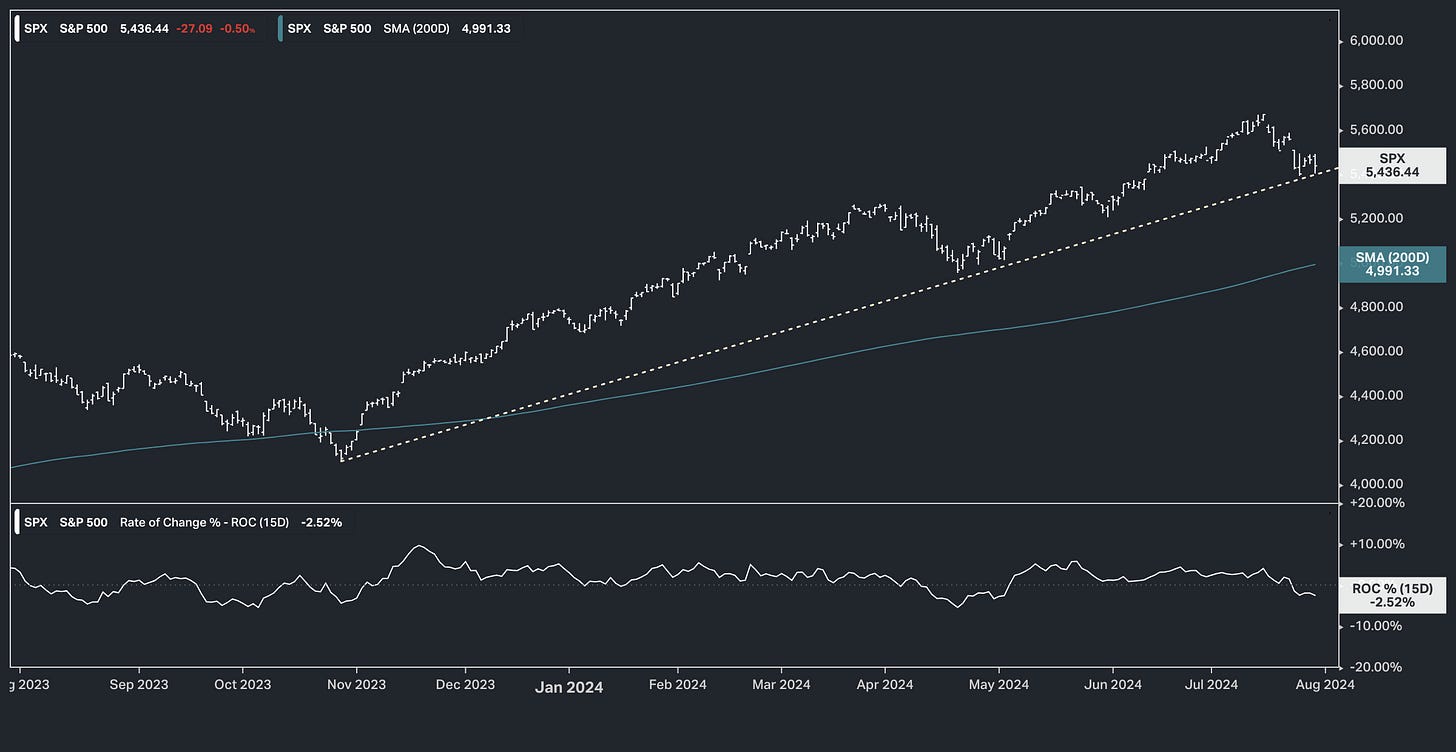

We head into two big central bank meetings with the most important stock markets in the world sitting on big technical trendlines …

Both the S&P and the Nasdaq sit on this big trendline that represents the trend from the October lows, which was marked by Fed signalling that the tightening cycle was over.

The trajectory of the trendlines represents the view that financial conditions will be easing.

That said, here we are nine months later, and the Fed has done a lot of talking, but has delivered no rate cuts. And based on the Fed's Financial Conditions Index, conditions have indeed eased from the extreme levels of October, but remain "tight," and continue to act as a headwind to GDP growth.

Add to this, the Bank of Japan has, over the past four months, delivered a policy change that tightens global financial conditions (extracts global liquidity).

With the above in mind, the policy expectations that induced the trendlines in the charts above, haven't materialised. Considering that, and the current policy environment, we probably see a break of these lines, and a further correction for stocks.

We will see.

it doesn't seem anyone agrees with you right now