Toward Highs

The Dow Jones marked its 7-day winning day on Thursday, closing 331 points higher, the S&P 500 added 0.5% and the Nasdaq Composite rose almost 0.3%.

The increase came after weekly jobless claims rose more than expected, reinforcing hopes for a potential interest rate cut.

However, comments from several policymakers have been suggesting rates will stay elevated for some more time.

PPI and CPI data due next week should provide further clarity on price pressures.

Exxon Mobil (1.9%), Home Depot (2.4%) and Costco (2%) rose but shares of Airbnb sank 6.8% after reporting a disappointing sales outlook, despite strong results for the quarter.

We've talked about the bounce back in stocks, from what looks like a relatively shallow technical correction (7% in the S&P 500 index).

Shallow corrections are a sign of strength in a bull market. What else has had a shallow correction?

Gold.

Silver.

Copper.

All are now moving back toward the highs.

The bull market is being fuelled by the global easing cycle that's underway. It started in Switzerland. Sweden followed. Yesterday the Bank of England signalled that inflation getting to its 2% target this quarter, to be accompanied by a rate cut (June).

With an easing cycle tailwind, UK stocks are on record highs. German stocks made new record highs, fully recovering the April correction. We should expect the same in U.S. stocks.

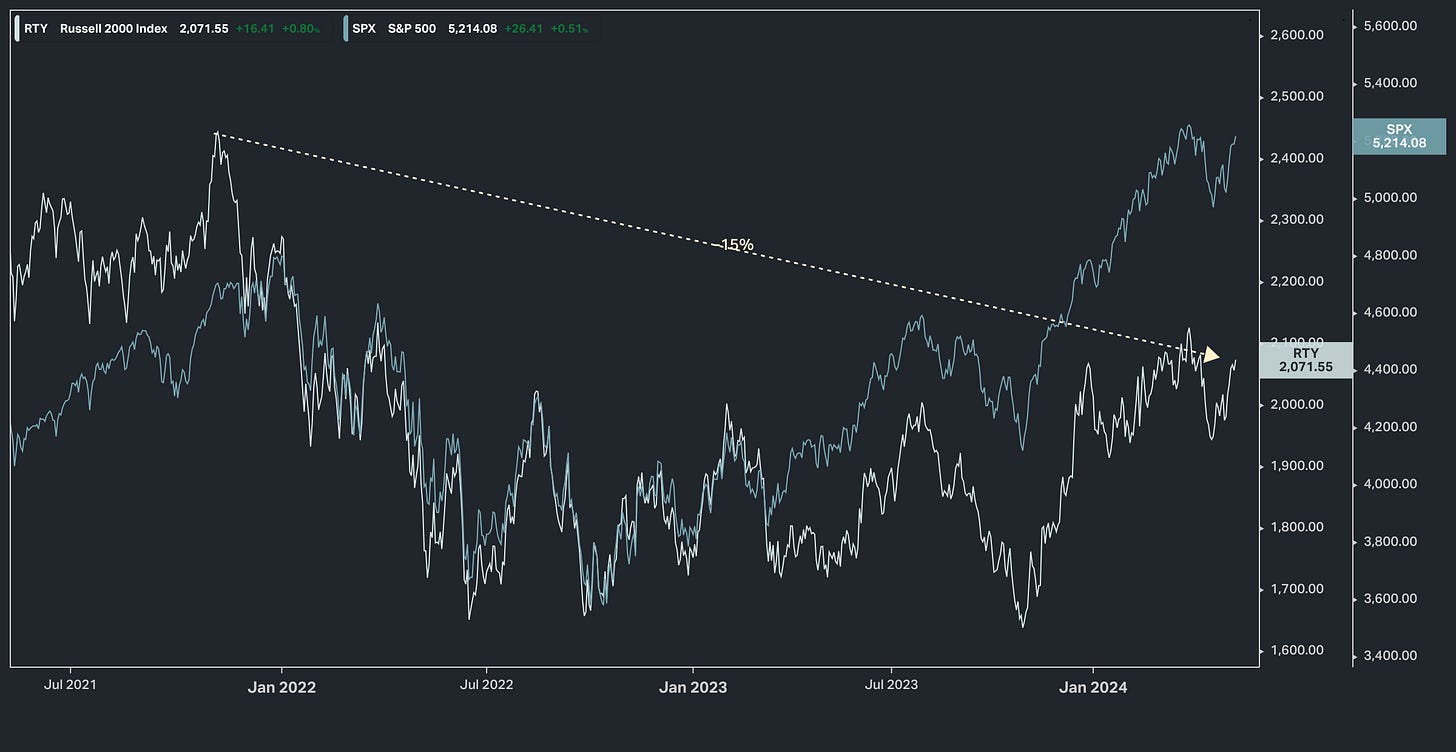

And, again, that makes the laggard small caps the spot to find relative value - the Russell 2000 (small caps) remains 15% off of the 2021 highs.

