$ Stablecoin

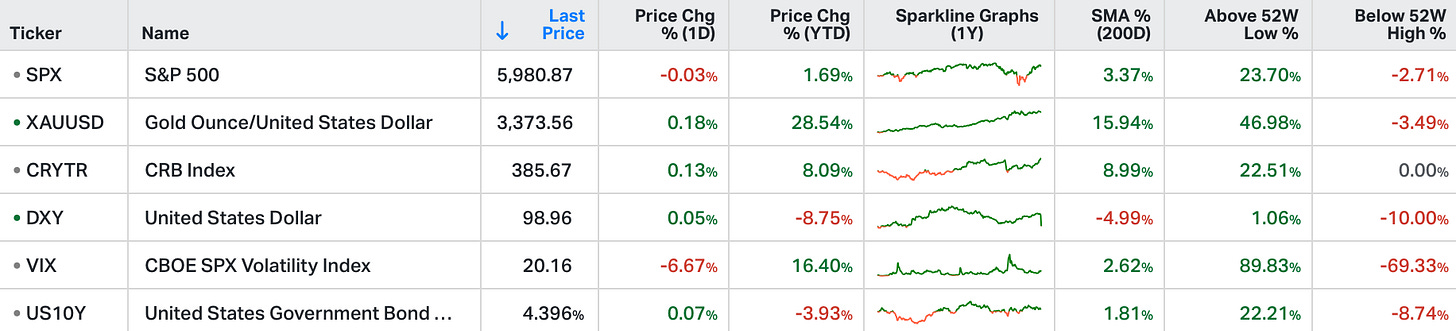

US stock futures edged lower Wednesday evening ahead of Thursday’s market closure for Juneteenth.

During the regular session, the Dow Jones and S&P 500 slipped 0.1% and 0.03%, respectively, while the Nasdaq Composite gained 0.13%.

Powell reaffirmed a data-dependent approach, pointing to unclear inflation impacts from President Trump’s tariffs and the risk of stagflation.

Fed projections now include two rate cuts in 2025, alongside downgraded growth expectations and higher inflation forecasts.

Investor sentiment was further dampened by escalating tensions in the Middle East, as the ongoing Israel-Iran conflict stoked fears of deeper US involvement.

We heard from the Fed on Wednesday - they held rates steady again.

For the second time in a row, in their Summary of Economic Projections, they revised growth DOWN and inflation UP.

And while the median projection for rate cuts by year-end was unchanged at 50 basis points (two cuts), the weighted-average target from the 19 Fed officials is now 4.04%. This tells us the consensus Fed expectations are actually closer to just one cut this year, not two.

