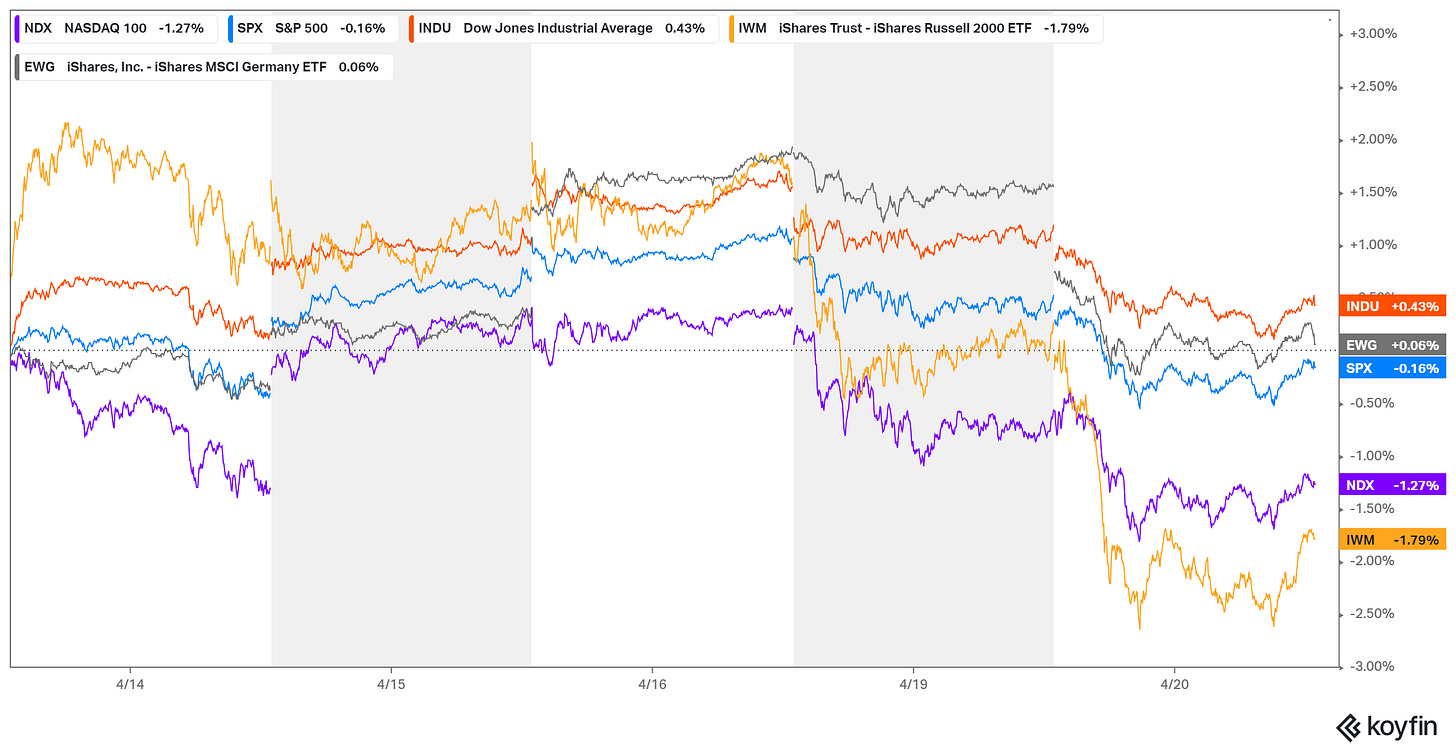

There were broad losses in global stock markets yesterday. That said, we continue to step through a strong earnings quarter, and the dip is a buying opportunity.

The biggest loser on the day, across markets, was lumber - it's been on a tear coming out of the initial lockdown period for the economy.

Lumber prices are up six-fold from the lows of April of last year. Why? Has demand for housing run wild? Yes. Is the supply-chain broken and still in the process of mending? Yes. This tends to be a formula for higher prices.

But, six-fold? The supply of standing trees (called stumpage) is abundant.The timber growers are getting no more today for a ton of stumpage than they were decades ago. What gives?

Reading about this from various viewpoints in the supply chain, it appears that there is some legitimate capacity constraints at the mills, turning timber into final product. But there also seems to be some healthy price manipulation (speculated by industry participants as third party buyers that are hoarding supply).

Bottom line: This parabolic price rise in lumber will be short-lived.

The lumber futures price put in a technical reversal signal (an outside day). It may be a good time for profit taking, if you've been lucky enough to benefit from soaring lumber prices.