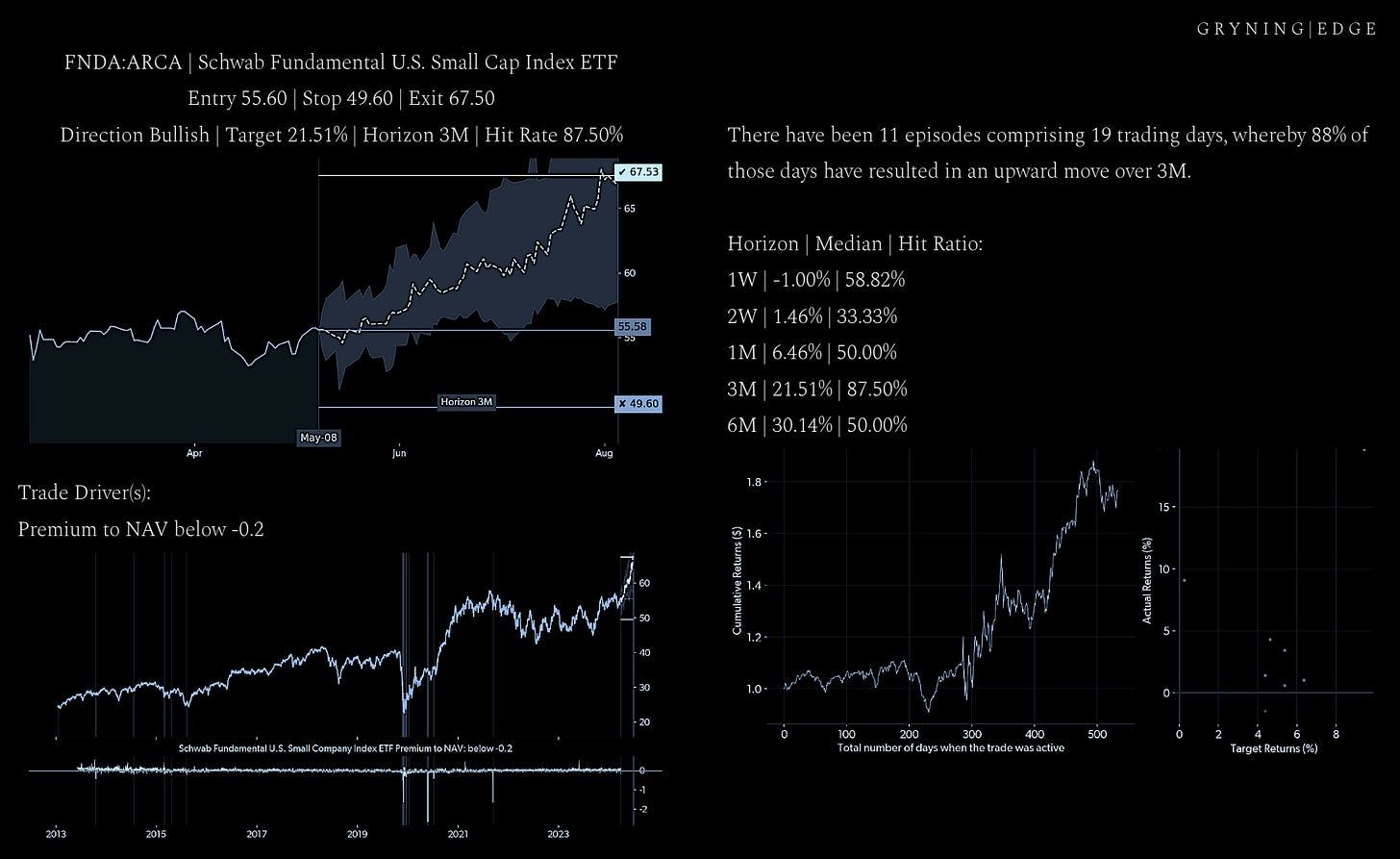

Gryning Edge clients were directed to look at FNDA 0.00%↑ - trade sheet below - as a means to gain small cap exposure.

To have EDGE delivered to your inbox, or for more information, click on the link below or send me an email.

a.karlsson@gryningcapital.com