G7 leaders and what does it mean for markets?

Back in 2016 I stepped through all of the G7 meeting communiques and analysed the message, and then the response in markets. The takeaway: There were plenty of crises in this time period, and when the G7 communique was focused on the economy, especially in the opening statements, stocks did well.

Let's fast forward to last year, at the depths of uncertainty in a global health crisis and economic lockdown.

First came the phone call with the world's leading finance officials. Then came a statement, pledging to "expand health services" and "take action" to "aid in the response to the virus" and "support the economy." Importantly for markets, this was a signal from global leaders that they would work together on a containment strategy, AND coordinate support for the economy. The Fed cut by 50 basis points hours later, and that was the beginning of the global central bank and government intervention that put a bottom in markets.

Now, going into this meeting, things are a bit different. The economy is recovering, but unevenly around the world. Will G7 leaders focus on the economy, or will they focus on the social and green/environment themes?

As a clue, we can look to the G7 Finance Ministers meeting communique of a week ago. Here are the two opening sentences…

"We will continue to work together to ensure a strong, sustainable, balanced and inclusive global recovery that builds back better and greener from the Covid-19 pandemic, recognising the disproportionate impact of the pandemic on certain groups including women, youth and vulnerable populations. We commit to sustain policy support as long as necessary and invest to promote growth, create high-quality jobs and address climate change and inequalities."

If there was any doubt that there is global coordination and agreement on the social and environment agenda, there shouldn't be after reading that statement.

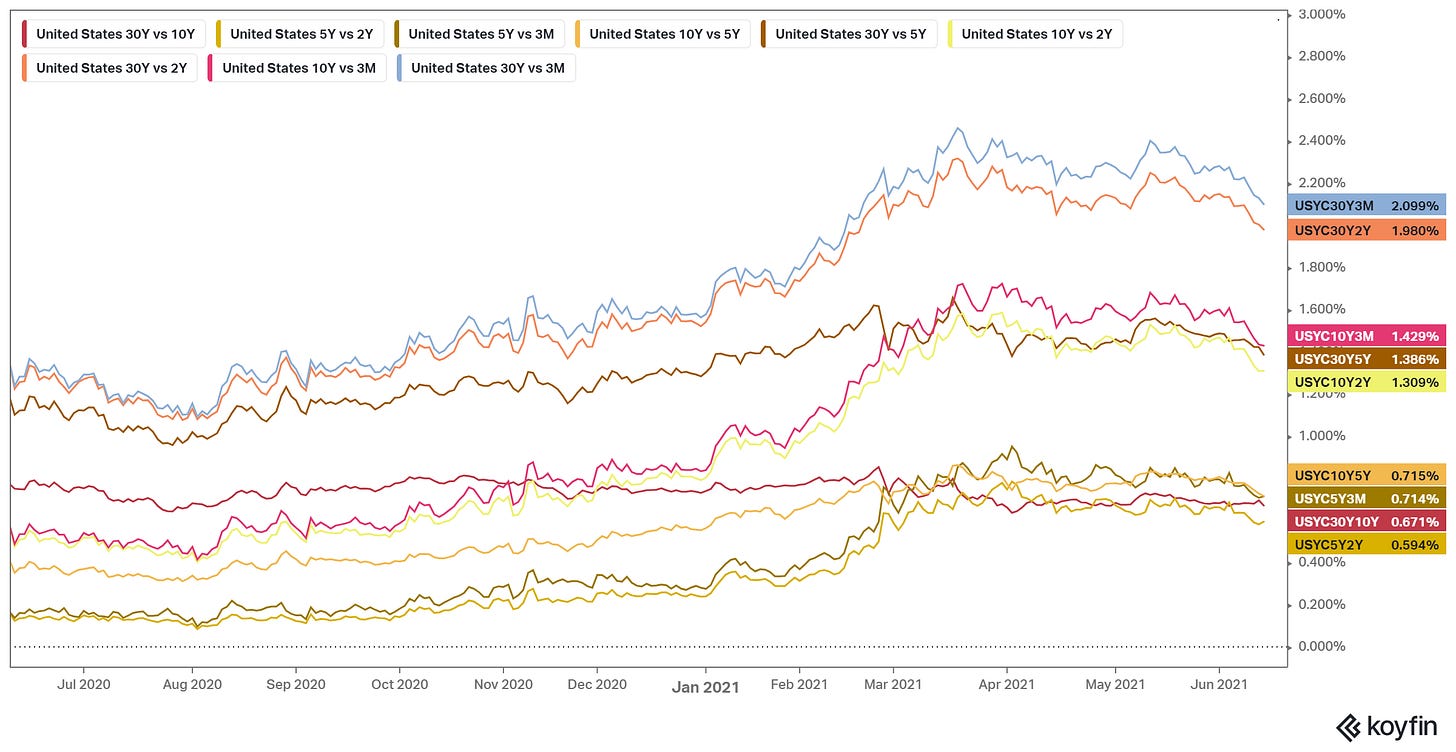

With this coordination, much like the era coming out of the financial crisis, when everyone is in the same boat (and rowing the same boat), we don't see the financial market penalties from policy extravagance (like ballooning the money supply, and running massive deficit spending programs). That means, the dollar and the treasury market probably come out of this unscathed (again).