We've been talking about the building energy crisis.

The melt up in energy prices continued; Crude oil broke $79, Coal was up 12%, and natural gas was up 9%. Again, this is just today.

The national average for gas prices was $2.18 a year ago, now it's $3.20 - and for the reasons we've discussed for the better part of the past year, crude oil prices are going higher from here, not lower.

That said, while the consumer is flushed with cash, and consumption has been running above trend levels, we should expect higher energy prices to start squeezing the consumer.

Add to that, we have a risk to the very healthy gains we've seen in the employment situation.

We're starting to see early signals in New York, of layoffs and walkouts, driven by vaccine mandates.

The biggest healthcare provider in New York fired 1.8% of it's staff on Monday. Unlike the post-pandemic unemployment environment, these newly unemployed healthcare workers will, not only, not get a generous Federal unemployment check, they won't qualify for state unemployment aid.

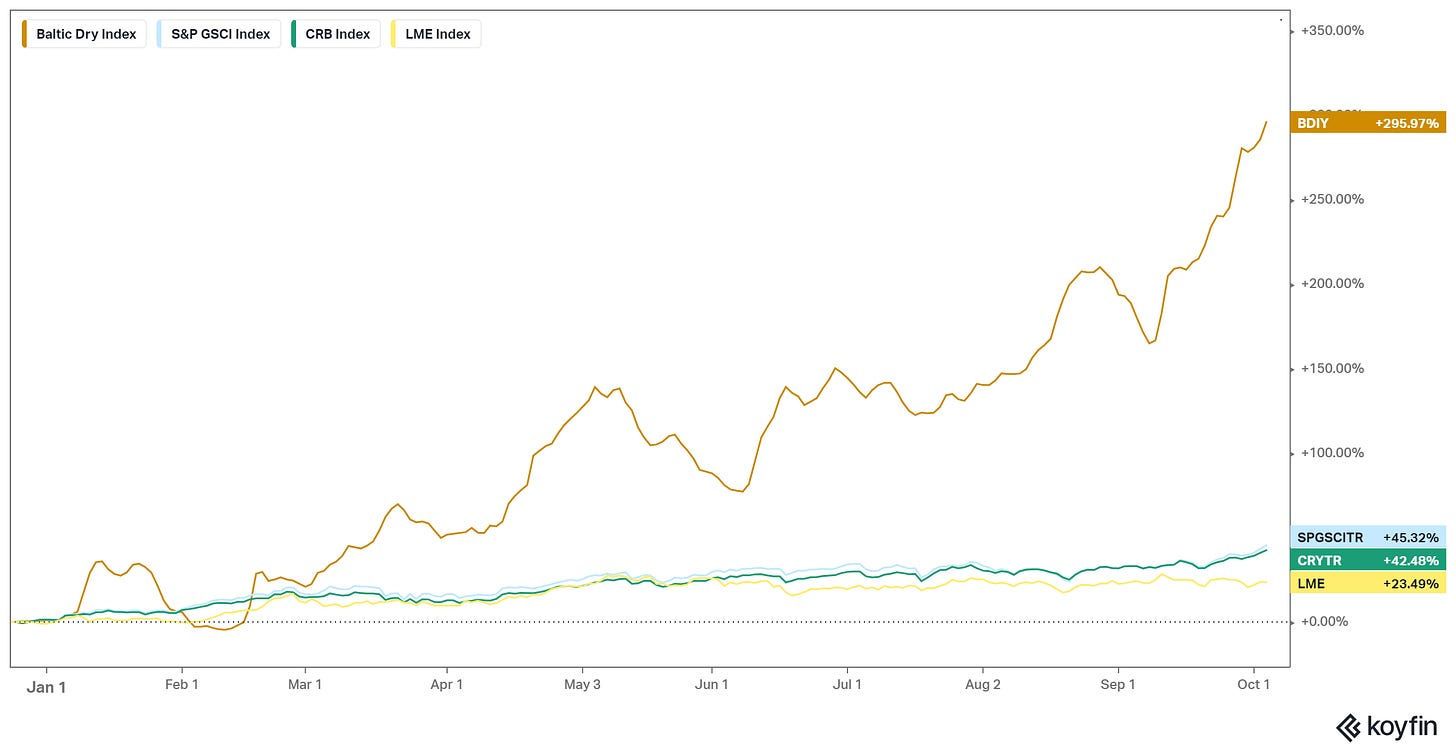

So we have higher prices, not just in energy, but practically all commodities and everyday consumption and we now have prospects for rising unemployment.

This is a clear formula for damaging what has been record-healthy consumer balance sheets - with both components of this formula having been expressly manufactured by policies of the Biden White House. I suspect this will create enough economic pain over the coming weeks (maybe months) to get the $4.7 trillion of additional fiscal spending across the line.