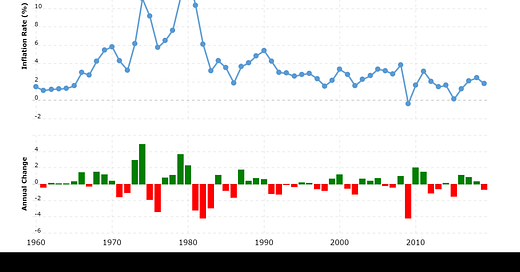

We get more inflation data this Thursday. As we discussed the past few weeks, when the Q2 data starts rolling in (in early July), we are going to see charts that look like these big spikes from the early 70s and 80s.

This is the type of inflationary environment (and what followed) that puts trend-following, as an investment strategy, on the map.

Two pioneers of rules-based trend investing became among the biggest and wealthiest in the hedge fund business by the 1990s (John Henry and Bill Dunn) - and it was because of the returns they generated from commodities price trends (booms and busts) surrounding the early 80s spike in inflation.

That said, trend following as a strategy has been an underperformer for the better of the past two decades, it's even been thought of as a defunct strategy. But it may be back, to date, the IASG trend following is the leading CTA strategy, up 12% - that outpaces broad hedge fund performance by about four percentage points on the year.

It may be just getting started for the trend followers. In a boom period for the strategy, the returns can be high double-digits, if not triple-digits. Driven by an adherence to rules, rather than emotions - which keeps them in trades that continue to trend, as long as they trend. As John Henry once said, "trends always go further than rational people expect, or even imagine."