Tightening financial conditions is not a typical brew for buying stocks.

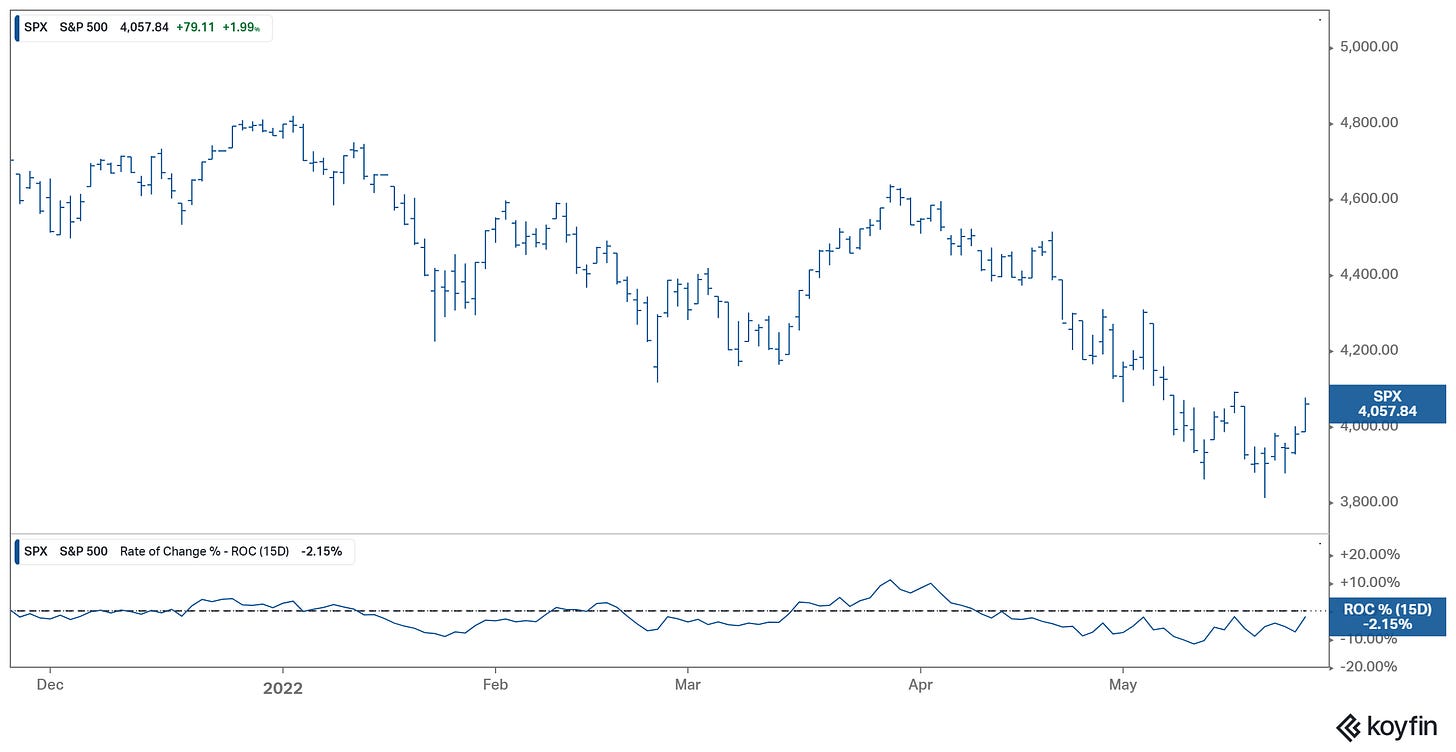

We've had a tightening, and yet, we came into yesterday talking about a bullish setup for stocks. We were looking for a break of the trendline (see yesterday’s note) in the S&P 500, and a close above the key 4,000 level. We got it.

This move will likely end the streak of seven consecutive negative return weeks for the S&P 500.

Visually that's very important, as the S&P 500 is the proxy for global stability and risk appetite - we had broadly positive risk appetite across global markets (stocks, commodities, currencies).

Look for this to continue.

The haircut in equity valuations (i.e. the stock market) over the course of the past five months has taken considerable air out of the exuberance of economic activity. Add to that, soaring gas prices and a spike in mortgage rates have quickly swung the conversation from inflationary boom to recession.

It's the "negative net worth effect" of stocks, and the "cost of living tax" from gas and mortgage rates, that have resulted in a "tightening" effect on the economy.

Bottom line: Markets have seemingly done the Fed's job for them.

Without having to move past 1% on the effective Fed Funds rate (to this point) or sell a single bond from their balance sheet, they've gotten the desired result - slowing demand.

Why is that positive? As we discussed yesterday, it reduces the probability of a 80s style inflation fight, and therefore, reduces the probability of a "hard landing" (i.e. a crash in the economy).