We’re excited to share a new insight or trading idea from our Global Trend Report & Daily Monitor. For a previously highlighted insight → click here.

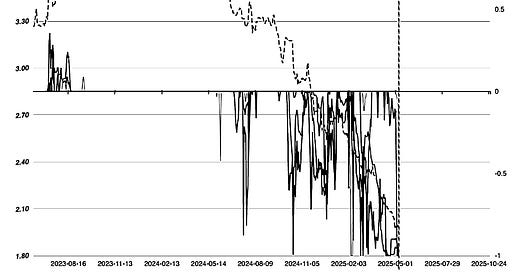

Netherland Government Bond 3M Yield (NL3M)

Our Global Trend Monitor shows the potential for a short-term change of regime around the end of May with some scenarios around the 20th of May, and some around the 30th of May.

What is remarkable - and provides an unusually strong signal - is the stability of the distribution of the estimated time of trend change since early March 2025. The fact that the daily trend forecasts have remained consistent for over two months significantly strengthens the confidence that the current trend is unsustainable, likely to plateau, and may even reverse, potentially leading to a decline in Dutch bond prices.

The Netherlands Government Bond 3M Yield is currently around 1.98%, down from higher rates around 2.7% at the beginning of 2025. This represents a significant downward accelerating trend in short-term government debt yields. Key contributing factors likely include:

Safe-Haven Demand: High demand for Dutch bonds as safe assets during economic uncertainty (e.g., Eurozone instability with changing inflation expectations) drives prices up and yields down.

Economic Expectations: Weak growth or deflationary pressures in the Eurozone signal lower future rates, depressing yields.

Technical factors in the bond market creating momentum

In this context, the Trend Monitor indicates a persistent excess demand for NL3M, driven in part by exuberant herding behaviour, which is likely to dissipate in the coming weeks.

The chart below shows NL3M price (dash line) alongside downside trend exhaustion spikes - which are increasing in density and amplitude - from various trend lengths to indicate a potential market turning point.

In the chart below we show our ‘Scenario Analysis’ for the likelihood of potential future price development for the asset.

Become a member to gain actionable insights designed to help you stay ahead in today’s fast-paced financial markets. Access this exclusive content by clicking the button below.