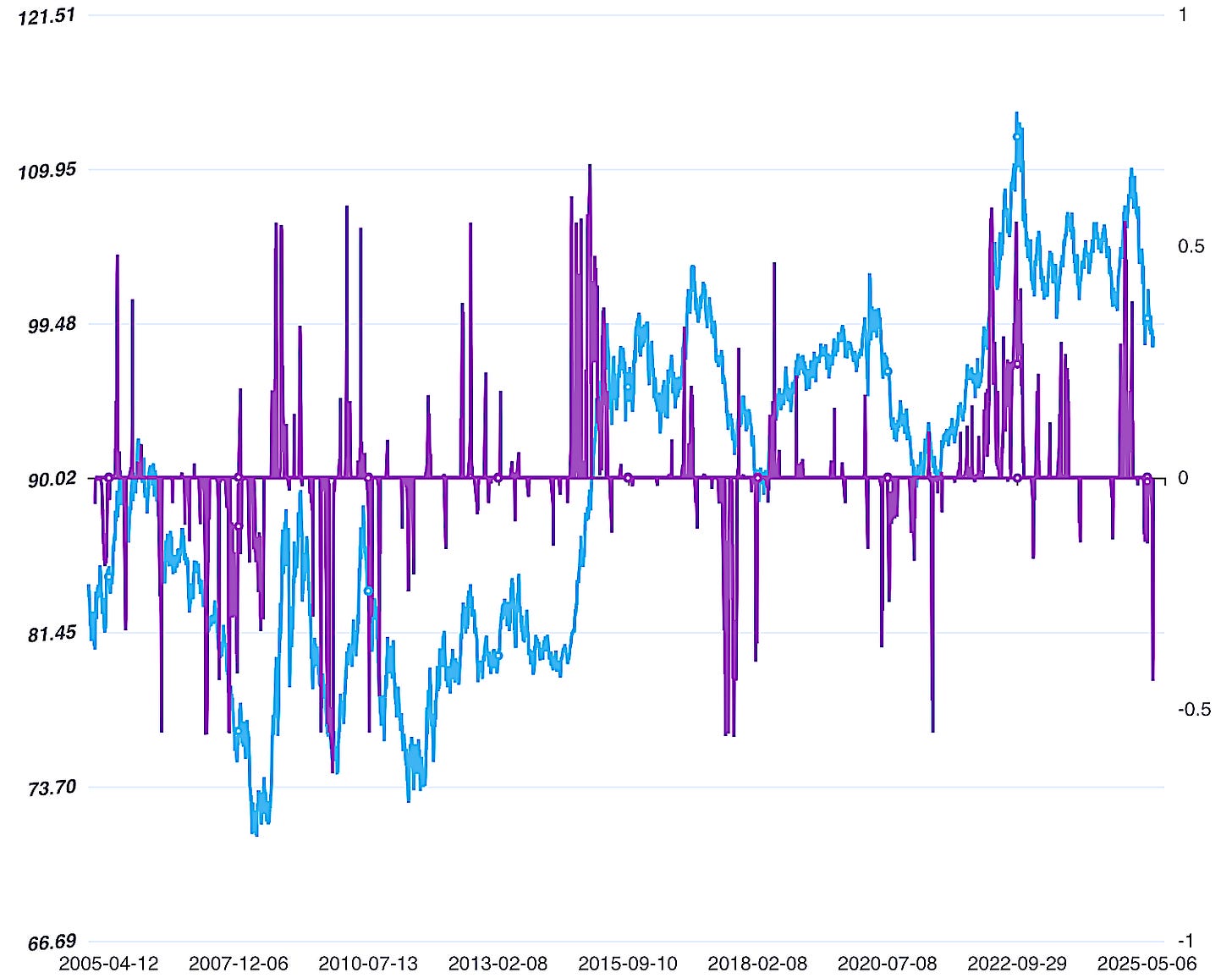

Let's talk about the dollar (DXY = Blue Line).

ECB President Christine Lagarde wrote a piece in the Financial Times arguing the dollar's days of global dominance are ending, and making the case for the euro to gain prominence, "the global euro moment."

China's head central banker followed suit the next day, making a similar case: the dollar's reign is ending, and alternatives like the digital yuan are rising.

The timing is no coincidence. This is a direct response to the legislation passed in the U.S. Senate. And it has everything to do with dollar stablecoins.

With that, let's revisit an excerpt from my note last month (Digital Reserve) on this ...

“the U.S. is working on a solution that will create a distinct edge, relative to the rest of the world, in ensuring robust demand for its debt.

The solution: a regulated, Treasury-backed dollar stablecoin. The legislation is progressing on this, and it will;

shore up the dollar's dominance in the world,

create a brand new, and very deep source of demand for U.S. Treasuries.

Not only will this move by Congress ensure the dollar remains the world's reserve currency, the dollar will become the world's digital reserve currency.”

So, people, businesses and governments from around the world will be able to own U.S. dollar stablecoins (effectively hold U.S. dollars) without the friction of opening a U.S. bank account or going through the U.S. financial system - they get instant and virtually free (no wire fees, no spreads) access to the stability, trust and liquidity of the dollar.”

Now, some important context: Core to the Trump economic policy platform have been these three explicit actions:

Lift restrictions on American energy production.

Terminate the Green New Deal initiatives within the Inflation Reduction Act

Oppose the creation of a central bank digital currency (CBDC).

The trading of global oil in U.S. dollars ("petrodollars") has been the cornerstone of the dollar's role as the world reserve currency, since the end of the gold standard. And the world reserve currency status has been key in building and sustaining the United States' position as the economic superpower.

That's why the anti-oil policies of the Biden administration were an assured path to the loss of reserve currency status of the dollar and, therefore, a loss of wealth and power for the country.

So, the anti-oil policies are being reversed. That, and this stablecoin legislation, disrupts years of globally coordinated efforts to shift the monetary system toward CBDCs and transform the global economy under the climate agenda.

That’s likely why we're hearing from central bank heads in Europe and China. Trump is blowing the plan up. What's the difference between a stablecoin and a CBDC?

A CBDC is issued and controlled directly by a central bank - it's programmable, surveilled, and designed to displace the private banking system. It’s centralised monetary control.

A private, regulated dollar stablecoin, is issued by private entities (like fintechs), fully backed by U.S. Treasuries (1:1), and operates on open blockchain networks. It's about market freedom, privacy, and competition.

The dollar stablecoin will strengthen the dollar and strengthen the solvency of the United States. Stablecoin companies will bring trillions of dollars of new demand to the Treasury market.