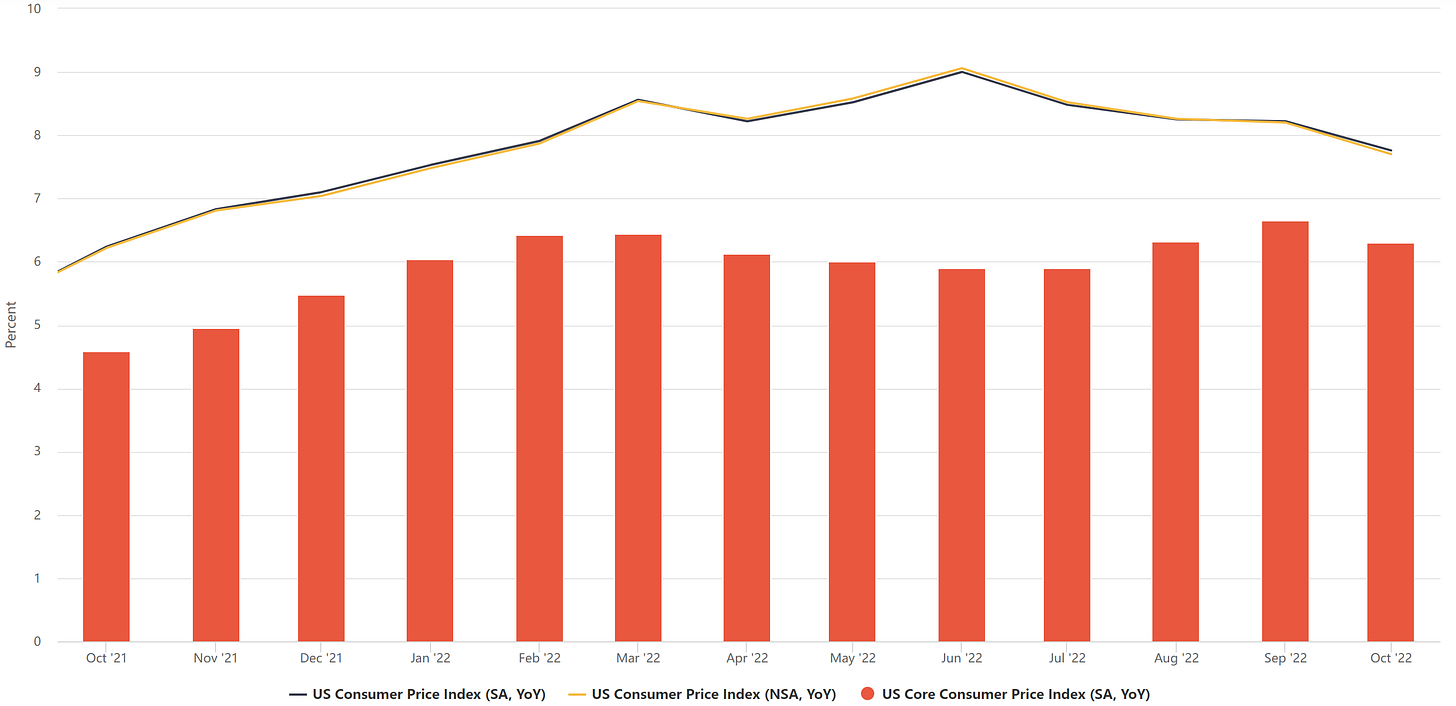

The latest US inflation report came in softer than expected, with headline inflation now at 7.7% YoY and core inflation at 6.3% YoY.

Inflationary pressures eased a touch as the deceleration in CPI was generally broad-based. Core goods inflation turned negative for the month while core services ex-rents inflation decelerated (this was partially due, however, to a technical change in insurance inflation). Rents generally remain elevated, but will likely soften going forward reflecting the current state of the housing market.

Overall the report was positive, reinforcing the idea that inflation has peaked and is starting to lower. However, it provided us with very little comfort as to where inflation is going to settle. While there is clearly some positive news on the inflation front, which will help inflation trend lower next year, there are still some negative factors which will likely prevent inflation from falling back to 2% anytime soon.

The Good news;

Money supply:

The huge injection of money since the beginning of Covid is what caused inflation, but since then money supply growth (as measured by M2) has slowed down significantly and is now at a level consistent with 2% inflation.

Rents:

Rents are key in forecasting US inflation as they represent a big part of the index (c. 30% for headline CPI and c. 40% for core CPI). Rents have been rising for most of the year, helping push inflation higher, but we now might be close to a turning point. Rents in the CPI index is usually a lagging indicator, due to the way it is constructed (for example, data for official rents is collected only twice per year in order to capture a larger sample). There are, however, more timely – albeit arguably less accurate – rents indicators and they all are suggesting a slowdown in rents growth. This slowdown will likely start to be reflected in official measures too over the next few months.

Dollar:

The US dollar has been rising sharply this year and this has impacted and will continue to impact inflation, particularly goods inflation. As most of goods are imported, a strong US dollar will likely results in lower goods prices.

Base effect:

This is more of a short term effect which might help to push YoY inflation lower. Last year, from October to February, core CPI was fairly high averaging almost 0.6% MoM. This means that, for core inflation to keep rising YoY, we need to see some fairly high MoM numbers over the next 5 months: possible, but tough given that core goods inflation is decelerating while rents growth will likely start to moderate soon.

On the flip side, inflation has now become very sticky and broad-based, however, while wage growth is still not consistent with 2% inflation. Moreover, the velocity of money remains a big unknown and could keep inflation high even if money supply falls.