We are now halfway through the third quarter, and this should be the quarter where we begin to see very clearly that the response is MUCH greater than the damage.

The economy is down $2.3 trillion from the Q4 peak.

We have more than $6.6 trillion worth of fiscal and monetary stimulus still working through the system.

So what does Q3 look like?

The Atlanta Fed model is currently projecting 26% annualized economic growth for the third quarter. The easy math on this says that the economic loss is, and will be, aggressively replenished – maybe even by the year end.

Leaving us with trillions and trillions of dollars worth of new money floating around the economy. Make no mistake, this is by design. Back in March, when Mnuchin and Powell were confronted with an apocalyptic scenario, they had one option, flood the world with money, reflate GDP and devalue debt.

Things are going according to plan. The downside? Inflation is coming.

With that, we looked at a chart of gold a couple of weeks ago, it has since traded as high as $2,072.

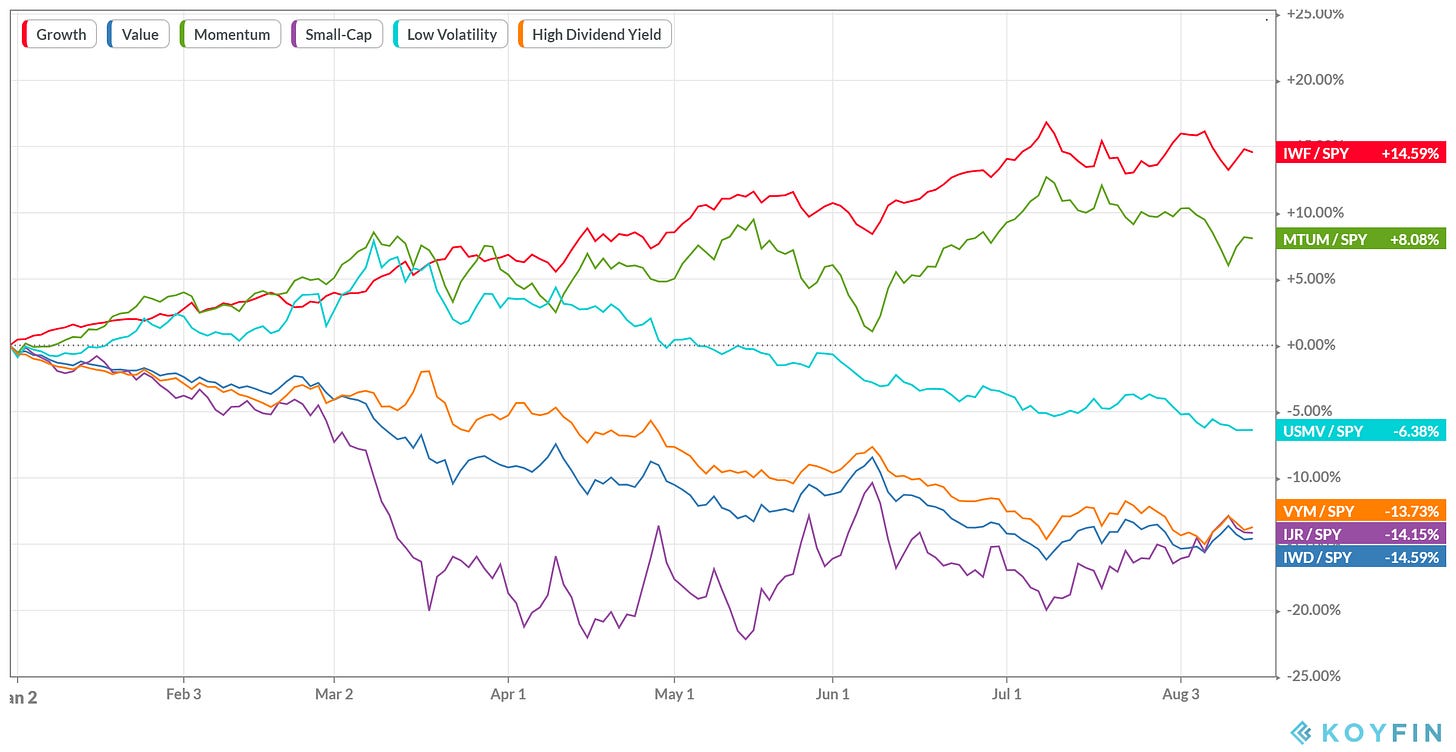

Within the Equity markets, I expect to see a rotation of some sorts - money managers and pension funds will be asked to reallocate their weightings and avoid any, less than mandated, leverage and over exposure. With that, the dynamics within the following chart will start to look different.