We talked about the subtle announcement that begins the move toward a U.S. central bank-backed digital currency (CBDC).

Just as the "build back better" and clean energy transformation is an agenda highly coordinated by major global economic powers, so is the concept of CBDCs - the BIS (Bank for International Settlements) consists of 63 global central banks, and nearly 90% of them are on this CBDC path.

What else is highly coordinated? Monetary policy.

Just as easy money policies were coordinated, so is the new tightening regime (with the exception of Japan).

With that, since Friday we've heard the same tough talk from all of the Western central banks that we heard from the Fed over the past few weeks, and it has come with some very familiar language. It's all a variation of Jay Powell's remarks on Friday: "we will keep at it (raising rates) until the job is done."

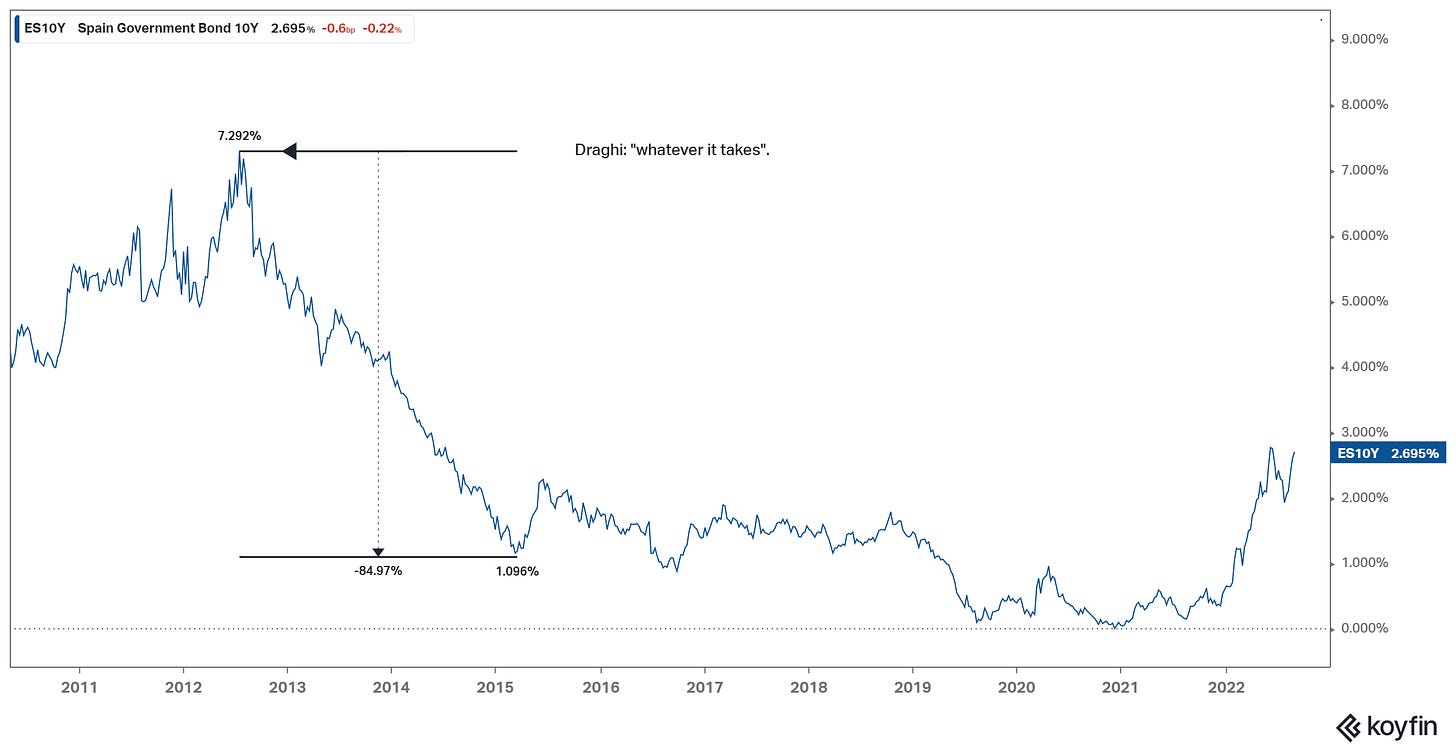

This reminds me of the Mario Draghi moment back in 2012. Draghi, the President of the European Central Bank, was facing a speculative attack on the weak eurozone bond markets (specifically Italian and Spanish bonds). In a zero interest rate world, mired in the post-financial crisis economic gloom, yields on these government bond markets had soared to 7%+. These countries were effectively insolvent, and a blow up/default there would quickly spread and result in the end of the euro (the second most widely held currency in the world). Apocalypse.

What happened? Draghi vowed to do "whatever it takes" to save the euro, and to maintain stability and solvency in the euro zone - he vowed to buy unlimited Spanish and Italian debt.

Here's what happened to yields on Spanish bonds...

Draghi's threat put in the top for yields, without the ECB having to buy a single bond. Within two years, yields on Spanish debt fell from almost 8% to 1% - a European collapse was averted.

That became a critical part of the playbook of major central banks for getting the desired behavior from markets and consumers: threats and/or promises. They called it "forward guidance."

With that, now we have this "keep at it" sentiment from Powell, and the promise to "unconditionally" fight the war on prices. And these promises are being echoed by his global central bank partners. But keep in mind, while the talk doesn't match the actions from the Fed, neither does it from other major central banks.

Here we are, well over a year into an inflation tsunami and the major central banks of the world are (on average) six percentage points UNDER the inflation rate (on average) - and all, still, well under the respective long term averages on interest rates.

This is all about verbally managing the desired outcome, and because they are all in it together (all major central banks), it has worked (at least to the extent of keeping the balls in the air).

This brings me to the latest topic of "tough talk": Energy.

We all know Europe is dealing with the upward spiral in natural gas prices - as much as 35 times the price of two years ago for Dutch Natural Gas (the leading benchmark price). There is plenty of speculation in this market. With that, the President of the European Commission appears to be going to the Draghi playbook - she's threatening "emergency intervention," to (somehow) sever the link between gas prices and electricity prices.

Already, Dutch gas prices are down 30%.