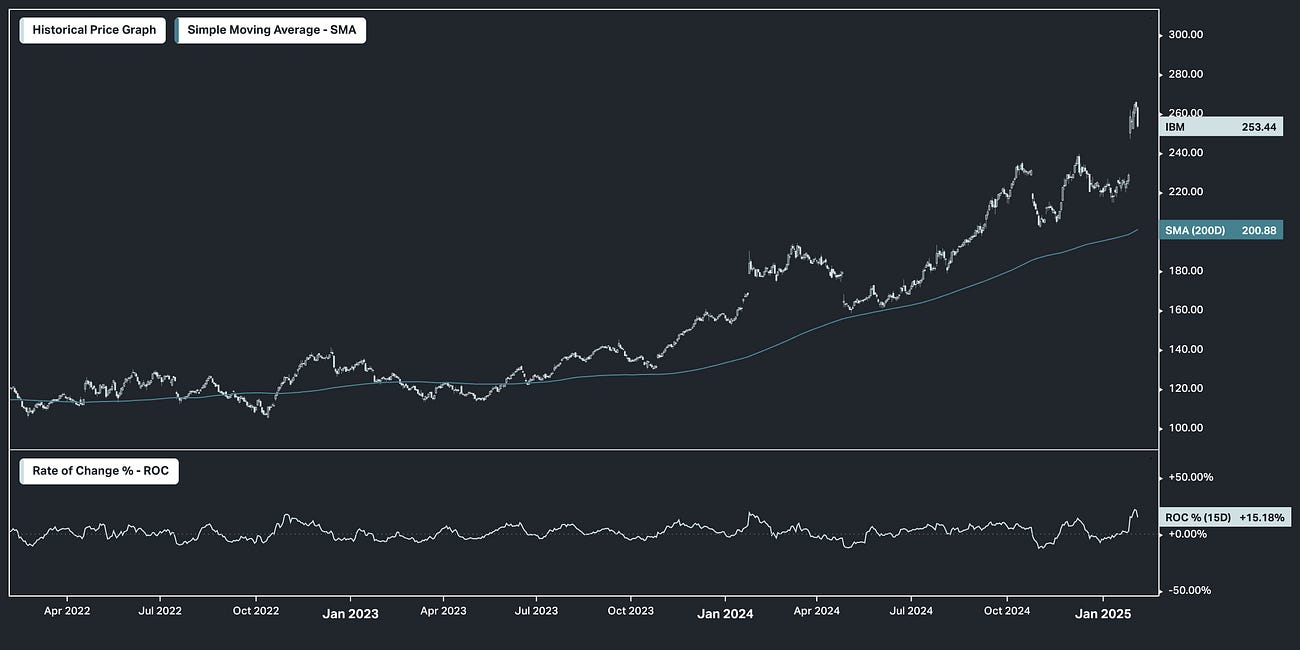

IBM’s stock saw a sharp acceleration in valuation since mid-2023, reaching a 10-year high, largely driven by its strategic focus on AI, robust financial performance, and strong analyst assessments. Our original trade idea, sent out to members on 05 February, was published here on 08 February.

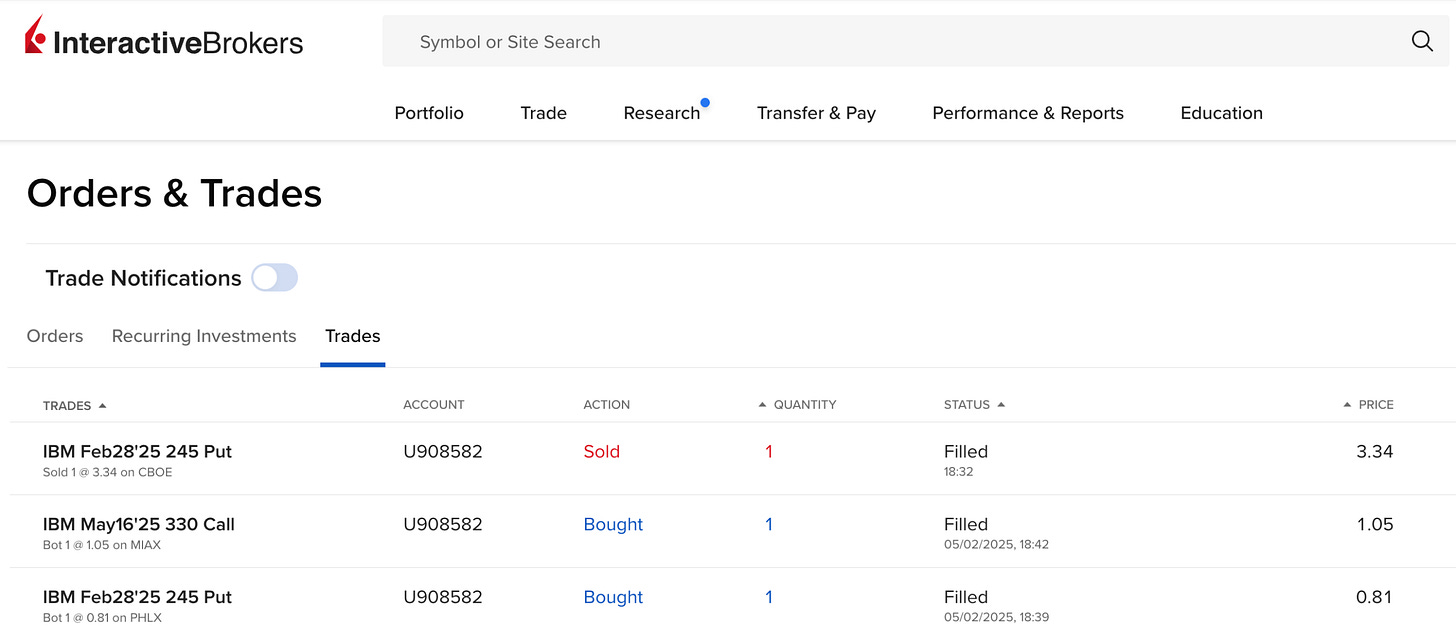

Date of Entry: February 5, 2025

Date of Exit: February 10, 2025

Our initial trade idea suggested a short-term correction while maintaining a longer-term bullish outlook. Based on our model indicators, we identified an opportunity to profit from transient volatility using put options with a strike of 245, expiring at the end of February.

Execution and Outcome

Following the entry on February 5, 2025, we closely monitored our model indicators, the price action, and volatility dynamics. Over the next five days, IBM’s stock experienced a temporary pullback, leading to an increase in the value of our put options. On February 10, 2025, we exited the position, selling the puts at $3.34, up from an initial purchase price of $0.81—a gain of over 300%.

Key Takeaways from the Exit Decision

Market Timing & Volatility: The put options increased significantly in value as IBM’s stock declined.

Daily Monitoring: Regular verification of our model indicators was critical in determining an optimal exit point.

Risk Considerations: Had we held the position one more day, profits would have been significantly lower, as the stock rebounded and the put option price declined.

Trader’s discretion: The exit strategy ultimately depends on the risk appetite of the trader—whether to lock in gains or speculate further.

This trade underscores the critical importance of real-time monitoring of our model indicators and adhering to a disciplined exit strategy. By promptly responding to short-term market corrections within a long-term bullish framework, we can effectively manage risk and secure profits. Implementing a well-defined exit strategy not only helps in managing risk but also secures profits and maintains emotional discipline.

At GRYNING we pride ourselves on our unique and sophisticated investment strategies designed to capture the gains of the stock market while minimising drawdowns during bear markets. If you're seeking expert guidance, become a member by clicking on the button below.