Move in MOVE?

US stocks rebounded firmly on Tuesday, driven by gains in tech megacaps as markets continued to assess the magnitude the Federal Reserve's next rate cuts.

The S&P 500 rose 1%, the Nasdaq 100 gained 1.5% and the Dow added 126 points, recovering some of the previous session's losses.

On the other hand, large oil companies edged lower due to the drop in WTI prices.

A dip in Treasury yields and cooling tensions in the Middle East provided relief to markets, shifting investor focus back to third-quarter earnings and key inflation data.

Markets are still pricing in a 25 basis-point rate cut by the Federal Reserve in November, awaiting further signals from tomorrow’s FOMC minutes and upcoming CPI and PPI reports.

The big banks will kick off Q3 earnings season on Friday.

Yesterday we heard from Jamie Dimon the CEO of JP Morgan.

No one has more information on the health and trends of consumer and business behaviour than the head of the biggest bank in the country. With that position of power, he also has a seat at the table with the Fed chair and White House economic advisors, as a member of the "President's Working Group on Financial Markets."

He has influence. So, what did he say?

He said "AI is real." Not coincidentally, the AI trade was dominant during the day - Nvidia finished 4% higher.

With the technology revolution in mind, he talked about the backlog for IPOs. We talked about this IPO outlook earlier this year, in looking at the parallels between the current environment and the late 90s boom.

A technology revolution was underway in the late 90s, with the rapid adoption of the internet. Productivity was high. Growth was hot. Inflation was low. And the Fed juiced it with rate cuts, starting in 1995.

Take a look at the volume of IPOs in the late 90s, the biggest of which came early, in 1996. Then the frenzied return chasing came in late 1999.

If history is our guide, we should expect a coming boom in IPOs. And the Wall Street kings of underwriting (the big banks) will be big beneficiaries.

What else did Jamie Dimon say?

He agreed with the Fed rate cut. And he had another comment about monetary policy that is interesting, particularly ahead of today's release of the minutes from the last Fed meeting.

Remember, as of September, the Fed is now easing policy through interest rate cuts, but it continues to withdraw liquidity from the system (i.e. it's simultaneously tightening) via its quantitative tightening programme. On the latter, Jamie Dimon has said in the past, that "rate cuts relate to inflation," while "QT relates to volatility and liquidity in the Treasury market."

He talked about the risk of volatility in the Treasury market. He complained that the banks have tonnes of excess cash but can't use it efficiently due to regulatory constraints. It's affecting their ability to provide liquidity in the Treasury market, while the Fed is simultaneously extracting liquidity from the Treasury market.

And with that, he implies that we will likely see another episode of big Treasury market volatility, caused by the Fed's quantitative tightening (he mis-spoke and said QE in the interview).

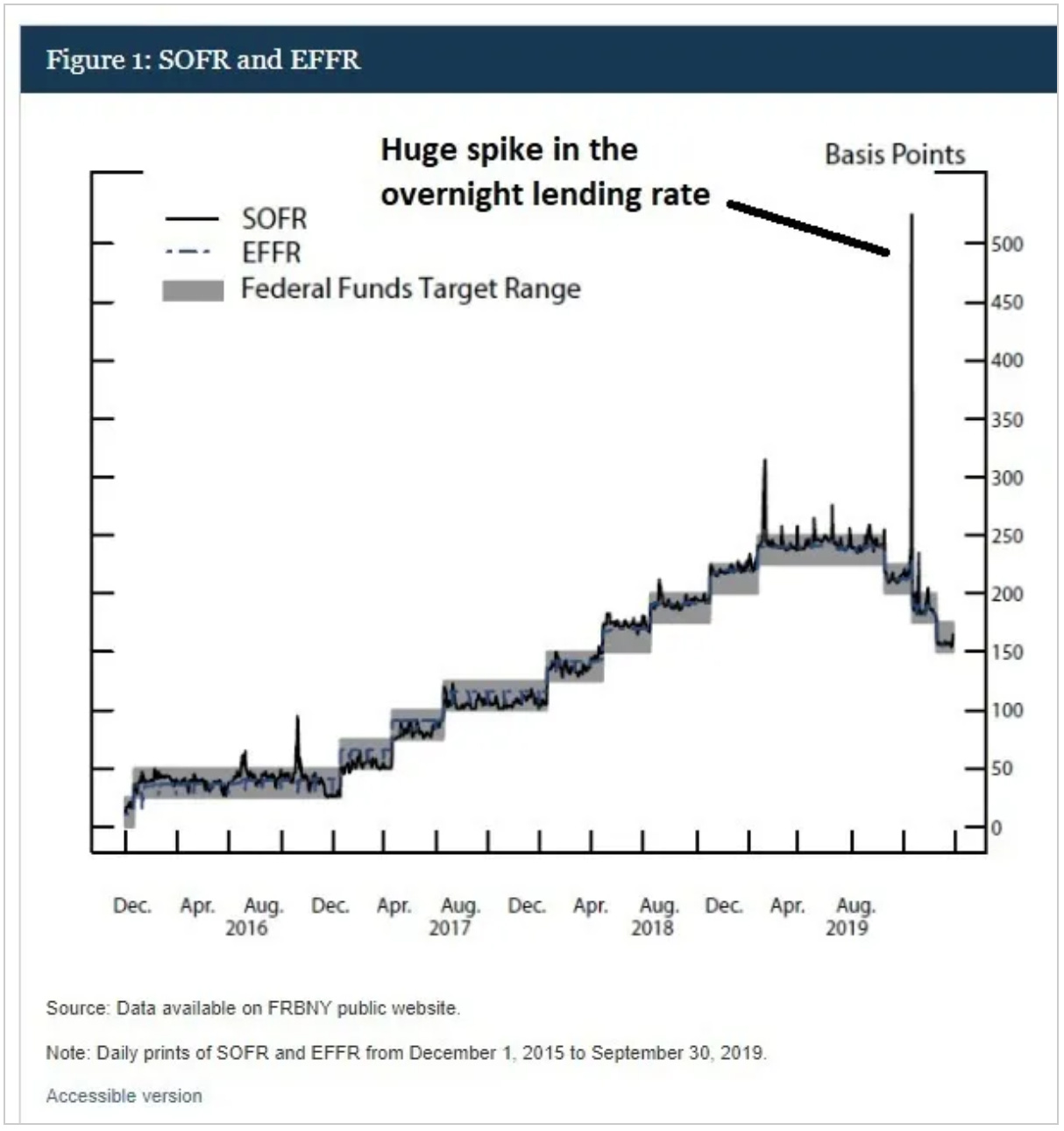

Jamie Dimon said the Fed should start “fixing” this “today.” Back in 2019, the Fed's attempt at quantitative tightening brought about this 300 basis point spike in the overnight lending market …

The Fed explained it as … "strains in money market … against a backdrop of a declining level of reserves, due to the Fed's balance sheet normalisation and heavy issuance of Treasury securities."

So, after a period of "balance sheet normalisation" (QT), the Fed was forced to return to QE.

With all of the above in mind, we'll see in today's Fed minutes what the committee had to say about plans to end QT (if anything), and keep an eye out on the following chart…