The Senate has passed a $1.2 trillion infrastructure package ( I wrote about some of the more idiosyncratic aspects of the bill here ). It now goes to the house - the wheels are turning on a $3.5 trillion spending bill, that the democrats will ram through with a tie breaking vote by the Vice President (through the "budget reconciliation" process).

With the spending blowout now reaching a crescendo, as we've discussed, the Fed has now fired warning shots on a reversal in the monetary policy path. Let's take a look at a couple of key charts…

Market interest rates have ripped almost a quarter point higher from the lows of last Wednesday...

You can see in the chart here, where a very well-placed comment came in from the Fed Vice Chair last Wednesday, suggesting they may be hiking rates by next year.

As we discussed yesterday, the prospects of rising U.S. interest rates, while the rest of the world remains with the monetary policy path pointed in the opposite direction, will stoke foreign capital flows from rest of the world to the U.S. (U.S. assets). The dollar is already up 1.3% since Wednesday in anticipation of this flow of capital.

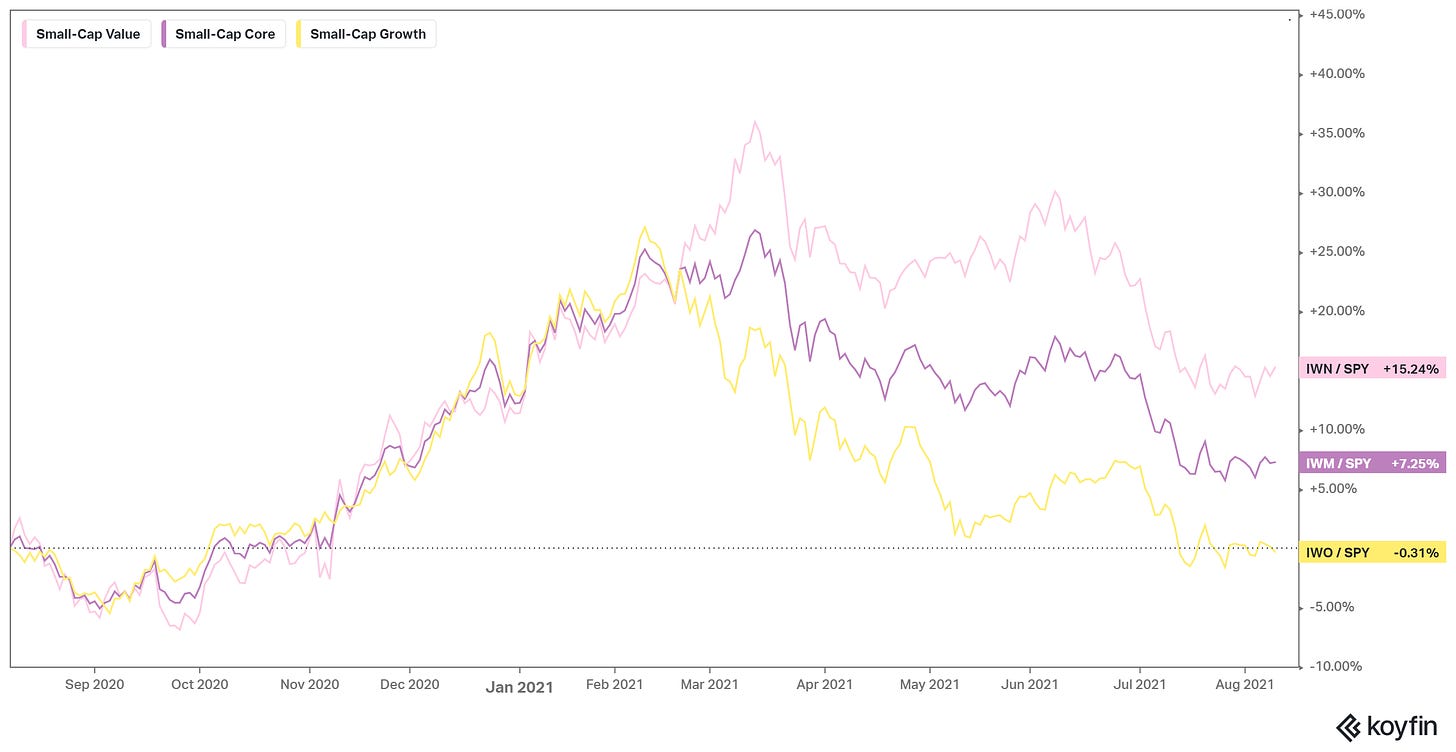

What area of the stock market responds the best, coming out of recession, when rates begin to turn? Small Caps. With blue chip stocks trading to new record highs yesterday, you can get small caps (Russell 2000) at a 5% discount to the highs of the year.