As we discussed yesterday, it looked like the weekend appearance was Jay Powell's attempt to jump in front of hot inflation data and hot earnings numbers due this week, to ensure the public that the Fed will not be budging on rates (ultra-easy policy) anytime soon.

We did indeed get hot inflation data yesterday morning, and we will indeed get hot earnings numbers later this week.

But maybe there was something else behind this Sunday night prime time appearance. As I said yesterday, these appearances have historically come when confidence has been shaken or is vulnerable. In this case, perhaps Powell knew about the negative vaccine news that hit this morning.

At this point, Powell's proactive approach appears to be working. He's told us that the Fed will be supporting the economy until the recovery is "complete" and inflation rate sustains above the Fed's target. That means the fuel for stocks will continue to flow, and as we know, rising stock prices play a key role in the Fed's pursuit of their goals. Stocks promote confidence and a wealth effect, both of which are important to fuel the economic recovery. With that, markets were broadly higher yesterday (global stocks and commodities), and the interest rate market was not only tame, but key interest rates slid.

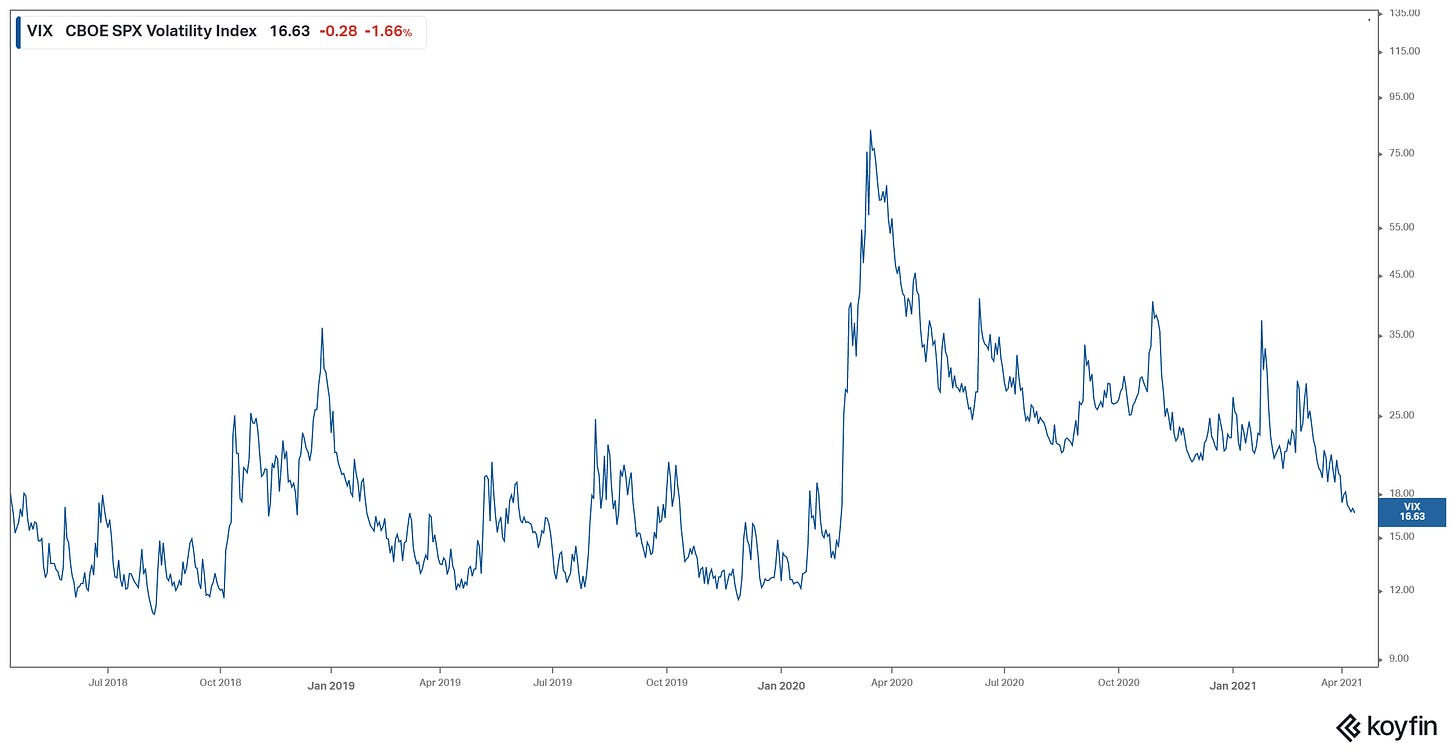

Does the institutional investor community believe in the recipe for stocks? It seems so. The VIX has quietly fallen back to pre-Pandemic levels...