As we've discussed often, we need a period of hot economic growth, rising wages (to restore the standard of living), and stable, but higher than average inflation to inflate away debt - not just in the U.S., but globally.

Indeed, if we look at the policy moves by the Western world, since the covid lockdowns, that seems to have been the plan;

Inflate asset prices.

Inflate the nominal size of the economy.

Inflate away debt.

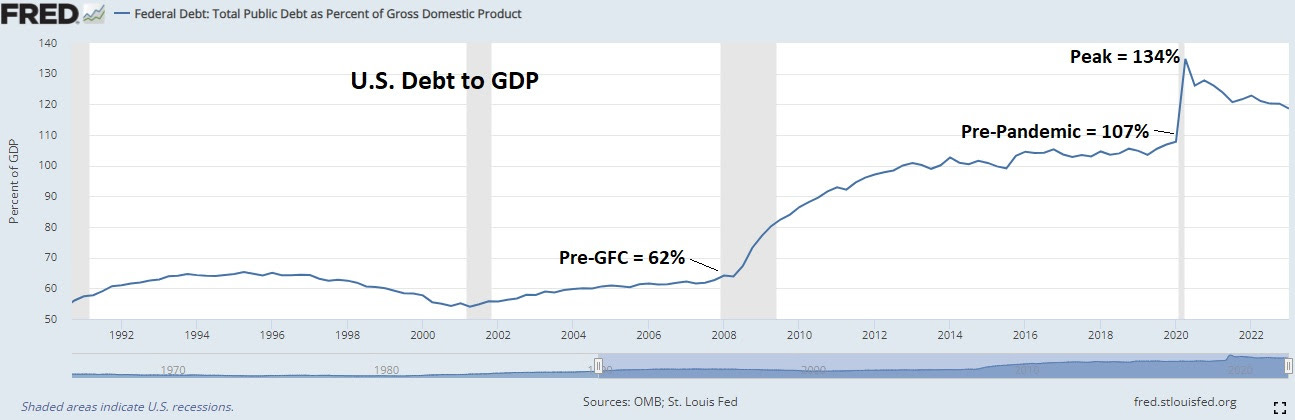

On that note, the Atlanta Fed's GDP model now has the U.S. economy running at a 5% growth rate for Q3. If we add in the inflation rate, that's over 8% nominal growth. That's better than double the nominal GDP growth for the decade prior to the pandemic . . . and with that, as you can see in the chart, the debt burden has been shrinking from the pandemic policy-response driven peak.

Speaking of inflating away the government debt burden, let's talk about Japan.

They reported Q2 GDP - the economy grew at a 6% annualized pace last quarter. If we add in inflation, which is running well north of 3%, we have a Japanese economy that is running near double-digit nominal growth - the fastest, by far, in many decades.

With that, let's revisit an excerpt from my June 22 note from last year ( here ):

" . . . if there is one common word we hear spoken from policymakers around the world (from the Great Financial Crisis era, through the pandemic and post-pandemic period) it's coordination.

They have resolved that, in a world of global interconnectedness, the only way to avert the spiral of global economic crises into an apocalyptic outcome is to coordinate policies.

With that, just a month ago, the top finance ministers from G7 countries met in Germany.

It's safe to say, they all know that the only way the world can start reversing emergency level monetary policy, while simultaneously running record level debt and deficits, is if the Bank of Japan is running wide-open-throttle, unlimited QE."

You keep the liquidity pumping from a part of the world that has a long-term structural deflation problem, and that has the biggest government debt load in the world.

The world gives Japan the greenlight to devalue the yen, inflate away debt and increase export competitiveness (through a weaker currency). They hit the reset button on an unsustainable, debt-laden economy.

This script continues to play out.